So, you’re thinking about buying or selling shares in a Limited Liability Company (LLC)? That’s fantastic! It’s an exciting step, whether you’re expanding your business or moving on to new ventures. But before you jump in, it’s absolutely crucial to have the right paperwork in place. This is where an LLC share purchase agreement template comes in handy. Think of it as your roadmap for a smooth and legally sound transaction. It clearly outlines all the terms and conditions of the sale, protecting both the buyer and the seller.

Without a solid agreement, you’re leaving yourself open to potential misunderstandings, disputes, and even legal trouble down the road. Imagine disagreements arising about the purchase price, payment schedule, or even what’s included in the sale! An LLC share purchase agreement acts as a shield, clarifying expectations and ensuring everyone is on the same page. It’s definitely worth the investment of time and effort to get it right.

This article will guide you through understanding the importance of an LLC share purchase agreement and provide insights into what key elements should be included. We will also explore resources where you can find a suitable LLC share purchase agreement template. So, let’s dive in and ensure your share transfer is as seamless as possible!

Understanding the Importance of a Robust LLC Share Purchase Agreement

A comprehensive LLC share purchase agreement is more than just a formality; it’s the bedrock of a successful transfer of ownership. It provides a clear and legally binding framework that minimizes risk and protects the interests of all parties involved. Think of it as an insurance policy against future disputes. Without one, you’re navigating uncharted waters, and that can be a risky proposition in the world of business.

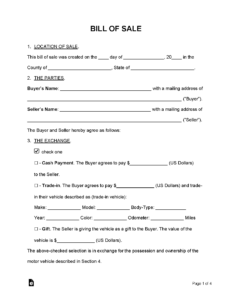

Specifically, a well-drafted agreement clearly defines exactly what is being sold. It meticulously details the number of shares being transferred, the associated percentage of ownership in the LLC, and any related rights or obligations that come along with those shares. This eliminates any ambiguity or potential disagreements about what the buyer is actually acquiring.

Furthermore, the agreement outlines the purchase price and the payment terms. This includes the total amount being paid for the shares, the method of payment (e.g., cash, installments), and the specific dates on which payments are due. Having these details clearly spelled out prevents misunderstandings and ensures that the seller receives the agreed-upon compensation.

In addition, a solid LLC share purchase agreement should address important issues like representations and warranties. These are essentially promises made by both the buyer and the seller regarding the state of the business and the ownership of the shares. For instance, the seller might warrant that they have the legal right to sell the shares and that the company is in good standing. The buyer might warrant that they have the financial resources to complete the purchase. These representations provide a level of assurance and protection to both parties.

Finally, a good agreement anticipates potential future scenarios and includes clauses to address them. This might involve provisions for dispute resolution, such as mediation or arbitration, should any disagreements arise after the sale. It might also include clauses addressing confidentiality, non-compete agreements, or the transfer of intellectual property. By thinking ahead and including these types of provisions, you can significantly reduce the likelihood of future complications.

Key Elements to Include in Your LLC Share Purchase Agreement

When crafting your LLC share purchase agreement, there are several key elements you need to include to ensure clarity and legal protection. While an LLC share purchase agreement template can be a great starting point, it is important to review and customize it to fit your specific circumstances. Failing to include essential details can lead to future disputes and legal complications.

First and foremost, clearly identify the parties involved. This includes the full legal names and addresses of both the seller and the buyer. Ensure that you’re dealing with authorized representatives who have the legal capacity to enter into the agreement. This sounds basic, but it’s a fundamental step that should never be overlooked.

Next, precisely define the shares being transferred. Specify the number of shares, the class of shares (if applicable), and the percentage of ownership they represent in the LLC. Attach a copy of the LLC’s operating agreement and any relevant membership certificates to the agreement as exhibits. This provides concrete evidence of the ownership structure and helps avoid any confusion.

Detail the purchase price and payment terms with utmost clarity. Specify the total purchase price, the method of payment (e.g., cash, wire transfer, promissory note), the payment schedule (including due dates and amounts), and any applicable interest rates or penalties for late payments. Consider including an escrow arrangement to secure the funds until all conditions of the sale are met.

Include representations and warranties from both the buyer and the seller. These are statements of fact that each party is promising to be true. For example, the seller might warrant that they have clear title to the shares, that the company’s financial statements are accurate, and that there are no undisclosed liabilities. The buyer might warrant that they have the financial capacity to complete the purchase and that they are not aware of any facts that would prevent them from doing so.

Finally, address potential future scenarios by including provisions for dispute resolution (e.g., mediation, arbitration), governing law (specifying which state’s laws will govern the agreement), and attorney’s fees (who pays if a dispute arises and requires legal action). Also, consider including clauses related to indemnification (protecting a party from losses or liabilities) and confidentiality (preventing the disclosure of sensitive information). A well-rounded agreement anticipates potential problems and provides a roadmap for resolving them efficiently and effectively.

Choosing to proceed with a share purchase within an LLC requires careful consideration. Taking the time to understand the purpose of each section of the share purchase agreement will prove beneficial in the long run.

Whether you’re buying or selling, ensuring a smooth transfer process is important. A well-written agreement acts as a roadmap, giving peace of mind knowing that both parties are protected.