So, you’re thinking about lending money to a family member, or maybe you’re the one asking for the loan. That’s great! Keeping it in the family can sometimes be easier than going to a bank. But let’s be real, even with the best intentions, mixing family and finances can get a little tricky. That’s where a solid agreement comes in handy. It helps everyone stay on the same page, avoids misunderstandings down the road, and keeps those family dinners from turning into awkward conversations about money.

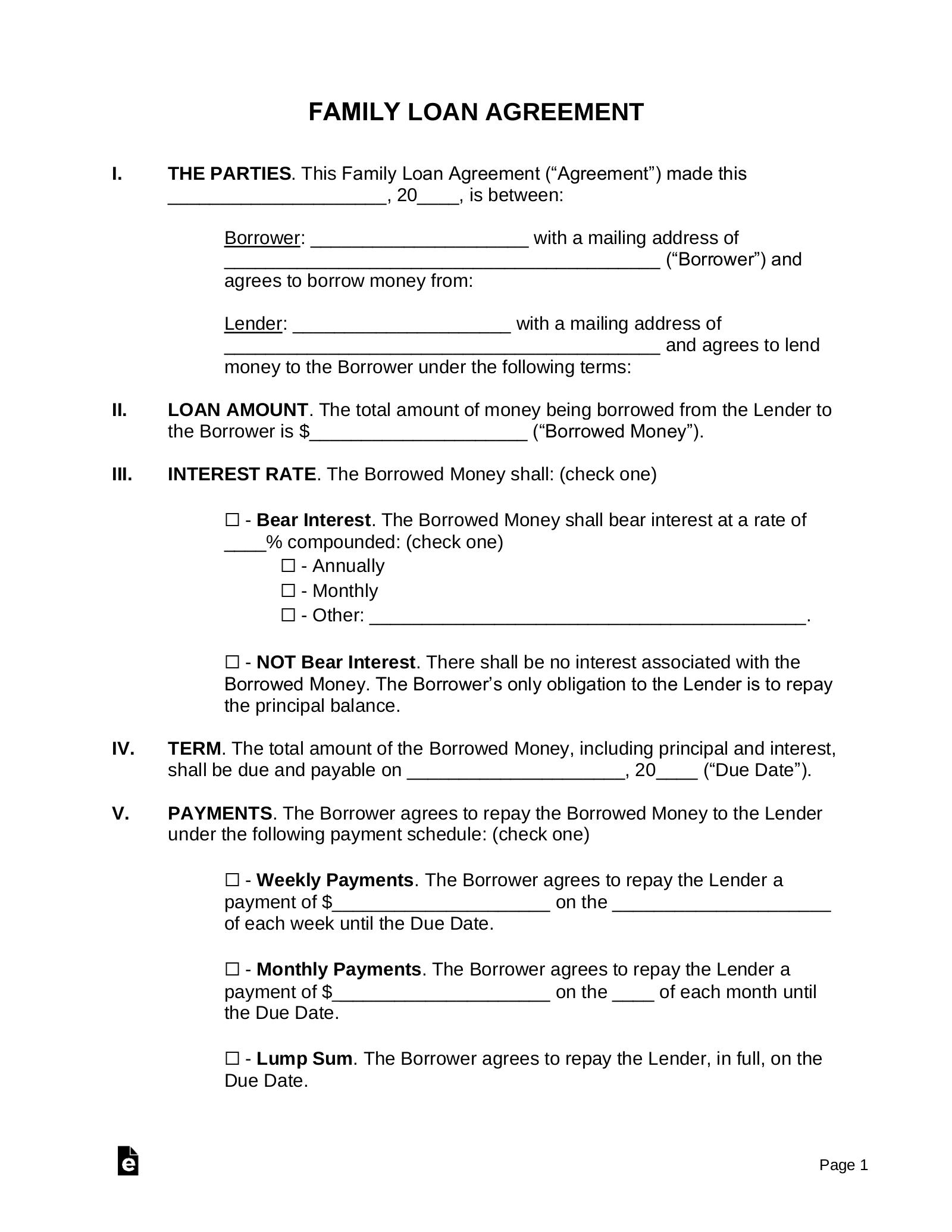

Think of a loan agreement template for family loans as a roadmap. It outlines the terms of the loan – how much is being borrowed, the interest rate (if any), when repayments are due, and what happens if someone misses a payment. It’s not about mistrust; it’s about clarity and respect. By putting everything in writing, you’re creating a framework that protects both the lender and the borrower. Plus, having a written record can be super helpful if any questions or disputes arise later on.

Whether you’re the generous aunt offering a helping hand, or the nephew looking to start a business, remember that open communication and a well-defined plan are key. Using a loan agreement template for family loans isn’t just about the money; it’s about preserving relationships and fostering financial responsibility within the family. So, let’s dive into what makes a good agreement and how it can benefit everyone involved.

Why You Absolutely Need a Loan Agreement When Lending to Family

Okay, so maybe you’re thinking, “It’s family! We trust each other. Do we really need a formal agreement?” The answer is a resounding YES! While trust is essential, relying solely on it when money is involved can be a recipe for disaster. Think about it: memories fade, circumstances change, and even the best intentions can get lost in translation. A loan agreement acts as a clear record of the agreement and protects everyone involved.

One of the biggest benefits of having a formal agreement is that it helps to manage expectations. Without a written document, assumptions can run wild. The lender might expect the money back sooner than the borrower anticipates, or the borrower might think the interest rate is lower than the lender intended. These kinds of misunderstandings can lead to tension and strain relationships, even if the amount is small. A well-drafted agreement eliminates any ambiguity and ensures that everyone is on the same page from the start.

Furthermore, a loan agreement can provide legal protection for both parties. While you probably don’t want to imagine having to take your family member to court, things can happen. If the borrower defaults on the loan, the lender has a written record of the agreement that they can use to pursue legal action if needed. Similarly, the borrower has protection against unreasonable demands from the lender. The loan agreement also protects the lender if the borrower declares bankruptcy. In that case, a properly documented loan may be treated differently than a verbal loan when it comes to repayment priority.

It’s also important to consider the impact of the loan on your overall financial picture. If you’re lending a significant amount of money, it’s wise to document it for tax purposes. Depending on the interest rate (if any), you may need to report the income to the IRS. Having a written agreement makes it easier to track the loan and ensure compliance with tax laws. Also, if you need to take out loans yourself in the future, a documented family loan can impact your debt-to-income ratio.

Finally, having a loan agreement sets a good precedent for future financial dealings within the family. It demonstrates a commitment to responsible lending and borrowing practices. This can be particularly important if you have children or younger family members who are learning about money management. By showing them that you treat financial matters seriously, even with family, you’re instilling valuable lessons that will benefit them throughout their lives. You are setting a responsible example for the family.

Key Elements of a Solid Family Loan Agreement

Now that you’re convinced of the importance of having a loan agreement, let’s talk about what should be included. A comprehensive agreement should cover all the essential details of the loan to avoid any confusion or disputes down the line. Think of it as a checklist to ensure you’ve covered all your bases.

First and foremost, the agreement should clearly identify the lender and the borrower by their full legal names and addresses. This may seem obvious, but it’s a crucial detail to ensure the agreement is legally binding. You should also include the date the agreement is being made. Next, state the principal amount of the loan – the exact amount of money being borrowed. There should be no ambiguity about the sum involved.

Another key element is the interest rate, if applicable. While you may choose to offer a loan without interest, clearly state that in the agreement. If you are charging interest, specify the annual percentage rate (APR) and how it will be calculated. You should also outline the repayment schedule, including the frequency of payments (e.g., monthly, quarterly), the due date for each payment, and the method of payment (e.g., check, electronic transfer). Including a detailed repayment schedule helps to keep everyone on track.

The agreement should also address what happens if the borrower misses a payment or defaults on the loan. Outline any late payment fees or penalties that may be incurred. Also, specify the steps the lender can take if the borrower fails to repay the loan as agreed. This could include renegotiating the terms of the loan, seeking mediation, or pursuing legal action. Having a clear plan for handling default can prevent disagreements and ensure that the lender has recourse if necessary. It protects both parties.

Finally, consider including any other relevant terms or conditions that are specific to your situation. For example, you might want to include a clause allowing the borrower to prepay the loan without penalty. You might also want to specify what happens if the borrower dies before the loan is fully repaid. Consult an attorney to ensure that your agreement complies with all applicable laws and regulations in your state. This step is optional, but it can provide peace of mind and ensure that your agreement is legally sound. The most important thing is to tailor the agreement to meet your specific needs and circumstances. Using a loan agreement template for family loans is a great start, but it’s essential to customize it to fit your individual situation.

It’s understandable to feel a little awkward when talking about money with family, but remember that a clear agreement is a sign of respect and strengthens relationships in the long run. It shows that you value the other person and want to ensure a fair and transparent transaction.

Ultimately, communication is key. Talk openly with your family member about your expectations, concerns, and any questions they may have. By working together to create a loan agreement that meets everyone’s needs, you can avoid misunderstandings and maintain healthy relationships for years to come.