Starting a Limited Liability Company (LLC) is an exciting venture, but navigating the legal and financial aspects can feel overwhelming. One crucial document you’ll encounter is the capital contribution agreement. Think of it as a roadmap outlining each member’s initial investment into the business. It clearly defines what each member contributes, whether it’s cash, property, or services, and establishes their ownership percentage in the LLC. Without a clear agreement, disputes can arise down the road, potentially jeopardizing the entire business. The beauty of an LLC is its flexibility, but that also means you need a well-defined framework.

Imagine you’re starting a coffee shop with a few friends. One friend puts up the cash for the espresso machine, another provides the initial inventory of beans, and a third offers their design skills to create the shop’s ambiance. The capital contribution agreement clarifies the value of each contribution and translates that into ownership shares. This prevents misunderstandings about who owns what percentage of the business and how profits (and losses) will be divided. It’s a foundational document that provides clarity and protects all involved parties.

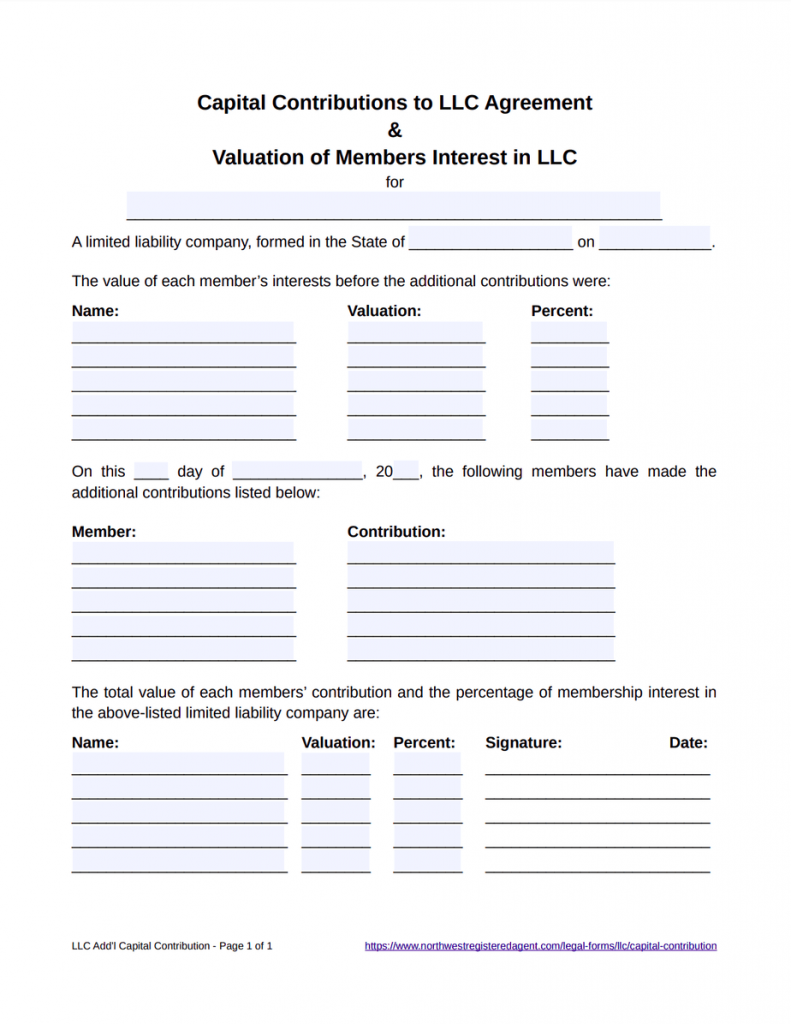

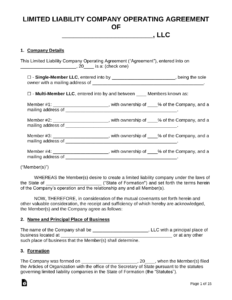

Many entrepreneurs find themselves searching for an “llc capital contribution agreement template” to help them get started. While templates can be a useful starting point, it’s vital to remember that every business is unique. A generic template might not address the specific needs and circumstances of your LLC. Therefore, tailoring the template or seeking legal advice is crucial to ensure the agreement accurately reflects the intentions of all members and complies with applicable state laws. Failing to do so can lead to costly legal battles and operational headaches later on. Think of it as customizing a suit – you might start with a standard pattern, but you’ll need adjustments to get the perfect fit.

Understanding the Key Components of an LLC Capital Contribution Agreement

A well-drafted LLC capital contribution agreement is more than just a formality; it’s a cornerstone of a successful and harmonious partnership. It outlines the specific details of each member’s investment in the LLC, ensuring everyone is on the same page from the outset. This document helps prevent misunderstandings and disputes that can arise later, potentially derailing the entire business venture. Let’s delve into some of the most critical components.

The agreement should clearly identify all members of the LLC, including their names, addresses, and contact information. It should also explicitly state the date the agreement is being executed. The core of the agreement details the specific contributions of each member. This might include cash, property (like equipment or real estate), or services. If a member is contributing property, the agreement should clearly describe the property and its agreed-upon fair market value. For service contributions, the agreement should specify the nature of the services, the agreed-upon value, and the timeframe for completion.

The agreement should also address the allocation of membership interests based on each member’s capital contribution. For example, if a member contributes 50% of the total capital, they would typically receive a 50% membership interest. This percentage determines their share of profits, losses, and voting rights within the LLC. The agreement should also outline the process for making additional capital contributions in the future. Will members be required to contribute additional funds if the business needs them? What happens if a member is unable or unwilling to contribute? These scenarios should be addressed to avoid future conflicts.

Furthermore, consider including provisions related to default. What happens if a member fails to make their agreed-upon capital contribution? The agreement might specify penalties, such as a reduction in their membership interest or even expulsion from the LLC. It’s also a good idea to address the process for valuing contributions if there are disagreements among the members. A third-party appraisal might be necessary in some cases. Think of this section as your safety net, protecting the LLC and its members from potential financial pitfalls related to contribution obligations.

Finally, it is essential to include standard legal clauses, such as a choice of law provision (which specifies the state law that will govern the agreement) and a dispute resolution mechanism (such as mediation or arbitration). These clauses can help streamline the resolution of any disagreements that might arise in the future. Remember, while a template can provide a starting point, consulting with an attorney is highly recommended to ensure the agreement is tailored to your specific circumstances and complies with all applicable state and federal laws. Using a “llc capital contribution agreement template” can save time initially, but legal review is crucial for long-term protection.

Benefits of Using an Llc Capital Contribution Agreement

Having a solid capital contribution agreement in place provides numerous benefits for both the LLC and its individual members. It serves as a clear and legally binding record of each member’s investment, preventing misunderstandings and disputes down the road. This clarity can be particularly valuable as the business grows and evolves.

One of the primary benefits is the protection it offers to individual members. By clearly defining each member’s capital contribution and ownership percentage, the agreement helps to shield members from personal liability for the LLC’s debts and obligations. This separation of personal and business assets is a key advantage of operating as an LLC. The agreement also provides a framework for resolving disputes related to capital contributions. If a member believes another member has not fulfilled their obligations, the agreement provides a process for addressing the issue, potentially avoiding costly litigation. It also helps manage expectations among the members, ensuring everyone is on the same page regarding their responsibilities and rewards.

From the LLC’s perspective, a capital contribution agreement helps to ensure that the business has the necessary resources to operate and grow. By clearly outlining the capital contributions of each member, the agreement provides a predictable stream of funding. This can be particularly important in the early stages of the business when cash flow may be tight. A well-defined agreement can also improve the LLC’s credibility with lenders and investors. They will be more likely to provide funding if they see that the LLC has a solid financial foundation and that the members are committed to its success.

Furthermore, a comprehensive capital contribution agreement clarifies the ownership structure of the LLC, which is crucial for various business decisions, including voting rights and profit distribution. It outlines how profits and losses will be allocated among the members, based on their respective capital contributions. This ensures fairness and transparency in the distribution of financial benefits and obligations. It also provides a roadmap for handling future capital contributions, ensuring that the LLC can continue to grow and thrive over time. The agreement can specify the process for soliciting additional capital from existing members or bringing in new investors, preserving the LLC’s operational flexibility.

Ultimately, investing the time and effort to create a robust capital contribution agreement is a wise decision for any LLC. It’s a proactive step that can prevent conflicts, protect individual members, and contribute to the long-term success of the business. Consider it a cornerstone of a well-managed and thriving LLC. A well-crafted document, especially when utilizing an “llc capital contribution agreement template” as a starting point, can provide peace of mind and a solid foundation for your business venture.

It’s crucial to ensure open communication and transparency throughout the process of creating and executing the agreement. Seek legal counsel to guarantee compliance with all relevant regulations and to ensure the agreement accurately reflects your specific needs.

Having this document in place can be a huge relief, knowing that you’ve taken steps to protect both yourself and your business from potential future complications.