Starting a limited liability company in Maryland is an exciting venture. You’re probably eager to get your business up and running, and rightfully so. But before you jump into the day-to-day operations, it’s crucial to lay a solid foundation. That’s where an LLC operating agreement comes in. It’s not just another piece of paperwork; it’s the backbone of your company, outlining how it will function and how decisions will be made.

Think of an operating agreement as a roadmap for your business. It clarifies the roles and responsibilities of each member, details how profits and losses will be distributed, and sets the stage for conflict resolution should disagreements arise. While Maryland doesn’t legally require you to have one, not having an operating agreement can leave your LLC vulnerable to default state laws, which may not align with your specific business needs or the intentions of the members.

So, whether you’re a seasoned entrepreneur or just starting, understanding the importance of an LLC operating agreement template Maryland and having one in place is a smart move. It provides clarity, structure, and protection, ensuring a smoother path to success for your Maryland-based LLC. It’s an investment in your company’s future and well worth the effort to get right.

Why You Absolutely Need an LLC Operating Agreement in Maryland

An LLC operating agreement is often described as the governing document for your limited liability company. It’s like the constitution for your business, dictating how things should be run. But why is it so important, especially in Maryland? The answer lies in the flexibility and protection it offers. Without one, your LLC will be subject to Maryland’s default rules for LLCs, which might not be suitable for your unique business structure or the desires of its members.

One of the key benefits of an operating agreement is that it allows you to customize the rules and regulations that govern your LLC. This includes specifying the percentage of ownership each member holds, how profits and losses are allocated, and how decisions are made. For example, if you and a partner are starting a business and investing different amounts of capital, the operating agreement can stipulate that profits are distributed proportionally to your investments, rather than equally. This level of customization is simply not possible without a well-drafted operating agreement.

Moreover, an operating agreement can protect your personal assets from business debts and liabilities. By clearly defining the roles and responsibilities of each member, it reinforces the separation between your personal and business finances. This is crucial in maintaining the limited liability protection that an LLC provides. In the event of a lawsuit or business debt, your personal assets are less likely to be at risk if you have a solid operating agreement in place.

Beyond financial protection, the operating agreement also addresses important operational aspects of your business. It can outline procedures for adding or removing members, transferring ownership interests, and dissolving the LLC. It can also detail how disputes will be resolved, which can save time and money in the long run by avoiding costly litigation. By proactively addressing these issues in the operating agreement, you can minimize potential conflicts and ensure a more stable and predictable business environment.

Ultimately, having an LLC operating agreement in Maryland is about taking control of your business destiny. It’s about creating a framework that aligns with your specific goals and protects your interests. While creating an LLC operating agreement template Maryland might seem like an extra step, it’s an essential one that can save you headaches, money, and potential legal battles down the road. Think of it as an investment in the long-term success and stability of your Maryland LLC.

Key Elements to Include in Your Maryland LLC Operating Agreement

Creating a comprehensive LLC operating agreement might seem daunting, but breaking it down into its key components makes the process much more manageable. Here are some essential elements that should be included in your Maryland LLC operating agreement to ensure its effectiveness and protect your business interests.

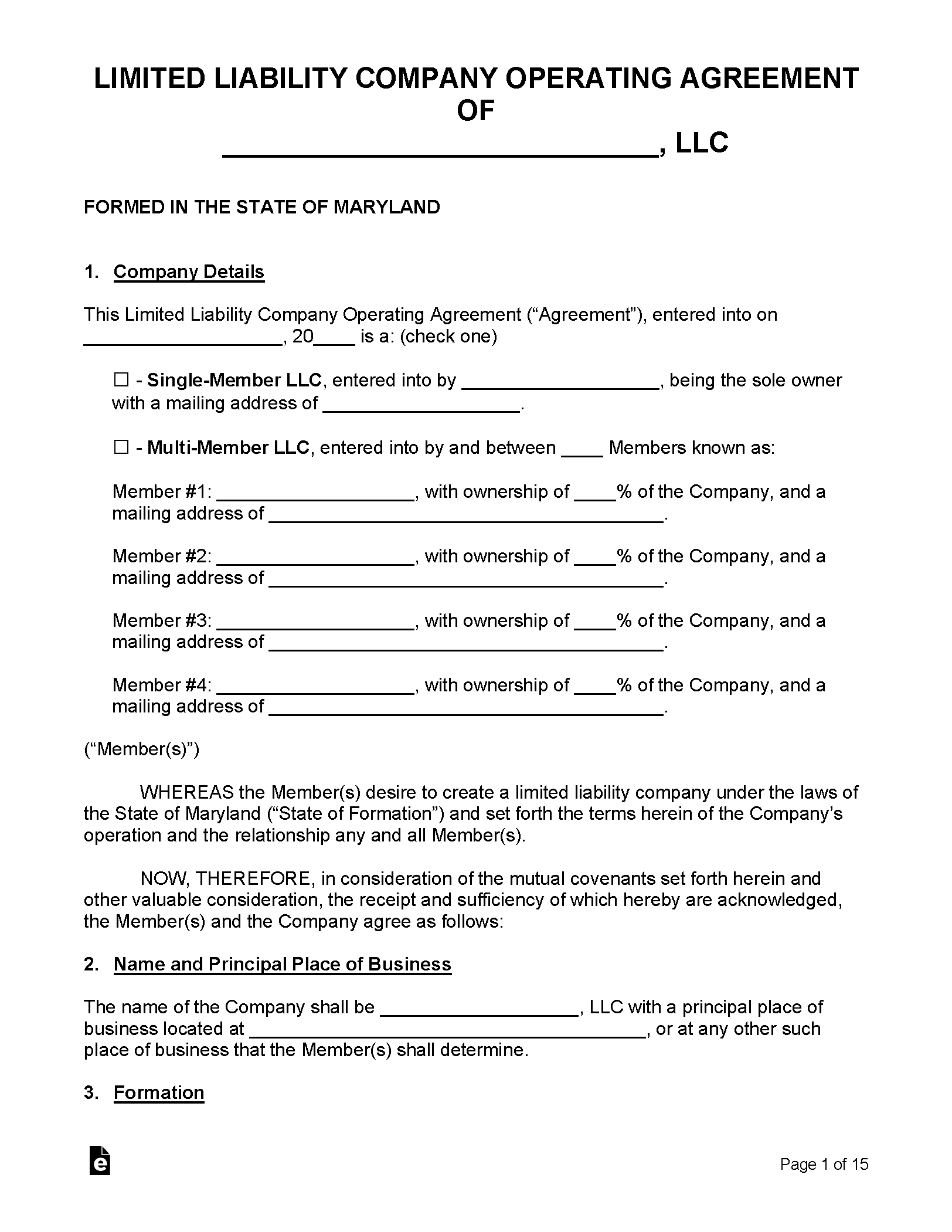

First and foremost, you need to clearly identify the basic information about your LLC. This includes the company name, its principal place of business, the registered agent’s name and address, and the date the agreement was created. Specifying the purpose of the LLC is also important. This section outlines the type of business your LLC will conduct, which helps define the scope of its activities and can protect against potential liability issues.

Next, the agreement should detail the membership structure of the LLC. This involves listing the names and addresses of each member, their initial capital contributions (both cash and non-cash), and their percentage ownership interests. The operating agreement should also specify how profits and losses will be allocated among the members. As mentioned earlier, this can be done proportionally to capital contributions or according to some other agreed-upon formula.

Another critical element is the management structure of the LLC. You need to decide whether your LLC will be member-managed or manager-managed. In a member-managed LLC, all members actively participate in the day-to-day operations and decision-making. In a manager-managed LLC, one or more designated managers are responsible for running the business. The operating agreement should clearly define the roles, responsibilities, and authority of each manager or member.

Finally, the operating agreement should address important operational procedures, such as how meetings will be conducted, how decisions will be made (e.g., by majority vote or unanimous consent), and how disputes will be resolved. It should also outline the procedures for adding or removing members, transferring ownership interests, and dissolving the LLC. Having clear and well-defined procedures in place can help prevent conflicts and ensure a smooth transition in the event of unforeseen circumstances. A well-crafted LLC operating agreement template Maryland will touch on all of these critical areas.

In summary, a well-drafted LLC operating agreement is a cornerstone of a successful Maryland LLC. It provides clarity, structure, and protection, ensuring that your business operates smoothly and efficiently. It’s an investment in your company’s future and a testament to your commitment to building a solid foundation for long-term success.

Starting an LLC can feel like navigating uncharted waters. There are forms to fill out, regulations to understand, and decisions to make. While it might be tempting to skip certain steps, like creating an operating agreement, remember that it serves as a critical safeguard for your business.

Think of the operating agreement as a silent partner, always working in the background to protect your interests. It’s a document that can help you avoid misunderstandings, resolve conflicts, and ensure that your business operates according to your vision. Investing the time and effort to create a comprehensive operating agreement is an investment in the future of your Maryland LLC.