So, you’re thinking about lending money to a friend or family member, or maybe you’re the one borrowing? That’s a big step! Lending and borrowing between individuals can be a great way to help someone out or get access to funds when you need them. But let’s be honest, mixing money and personal relationships can be a recipe for disaster if not handled correctly. That’s where a solid loan agreement template between two individuals comes in handy. It’s not about distrust, it’s about clarity and protecting everyone involved.

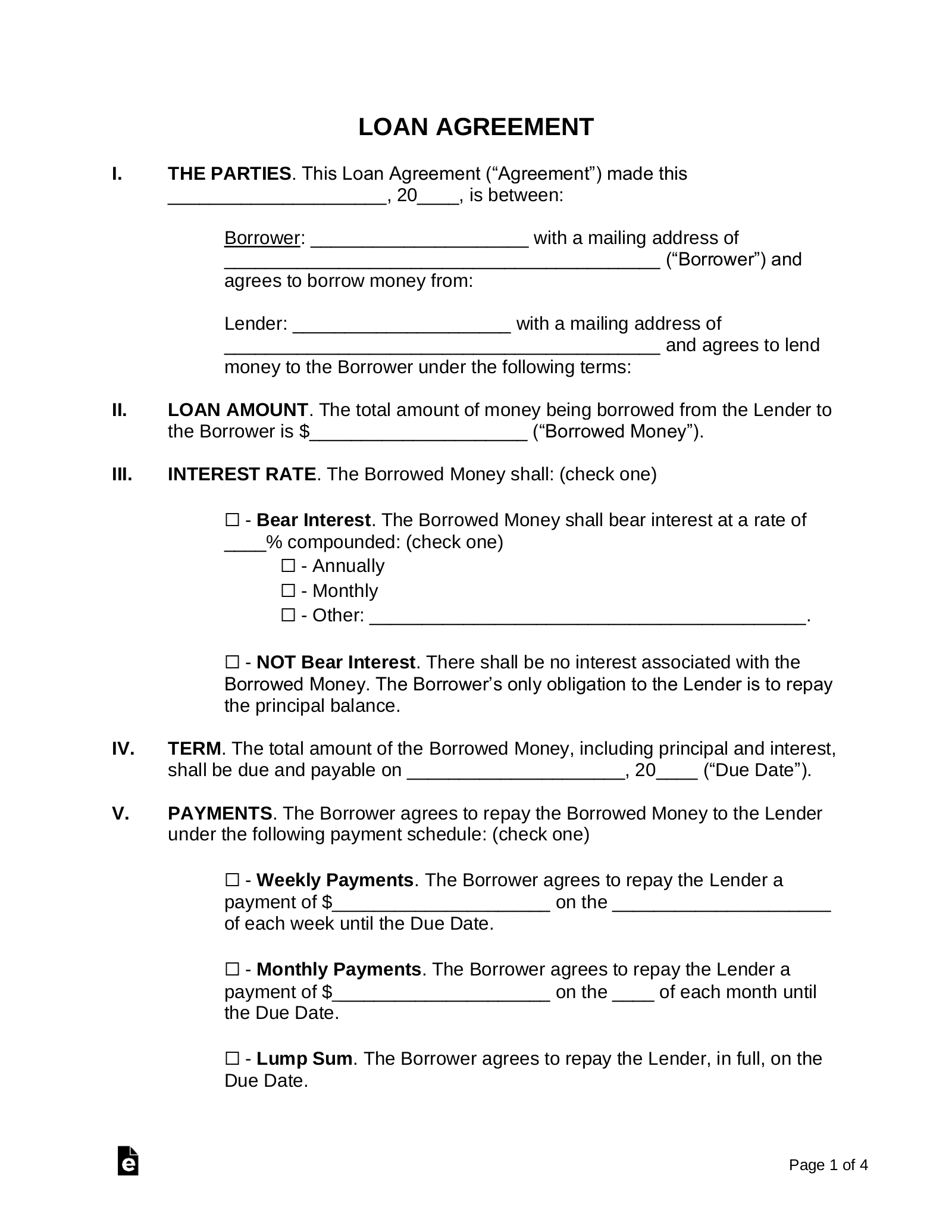

Think of a loan agreement like a roadmap. It clearly outlines the terms of the loan, like how much money is being borrowed, the interest rate (if any), the repayment schedule, and what happens if someone doesn’t hold up their end of the bargain. Having these details in writing helps prevent misunderstandings and ensures that both parties are on the same page. It provides a framework for a smooth transaction and protects your relationship from potential financial disagreements. It’s also useful as a document should you need it for tax purposes.

In this article, we’ll walk you through why using a loan agreement template between two individuals is so important, what key elements it should include, and how to use one effectively. We’ll break down the legal jargon into simple terms so you can create a clear and concise agreement that protects your interests and maintains a healthy relationship with the other party. Let’s get started on crafting an agreement that works for both of you.

Why a Formal Loan Agreement is Essential

Lending money to someone you know can feel informal, like a handshake deal. However, relying solely on verbal agreements is a risky proposition. Memories fade, perspectives differ, and what seemed clear at the outset can become murky over time. A formal loan agreement provides a written record of the terms, minimizing the potential for disputes and protecting both the lender and the borrower.

A comprehensive loan agreement template between two individuals removes any ambiguity. It clearly spells out the amount of the loan (the principal), the agreed-upon interest rate (if any), the repayment schedule (including the amount and frequency of payments), and any late payment penalties. This level of detail ensures that both parties understand their obligations and responsibilities, preventing future disagreements stemming from misunderstandings.

Beyond clarifying the terms, a formal loan agreement provides legal recourse if things go wrong. While no one wants to imagine a scenario where a friend or family member defaults on a loan, it’s crucial to protect your financial interests. With a written agreement, you have a legal document that can be used in court to recover the outstanding debt. Without it, proving the existence of the loan and its terms can be difficult, if not impossible.

Consider this scenario: You lend a friend $5,000 without a written agreement. They make a few payments but then stop responding to your calls. Without a loan agreement, you have limited options for recovering your money. You might be able to pursue a claim based on verbal agreement but it’s difficult to prove and can easily devolve into “he said, she said.” A written agreement provides concrete evidence of the loan and its terms, strengthening your case and increasing your chances of recovering your funds.

Ultimately, creating a formal loan agreement, even with someone you trust, is a responsible and prudent decision. It demonstrates a commitment to transparency and protects both parties involved. It establishes clear expectations, minimizing the risk of misunderstandings and preserving your relationship. It allows you to lend or borrow money with confidence, knowing that you have a legally sound agreement in place.

Key Elements of a Solid Loan Agreement

A well-drafted loan agreement should cover several essential points to ensure clarity and protect the interests of both parties. Here’s a breakdown of the crucial elements to include in your loan agreement template between two individuals.

Parties Involved: Clearly identify the lender and the borrower by their full legal names and addresses. This establishes who is bound by the agreement and avoids confusion later on.

Loan Amount (Principal): State the exact amount of money being lent. This is the foundation of the agreement, so ensure it is accurate.

Interest Rate: If you are charging interest, specify the annual interest rate. Be sure to comply with applicable usury laws (laws that limit the amount of interest that can be charged on a loan) in your jurisdiction.

Repayment Schedule: Detail how the loan will be repaid. This includes the frequency of payments (e.g., monthly, bi-weekly), the amount of each payment, and the due date. You can also specify the method of payment (e.g., check, electronic transfer).

Late Payment Penalties: Outline any penalties for late payments. This could include a late fee or an increase in the interest rate. Setting clear consequences for late payments encourages timely repayment.

Default: Define what constitutes a default (e.g., missing multiple payments, bankruptcy). Specify the lender’s remedies in the event of a default, such as the right to accelerate the loan (demand immediate repayment of the entire outstanding balance) or pursue legal action.

Governing Law: Indicate which state’s laws will govern the interpretation and enforcement of the agreement. This is important in case of a dispute, as it determines which jurisdiction’s laws will apply.

Signatures: Both the lender and the borrower should sign and date the agreement. It’s also a good idea to have the signatures notarized to provide additional legal validity.

Crafting a solid loan agreement requires careful consideration of each of these elements. A well-defined agreement minimizes the risk of misunderstandings and protects the interests of both the lender and the borrower, ensuring a smoother and more transparent lending process.

While entering a loan with someone you know well could feel unusual to have on paper, remember that this is not about mistrust, it’s simply about creating a mutual understanding and clarity. Protecting everyone involved and your relationship is most important.