So, you’re thinking about starting an LLC in Washington State? That’s fantastic! You’re probably already envisioning the possibilities and excitement of running your own business. But before you dive headfirst into the world of entrepreneurship, there’s a crucial document you absolutely need to get in order: the LLC operating agreement. Think of it as the roadmap for your company, outlining the rules and regulations that will govern how your LLC operates. Don’t worry, it’s not as scary as it sounds, and having a solid operating agreement in place can save you a lot of headaches down the road.

An LLC operating agreement is essentially a contract between the members (owners) of the LLC. It details everything from each member’s responsibilities and contributions to how profits and losses are distributed. It also clarifies how decisions are made and what happens if a member decides to leave or if the LLC needs to be dissolved. In short, it’s a comprehensive guide that keeps everyone on the same page and helps prevent disagreements or misunderstandings. And while Washington State doesn’t legally require you to have one, it’s something any smart business owner shouldn’t skip.

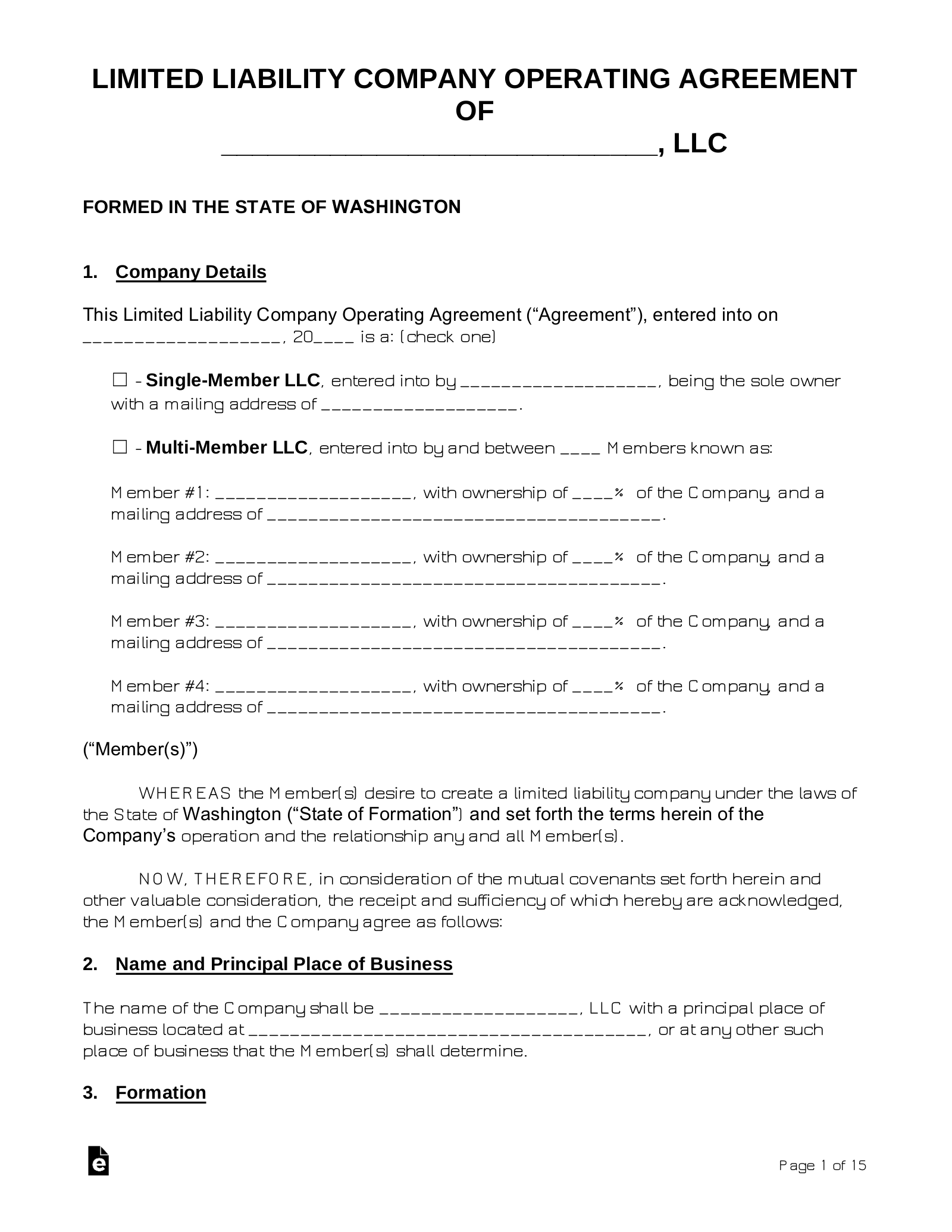

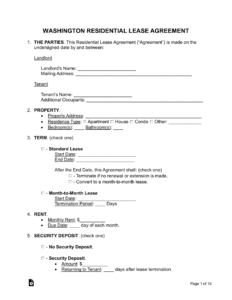

This article is all about helping you understand the importance of having an LLC operating agreement, especially focusing on finding a suitable “llc operating agreement template washington state”. We’ll discuss why it’s so vital, what key elements it should include, and where you can find reliable templates to get you started. Think of this guide as your friendly companion as you embark on your LLC journey. Let’s get started!

Why You Need an LLC Operating Agreement in Washington State

Even though Washington State doesn’t legally mandate an operating agreement for LLCs, operating without one is like sailing a ship without a rudder. You might be able to float along for a while, but you’ll eventually run into trouble. Think of it this way: without an operating agreement, your LLC will be governed by Washington State’s default laws for LLCs. While these laws provide a basic framework, they might not be ideal for your specific business needs and goals. These laws can be rigid and might not reflect the unique arrangements you and your fellow members have agreed upon.

For instance, the default rules might dictate how profits are divided, how decisions are made, or what happens if a member wants to leave the LLC. But what if you and your partners have a different vision? What if you want to allocate profits based on each member’s contribution, rather than an equal split? Or perhaps you have a specific process for handling membership changes. An operating agreement allows you to customize these rules to fit your specific circumstances. It’s your chance to create a framework that aligns perfectly with your business structure and goals.

Beyond customization, an operating agreement can also provide crucial liability protection. It helps solidify the separation between your personal assets and the LLC’s assets. This is particularly important because one of the primary reasons people choose to form an LLC is to limit their personal liability for the business’s debts and obligations. A well-drafted operating agreement reinforces this separation, making it more difficult for creditors to pierce the corporate veil and come after your personal assets.

Consider the potential for disputes among members. Even if you’re starting a business with your best friend, disagreements can arise, especially when money is involved. An operating agreement acts as a prenuptial agreement for your business, outlining how disagreements will be resolved, how decisions will be made in deadlocks, and what happens if a member wants to leave or is forced out. By addressing these issues upfront, you can avoid costly and time-consuming legal battles down the road.

In essence, an LLC operating agreement is a safeguard, a customizable framework, and a dispute-resolution mechanism all rolled into one. It’s a foundational document that provides clarity, protects your interests, and sets your LLC up for success in Washington State. Finding the right “llc operating agreement template washington state” is the first step.

Key Elements to Include in Your Washington State LLC Operating Agreement

So, you’re ready to create your LLC operating agreement? Great! But what should you actually include? While every LLC is different, there are certain key elements that should be addressed in almost every operating agreement. Think of these as the essential building blocks that form the foundation of your LLC’s governance.

First and foremost, you’ll need to clearly identify the LLC’s name and principal place of business. This seems simple, but it’s important to be precise and consistent. You should also specify the LLC’s purpose, which is a brief description of the type of business the LLC will conduct. This doesn’t need to be overly detailed, but it should be clear enough to give anyone reading the agreement a general understanding of what the LLC does. Next, list the names and addresses of all the members (owners) of the LLC. This establishes who the owners are and provides a point of contact for each member.

Another critical element is the contribution of each member. This outlines the initial investment that each member made in the LLC, whether it’s cash, property, or services. It’s also important to specify how future capital contributions will be handled. Will members be required to contribute additional capital if needed? How will these contributions be valued? Be sure to detail profit and loss allocation. This section outlines how the LLC’s profits and losses will be distributed among the members. This can be an equal split, or it can be based on each member’s contribution, involvement, or another agreed-upon formula.

Management structure is also something to consider. Will the LLC be member-managed, meaning that the members will collectively manage the business? Or will it be manager-managed, meaning that one or more designated managers will be responsible for the day-to-day operations? Outline the decision-making process. This section details how decisions will be made within the LLC. Will decisions require a unanimous vote of the members? Or will a majority vote suffice? You should also specify how meetings will be conducted and how members can participate in decision-making.

Finally, think about membership changes and dissolution procedures. This outlines what happens if a member wants to leave the LLC, or if the LLC needs to be dissolved. It should specify the process for transferring membership interests, valuing those interests, and distributing assets upon dissolution. Addressing these issues upfront can prevent disputes and ensure a smooth transition if these situations arise. Using an “llc operating agreement template washington state” will help make sure you have all the main points covered, but remember to adjust it to fit the individual needs of your business.

Crafting an LLC operating agreement may seem daunting, but with careful planning and attention to detail, you can create a document that protects your interests and sets your LLC up for success. Remember to consult with an attorney or business advisor if you have any questions or need help drafting your operating agreement.

Think of your LLC operating agreement as more than just a legal document; it’s an investment in the future of your business. By taking the time to create a comprehensive and well-thought-out agreement, you’re laying the groundwork for a successful and sustainable business venture.