So, you’re thinking about starting an LLC in Massachusetts? That’s fantastic! It’s a smart move for so many entrepreneurs and small business owners. But before you dive headfirst into the exciting world of business ownership, there’s a crucial document you need to get right: your LLC operating agreement. Think of it as the constitution for your company. It outlines the rules, responsibilities, and rights of each member, ensuring everything runs smoothly and that everyone is on the same page.

While Massachusetts doesn’t legally *require* you to have an operating agreement, trust me, you absolutely want one. Without it, your LLC will be governed by the default rules of Massachusetts state law, which might not be ideal for your specific business structure or the needs of your members. It’s kind of like driving a car without a steering wheel – you *might* get where you’re going, but it’s going to be a bumpy ride and you have very little control.

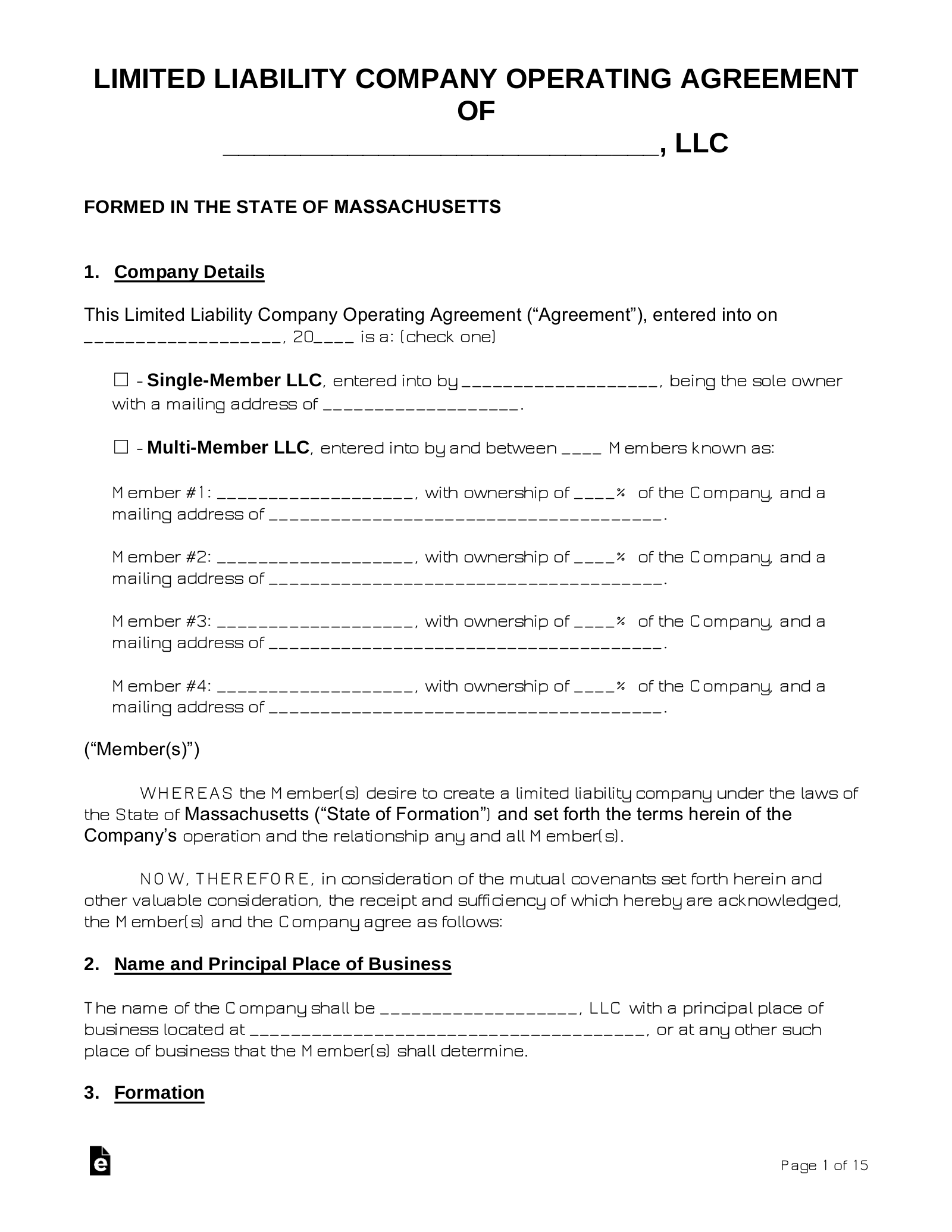

That’s where an llc operating agreement template massachusetts comes in handy. It gives you a solid foundation, a pre-built structure you can customize to fit your business like a glove. It’s a starting point, saving you time and legal fees. Let’s explore what this document is all about and why it’s so important.

Why You Absolutely Need an LLC Operating Agreement in Massachusetts

Even though the state of Massachusetts doesn’t mandate an operating agreement for LLCs, choosing to forego one is generally viewed as a strategic misstep for most business owners. Think of it this way: you wouldn’t build a house without a blueprint, right? An operating agreement serves a similar purpose for your LLC. It provides clarity, structure, and protection for your business and its members.

One of the most important reasons to have an operating agreement is to establish the ownership percentages of each member. This might seem straightforward if you have a 50/50 partnership, but what if one member contributes significantly more capital or expertise? The operating agreement allows you to clearly define each member’s stake in the company, which can prevent disputes down the road. Furthermore, it outlines how profits and losses will be distributed among the members. Will it be strictly based on ownership percentages, or will other factors be considered?

Beyond ownership and profits, an operating agreement details the roles and responsibilities of each member. Who is responsible for managing the day-to-day operations of the business? Who has the authority to make financial decisions? Clearly defining these roles can prevent confusion and ensure that everyone knows their responsibilities. This is particularly important if you have a complex organizational structure or multiple members with different areas of expertise.

Another crucial aspect covered in an operating agreement is the process for adding or removing members. What happens if a member wants to leave the company? What if you want to bring in a new partner? The operating agreement should outline the procedures for these scenarios, ensuring a smooth transition and protecting the interests of all members. It can specify buy-out terms, voting rights for new members, and other important considerations.

Finally, and perhaps most importantly, an operating agreement can help protect your personal assets. By clearly separating your personal finances from your business finances, you can limit your personal liability in the event of a lawsuit or debt. The operating agreement reinforces the legal distinction between you and your LLC, which is a key benefit of the LLC structure. Without a well-defined operating agreement, a court might be more likely to “pierce the corporate veil” and hold you personally liable for the debts and obligations of your business.

Key Elements of an LLC Operating Agreement Template Massachusetts

So, you’re convinced you need an llc operating agreement template massachusetts – great! But what exactly should it include? While every business is unique, there are some essential elements that should be included in every operating agreement. Let’s break down the key components.

First and foremost, the operating agreement should clearly identify the LLC’s name and principal place of business. This seems obvious, but it’s important to have this information readily available. It should also state the purpose of the LLC. What type of business will it be conducting? This helps to define the scope of your business activities and can be useful in limiting liability.

Next, the agreement needs to clearly outline the members of the LLC, their names, addresses, and their percentage of ownership. As mentioned before, this is crucial for determining profit and loss distribution, as well as voting rights. The agreement should also specify how capital contributions are handled. What initial investments did each member make? How will future capital contributions be handled? This can be in the form of cash, property, or services.

Another vital section is the management structure of the LLC. Will it be member-managed or manager-managed? In a member-managed LLC, all members participate in the day-to-day operations of the business. In a manager-managed LLC, one or more designated managers are responsible for running the business. The operating agreement should clearly define the roles and responsibilities of each member or manager.

The operating agreement should also address the procedures for making decisions. How will decisions be made? Will it be by majority vote, unanimous consent, or some other method? The agreement should also outline the procedures for holding meetings and keeping records. Proper record-keeping is essential for maintaining the integrity of your LLC and complying with state regulations.

Finally, the operating agreement should include provisions for dissolution of the LLC. What happens if the members decide to close the business? How will the assets be distributed? The agreement should also address what happens if a member dies, becomes disabled, or wants to withdraw from the LLC. Having these procedures in place can prevent disputes and ensure a smooth winding-down of the business.

Creating an LLC operating agreement might seem daunting, but it’s an investment in the future of your company. It’s better to invest time and effort at the beginning to establish clear rules and procedures than to deal with costly disputes later on.

Remember, it’s always a good idea to consult with an attorney to ensure your operating agreement is comprehensive and compliant with Massachusetts law. Using an llc operating agreement template massachusetts can be a great starting point, but professional legal advice can provide peace of mind and protect your business for years to come.