Starting a Limited Liability Company in Minnesota? Congratulations! You’re embarking on an exciting journey. One of the most crucial steps in setting up your LLC, often overlooked, is creating an operating agreement. Think of it as the rulebook for your business, outlining how it will be run and how decisions will be made. While Minnesota doesn’t legally *require* you to have one, trust me, you absolutely want one.

Why is an operating agreement so important? Well, it helps prevent misunderstandings and disagreements among members, especially down the road. It’s far easier to agree on the rules of the game *before* a conflict arises than to try and figure things out when tensions are already high. Plus, it reinforces the limited liability protection that comes with forming an LLC.

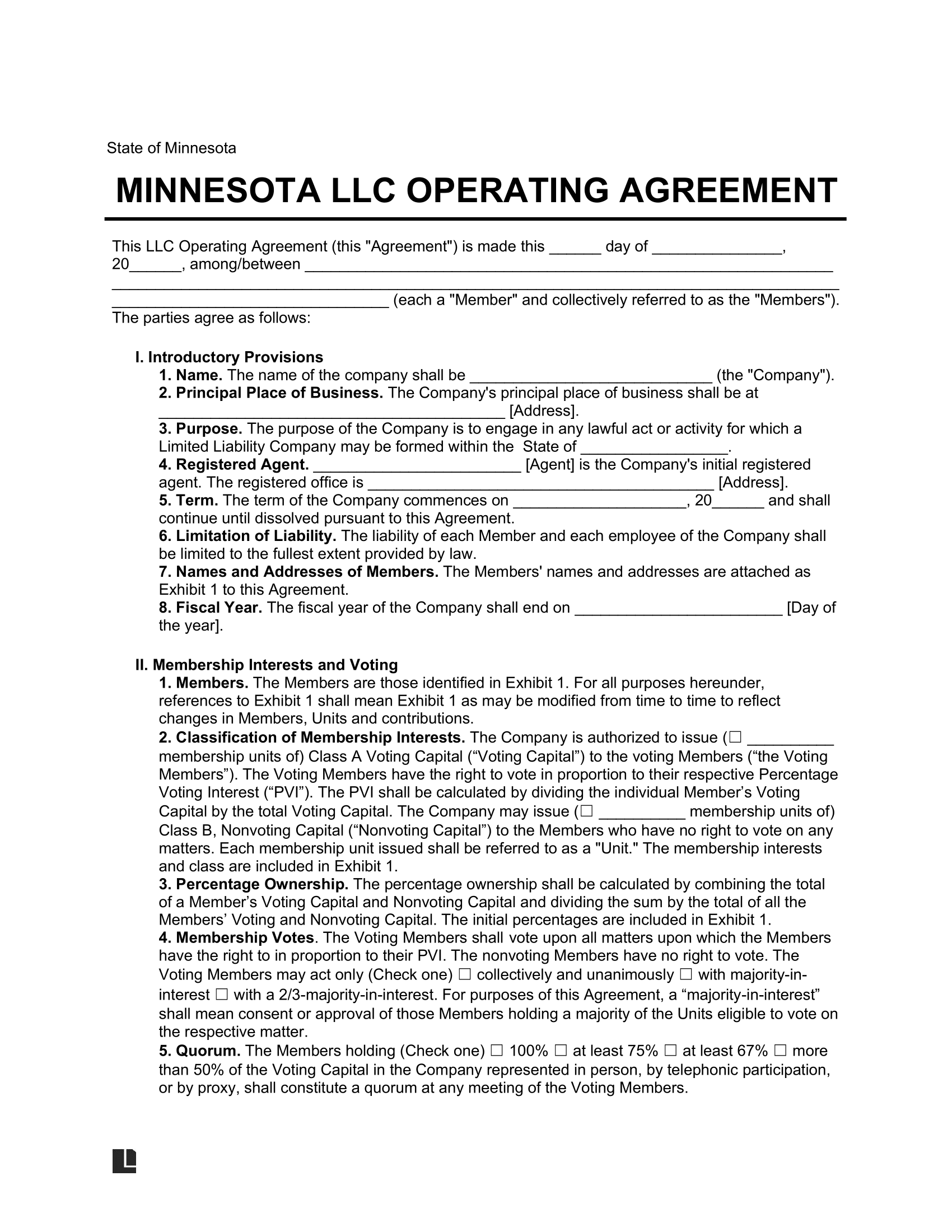

So, you’re probably wondering where to start. Creating a comprehensive operating agreement might seem daunting, but it doesn’t have to be. You could hire a lawyer, which can be expensive. Or, you could use an llc operating agreement template Minnesota as a starting point. This article will guide you through why you need one and what to consider.

Why You Absolutely Need an Operating Agreement in Minnesota

Even though Minnesota law might not explicitly demand an operating agreement, operating without one is like sailing a ship without a rudder. Sure, you might get somewhere, but you’re likely to drift off course, encounter unexpected storms, and potentially crash. An operating agreement provides structure, clarity, and legal protection, making it an indispensable document for any Minnesota LLC.

Think of it this way: without an operating agreement, Minnesota state law will govern how your LLC operates. While state law is a good starting point, it’s a one-size-fits-all approach that might not be suitable for your specific business and its unique circumstances. Your business is unique, so shouldn’t its governing document be too?

An operating agreement allows you to customize the rules to fit your specific needs. For example, you can define each member’s responsibilities, outline how profits and losses will be allocated, establish procedures for admitting new members, and determine how decisions will be made. These are all crucial aspects of running a business smoothly, and an operating agreement ensures everyone is on the same page.

Furthermore, an operating agreement protects your limited liability status. By clearly defining the rights and responsibilities of the members, it demonstrates that your LLC is a separate entity from its owners. This strengthens the barrier between your personal assets and the liabilities of the business. In the event of a lawsuit or debt, this separation is crucial in protecting your personal finances.

Finally, an operating agreement helps prevent disputes among members. Disagreements are inevitable in any business partnership, but having a clear set of rules in place can help resolve conflicts quickly and efficiently. It can also help prevent disagreements from escalating into costly legal battles. A well-drafted operating agreement outlines the process for resolving disputes, whether through mediation, arbitration, or other methods. Having these procedures defined in advance can save you time, money, and headaches down the road.

Key Elements to Include in Your Minnesota LLC Operating Agreement

Crafting a solid operating agreement involves carefully considering several key elements that will govern the operation of your LLC. These elements provide a roadmap for your business, ensuring clarity and preventing potential conflicts.

First and foremost, clearly identify the members of the LLC and their respective ownership percentages. This seems obvious, but it’s crucial to document accurately from the start. Specify how profits and losses will be allocated among the members. Will it be based on ownership percentage, contributions, or some other formula? Be specific.

Next, outline the management structure of your LLC. Will it be member-managed, where the members are directly involved in day-to-day operations, or manager-managed, where a designated manager or managers handle the business affairs? Describe the roles and responsibilities of each member or manager.

Another vital component is the decision-making process. How will important decisions be made? Will it require a simple majority vote, a unanimous vote, or some other threshold? Specify the types of decisions that require a specific level of approval. Furthermore, you should establish procedures for adding or removing members from the LLC.

Finally, you need to address the process for dissolving the LLC. Under what circumstances will the LLC be dissolved? How will assets be distributed upon dissolution? Having a plan in place for the end of the business can prevent disputes and ensure a smooth winding-down process. These are just some of the important considerations when drafting your llc operating agreement template Minnesota.

Starting a business is a big deal and requires a lot of moving parts. We hope that this article helps you understand the ins and outs of LLC operating agreements so that you can start your business with confidence.