Lending money to friends can be tricky. On one hand, you want to help someone you care about, but on the other, you want to protect your own financial wellbeing and avoid any awkwardness that could damage the friendship. That’s where a written loan agreement, or promissory note, comes in handy. It might seem formal when dealing with a friend, but it’s a smart way to ensure everyone is on the same page and minimizes the potential for misunderstandings down the line.

Think of a loan agreement template between friends as a safeguard, a way to codify the terms of your friendly loan. It lays out exactly how much money is being lent, the repayment schedule, interest rate (if any), and what happens if payments are missed. It’s not about distrust; it’s about clarity and providing a structured approach to the loan that protects both parties.

Using a loan agreement template between friends doesn’t have to be complicated. You can find plenty of examples online, which we’ll get into shortly. The goal is to take emotion out of the equation and put the agreement in writing. This way, if life throws a curveball, you have a reference point and a clear understanding of the agreed-upon terms, helping to maintain your friendship and your financial health.

Why You Absolutely Need a Written Loan Agreement with Friends

Okay, let’s be real. Handshake deals between friends are great in theory, but memory can be unreliable, and assumptions can lead to conflicts. A written loan agreement is your best friend when lending money to a friend. It removes ambiguity and clearly defines the expectations for both the lender and the borrower. Without it, you’re relying on memory and goodwill, which can quickly evaporate when money is involved.

Imagine this scenario: You lend your friend some money for a down payment on a car, verbally agreeing they’ll pay you back “when they can.” Months pass, you haven’t seen a dime, and you’re starting to feel resentful. They might feel like you’re rushing them, even if you had a specific timeframe in mind. A loan agreement template between friends avoids this by establishing a clear repayment schedule. It eliminates the guesswork and prevents hard feelings from brewing.

Furthermore, a loan agreement can provide legal protection. While you hopefully won’t need it, having a written agreement gives you recourse if your friend defaults on the loan. It serves as evidence of the debt and the agreed-upon terms, making it easier to pursue legal action if necessary. Think of it as an insurance policy for your loan, protecting your investment and your peace of mind.

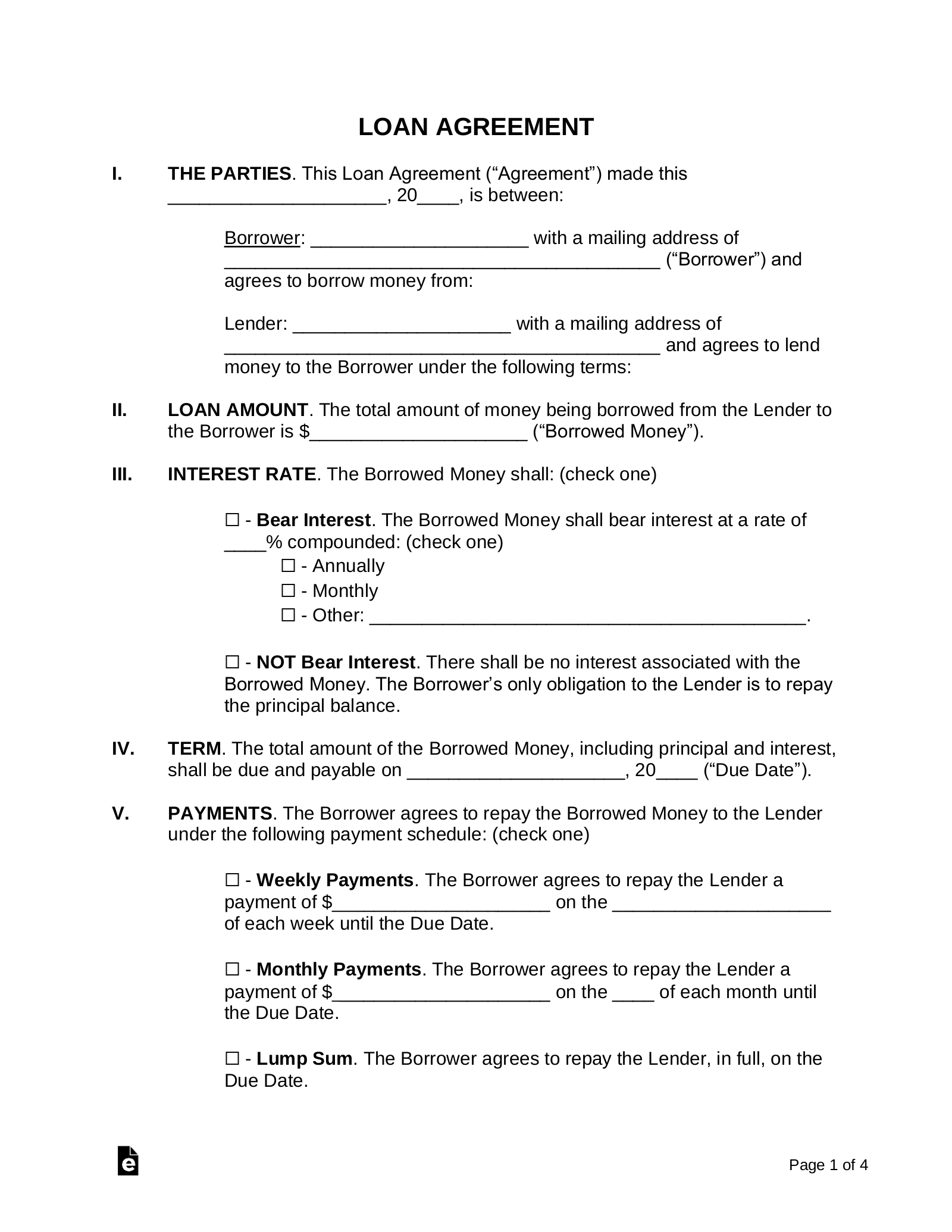

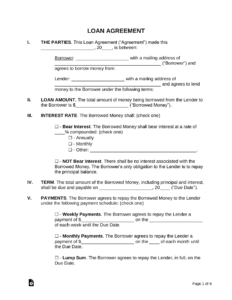

So, what should be included in this crucial document? Key components include the principal loan amount, the interest rate (if any), the repayment schedule (weekly, monthly, etc.), the date of the first payment, and any late payment penalties. It’s also wise to include a clause outlining what happens if the borrower defaults, such as the lender having the right to demand immediate repayment of the outstanding balance.

Don’t forget about signatures! Both you and your friend should carefully read and sign the agreement, acknowledging that you both understand and agree to the terms. Consider having the signatures notarized for an extra layer of protection, especially for larger loan amounts. Remember, the goal is to create a clear, legally sound document that protects both your friendship and your finances.

What if we don’t add an interest rate?

That is up to you and your friend. You are allowed to add 0% of interest to the loan. That is between you both.

Key Elements of a Solid Loan Agreement Template

A well-structured loan agreement isn’t just a formality; it’s a comprehensive roadmap for the lending relationship. It outlines every detail of the loan, ensuring that both parties are aware of their responsibilities and rights. So, what exactly makes up a solid loan agreement template? Let’s break down the essential components.

First and foremost, clearly state the names and addresses of both the lender (you) and the borrower (your friend). This establishes who the agreement is between. Next, specify the exact principal amount of the loan. Avoid vague language; state the precise dollar amount being lent. Following that, clearly define the interest rate, if any. Remember, even a small interest rate can help offset the potential loss of investment income you might experience by lending the money. If no interest is charged, explicitly state “interest rate: 0%”.

The repayment schedule is another crucial element. Detail the frequency of payments (weekly, bi-weekly, monthly), the amount of each payment, and the due date for each payment. Include instructions on how payments should be made (e.g., check, electronic transfer). It’s also wise to include a clause outlining penalties for late payments, such as a late fee or an increase in the interest rate. This encourages timely payments and provides a clear consequence for failing to meet the agreed-upon schedule.

Furthermore, the loan agreement should address what happens in the event of a default. Define what constitutes a default (e.g., missing multiple payments) and outline the lender’s recourse, such as the right to demand immediate repayment of the entire outstanding balance or the option to pursue legal action. Also, consider adding a section on how the agreement can be amended or terminated. This provides flexibility if circumstances change and allows both parties to modify the terms with mutual consent. Any changes must be in writing and signed by both parties.

Finally, ensure the agreement includes a governing law clause, specifying which state’s laws will govern the interpretation and enforcement of the agreement. This is important in case of any disputes. Both you and your friend should carefully read the entire document before signing it, ensuring you both fully understand and agree to all the terms and conditions. A loan agreement template between friends is a tool to create a better environment.

Protecting personal relationships while managing finances requires careful consideration. It involves balancing generosity with prudence, ensuring that both friendship and financial security are maintained.

Remember that clear communication is key to navigating any financial arrangement with friends. Openly discussing expectations, addressing concerns, and maintaining transparency throughout the loan process can prevent misunderstandings and strengthen the bond of friendship.