So, you’re thinking about transferring your ownership in an LLC, huh? Or maybe you’re on the receiving end of that transfer? Either way, navigating the world of LLCs can feel like wading through legal jargon. One document that you’ll absolutely need is an LLC membership interest transfer agreement. This isn’t just some piece of paper; it’s the key to legally and smoothly transferring ownership in a limited liability company. Think of it as a roadmap ensuring everyone knows what’s happening and what their responsibilities are.

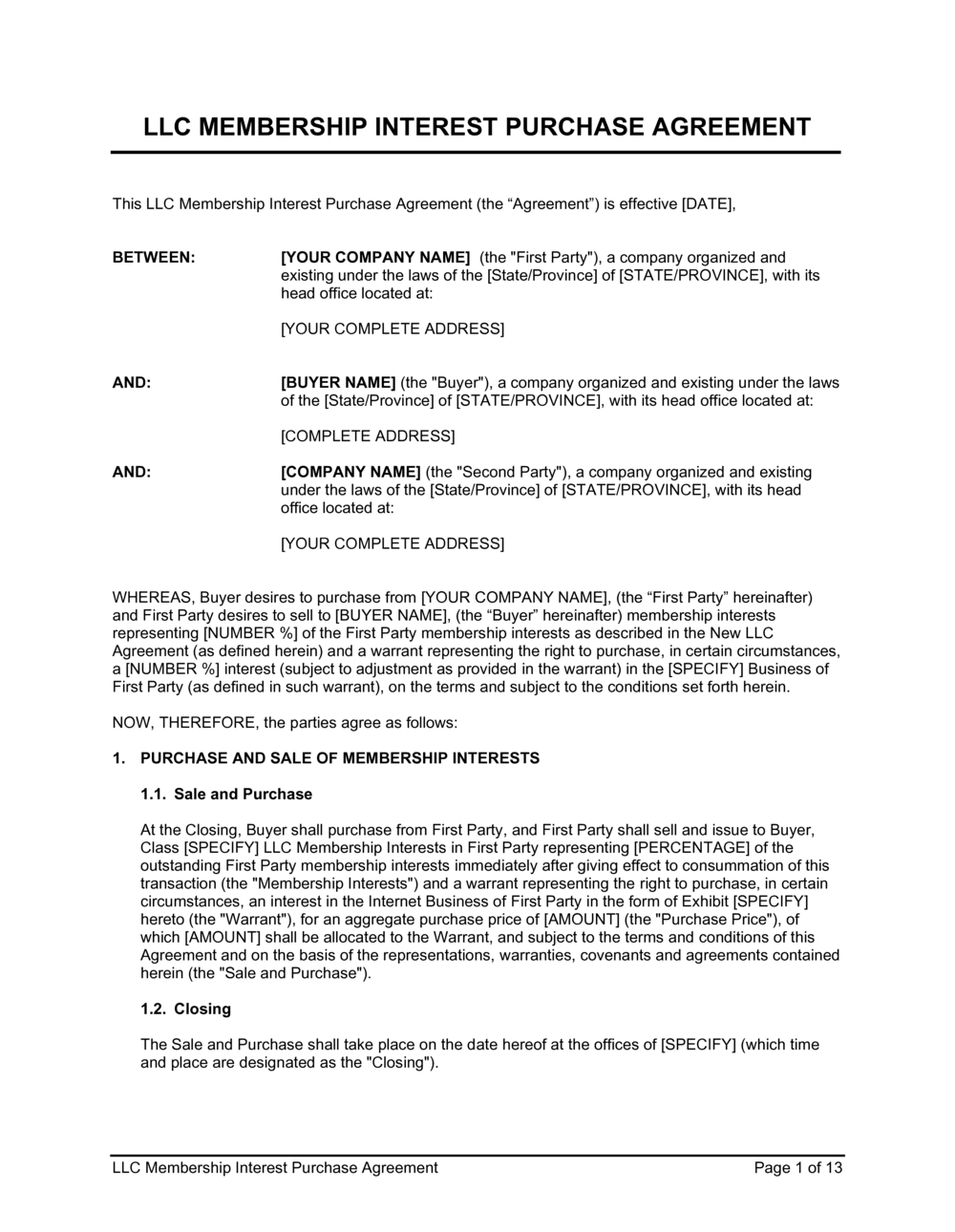

The good news is you don’t have to start from scratch. A quality LLC membership interest transfer agreement template can save you time, money, and a whole lot of headaches. It provides a framework covering all the essential elements, like the parties involved, the percentage of ownership being transferred, the purchase price, and any conditions attached to the transfer. Using a template allows you to focus on the specific details of your situation rather than trying to figure out the legal language.

This article will break down everything you need to know about LLC membership interest transfer agreements and how to use a template effectively. We’ll cover the key components of the agreement, common pitfalls to avoid, and resources to help you find the right template for your needs. Consider this your guide to making a smooth and legally sound transfer of ownership in your LLC.

Understanding the LLC Membership Interest Transfer Agreement

An LLC membership interest transfer agreement is a legally binding contract that outlines the terms and conditions for transferring a member’s ownership stake in a limited liability company to another party. This agreement is crucial for ensuring a clear and transparent transfer process, protecting the interests of all parties involved, and maintaining the legal integrity of the LLC. Without a properly executed transfer agreement, disputes can arise regarding ownership, rights, and responsibilities, potentially leading to costly litigation and disruption of the business.

At its core, the agreement clarifies exactly what is being transferred. This includes specifying the percentage of membership interest, voting rights, rights to profits and losses, and any other rights or obligations associated with the membership. It also clearly identifies the parties involved: the transferring member (the seller or assignor) and the receiving member (the buyer or assignee). Clear identification prevents any ambiguity about who is responsible for what during and after the transfer.

The agreement also meticulously details the purchase price for the membership interest. This includes the total amount being paid, the method of payment (e.g., cash, stock, promissory note), and the schedule for payment. Clearly defining the financial terms of the transaction is crucial for preventing misunderstandings and disputes. It also covers any contingencies related to the payment, such as financing approvals or due diligence requirements.

Furthermore, the agreement should address any restrictions on the transfer of membership interests. Most LLC operating agreements contain provisions regarding the transfer of ownership, such as rights of first refusal or consent requirements. The transfer agreement must comply with these provisions to be valid. It should also specify any conditions that must be met before the transfer can be completed, such as obtaining the consent of other members or satisfying regulatory requirements. These conditions are designed to protect the interests of the remaining members and ensure the continued stability of the LLC.

Finally, a well-drafted LLC membership interest transfer agreement will include clauses addressing warranties, representations, and indemnification. These clauses provide protection to both the transferring and receiving members by ensuring that each party is accountable for their actions and statements. For example, the transferring member might warrant that they have the legal right to transfer the membership interest and that the interest is free from any liens or encumbrances. The agreement may also include provisions for indemnification, which require one party to compensate the other for any losses or damages arising from a breach of the agreement.

Key Considerations When Using an LLC Membership Interest Transfer Agreement Template

While an LLC membership interest transfer agreement template provides a valuable starting point, it’s crucial to recognize that it’s not a one-size-fits-all solution. Every LLC is unique, with its own operating agreement, membership structure, and specific circumstances. Therefore, simply downloading a template and filling in the blanks without careful consideration can lead to problems down the road.

First and foremost, carefully review your LLC operating agreement. This document governs the internal affairs of your LLC and likely contains provisions related to the transfer of membership interests. These provisions might include restrictions on transfers, rights of first refusal for existing members, or requirements for obtaining consent from other members. The transfer agreement must be consistent with the operating agreement; otherwise, the transfer could be deemed invalid.

Another key consideration is the valuation of the membership interest. Determining the fair market value of the interest being transferred is essential for ensuring a fair deal for both the transferring and receiving members. This valuation should take into account factors such as the LLC’s assets, liabilities, revenue, and profitability. In some cases, it might be necessary to engage a professional appraiser to determine the value of the membership interest accurately.

Think carefully about the tax implications of the transfer. The sale of a membership interest in an LLC can have significant tax consequences for both the transferring and receiving members. It’s wise to consult with a tax advisor to understand the tax implications of the transaction and ensure that it is structured in a tax-efficient manner. For example, the transfer might be structured as a sale of assets rather than a sale of membership interests to minimize tax liabilities.

Also consider including representations and warranties in the agreement. These clauses provide assurance to the receiving member that the transferring member has the legal right to transfer the membership interest and that the interest is free from any liens or encumbrances. They also protect the transferring member by ensuring that the receiving member is aware of any potential risks or liabilities associated with the membership interest.

Finally, it’s always a good idea to have the transfer agreement reviewed by an attorney specializing in business law. An attorney can ensure that the agreement is legally sound, complies with all applicable laws and regulations, and protects your interests. They can also help you navigate any complex legal issues that might arise during the transfer process. While a template can save time and money, professional legal advice is invaluable for ensuring a smooth and successful transfer.

This information is purely for educational purposes and should not be considered legal advice. It is important to consult with legal and financial professionals. Each situation is unique, and expert guidance will help ensure your specific needs are met. Remember to carefully review all legal documents before signing.

In conclusion, navigating the process of transferring LLC membership requires careful planning and adherence to legal guidelines, and utilizing resources such as templates and expert advice can pave the way for a seamless transition.