So, you’re diving into the exciting world of entrepreneurship in Texas and starting an LLC? Congratulations! That’s a fantastic step towards building your dream business. One of the most important documents you’ll need, and often overlooked, is your LLC operating agreement. Think of it as the rulebook for your company, outlining how things will be run, who’s responsible for what, and how profits and losses are divided. It might seem intimidating, but it’s really about setting a clear foundation for success.

While Texas doesn’t legally *require* you to have an operating agreement, trust me, you absolutely want one. It’s like having insurance for your business. It protects you from potential disputes, clarifies member roles, and even helps maintain your limited liability status. Without it, Texas state law will dictate how your LLC operates, and that might not align with your specific needs or vision. So, let’s get down to figuring out what needs to be in there, and how an llc operating agreement template texas can get you started.

Now, you might be wondering where to even begin. The good news is, you don’t have to start from scratch! There are plenty of resources available, including templates that can serve as a strong foundation. But remember, a template is just a starting point. It’s crucial to tailor it to your specific business structure, member agreements, and long-term goals. Think of it as customizing a suit – you want it to fit *you* perfectly. We’ll walk you through the key components and how to make sure it’s the right fit for your Texas LLC.

Why You Absolutely Need an Operating Agreement (Even Though Texas Doesn’t *Make* You)

Okay, let’s drill down on why this document is so critical. Yes, Texas doesn’t mandate it, but skipping it is a bit like driving without a seatbelt – you *can* do it, but it’s a really bad idea. An operating agreement essentially provides a roadmap for your LLC’s operations. It details everything from member responsibilities and voting rights to profit distribution and what happens if a member wants to leave or if the company dissolves. Think of it as preventative medicine for your business. It can help you avoid costly legal battles and misunderstandings down the road.

One of the biggest benefits of having an operating agreement is that it clearly defines the roles and responsibilities of each member. This is especially important if you have multiple members. Who’s in charge of marketing? Who handles the finances? Who’s responsible for day-to-day operations? By outlining these things in writing, you minimize the potential for confusion and conflict. A well-written operating agreement can prevent members from making major decisions that could impact the entire business without proper authorization, protecting everyone involved.

Beyond clarifying roles, the agreement also addresses the crucial issue of profit and loss distribution. How will profits be split among the members? Will it be based on ownership percentage, capital contributions, or some other agreed-upon formula? The operating agreement allows you to customize this distribution to fit your specific circumstances. It also specifies how losses will be handled, which can be just as important as how you share profits.

Moreover, an operating agreement can help protect your personal assets by reinforcing the limited liability status of your LLC. This means that your personal assets (like your house and car) are generally shielded from business debts and lawsuits. However, this protection can be weakened if you don’t have a clear separation between your personal and business finances. A properly drafted operating agreement helps demonstrate this separation, strengthening your limited liability shield. This is important for showing creditors and legal authorities that your LLC is a distinct legal entity.

Finally, consider what happens if a member leaves the LLC, becomes incapacitated, or passes away. An operating agreement outlines the procedures for these situations, including how the member’s interest will be transferred or redeemed. Without these guidelines, you could face significant legal and financial complications. The operating agreement can specify a buy-sell agreement, which provides a predetermined method for valuing and transferring ownership shares in such events, ensuring a smooth transition and minimizing disruption to the business.

Key Components of an LLC Operating Agreement Template Texas

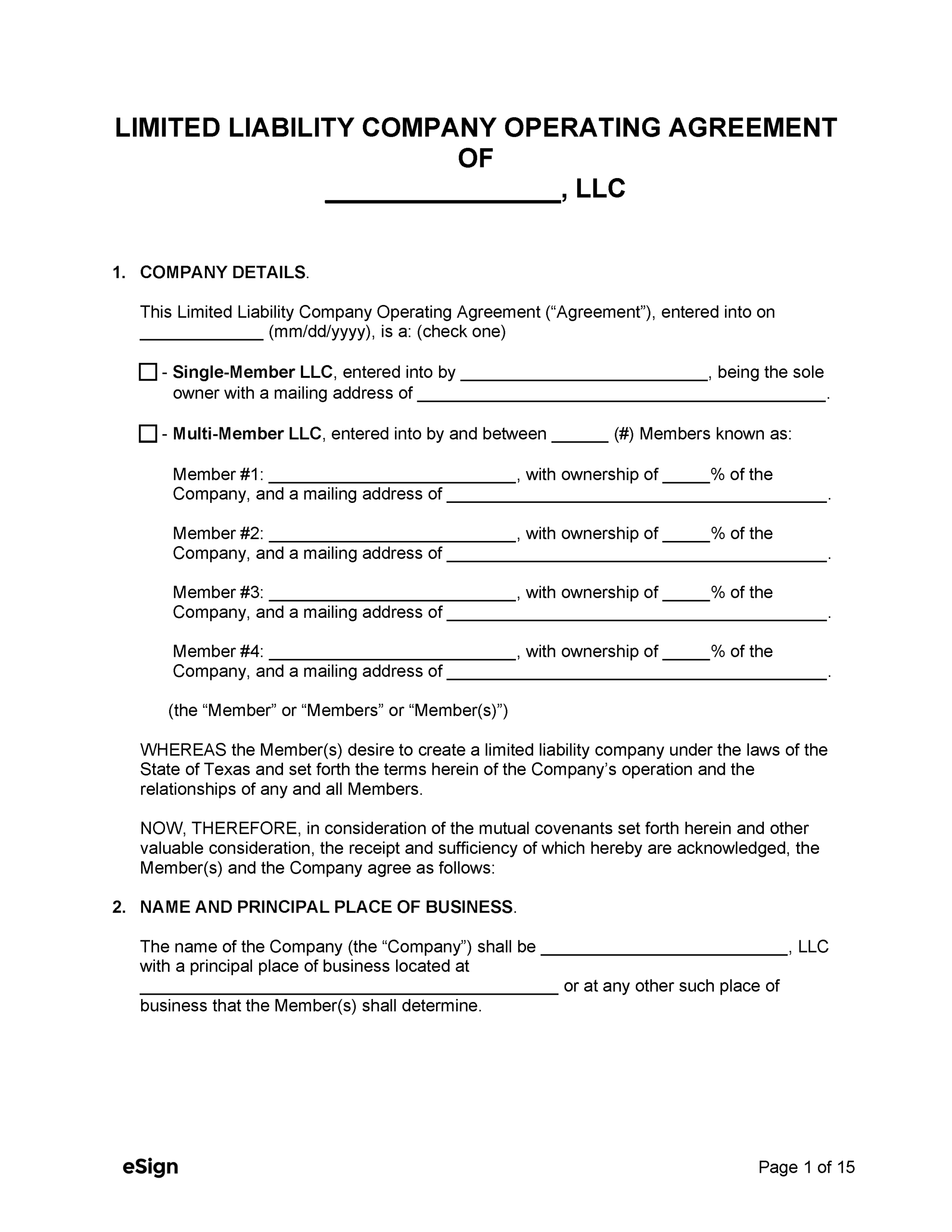

Alright, let’s break down what you’ll typically find in an llc operating agreement template texas. While every template will vary slightly, there are some core elements that should always be included. First, you’ll need to identify the name and address of your LLC, as well as the names and addresses of all the members. This establishes the basic identity of the business and its owners.

Next, the agreement should outline the purpose of your LLC. What specific business activities will your company engage in? This section doesn’t need to be overly detailed, but it should clearly define the scope of your business. You will also want to have a section dedicated to the contributions of each member. This will include the initial contribution from each member of the LLC, which can include cash, property, or services. This section may also specify the process for making future contributions and the consequences for failing to do so.

Another crucial section covers the management structure of your LLC. Will it be member-managed (where the members directly manage the business) or manager-managed (where one or more designated managers run the company)? This decision will significantly impact how decisions are made and who has the authority to act on behalf of the LLC. For a member managed LLC, the operating agreement will clearly define the responsibilities of each member. This may include specific duties such as handling finances, managing operations, or overseeing marketing efforts. For a manager-managed LLC, the operating agreement will outline the powers and limitations of the managers. It will also specify how managers are selected, removed, and compensated.

As we discussed earlier, the operating agreement should also detail how profits and losses will be allocated among the members. This section should be very clear and unambiguous to avoid any disputes. It should also specify when and how distributions will be made. Beyond the distribution of profits, the agreement should also outline the process for handling losses. Will members be required to contribute additional capital to cover losses? How will losses be allocated among the members for tax purposes?

Finally, the operating agreement should address the process for amending the agreement, admitting new members, and dissolving the LLC. What percentage of member approval is required to make changes to the agreement? What are the procedures for admitting new members and transferring ownership interests? Under what circumstances can the LLC be dissolved, and how will assets be distributed upon dissolution? Addressing these issues proactively can save you a lot of headaches down the road.

Creating an LLC and running a business involves many steps. You’re probably thinking about all the logistical things like securing funding and marketing your products. These are all very important, but taking the time to get a sound operating agreement ensures that the core operations and agreements between members are clear, leading to long-term business stability.

Starting a new business can be a challenge, but knowing you’ve put in the work ahead of time, can take some of the pressure off. So, take that llc operating agreement template texas, personalize it, and make sure it’s reflective of your LLC’s individual needs. By taking this step you’ve laid a foundation that will hopefully result in long-term business success.