Lending money to friends can be a tricky situation. On one hand, you want to help someone you care about, but on the other, you need to protect your own financial well-being. A verbal agreement might seem sufficient when dealing with people you trust, but memories fade, circumstances change, and misunderstandings can arise. This is where a written loan agreement can save the day, providing clarity and security for both the lender and the borrower. Think of it as a way to maintain your friendship and your financial health simultaneously.

A loan agreement isn’t about distrust; it’s about establishing clear expectations and protecting everyone involved. It outlines the terms of the loan, including the amount, interest rate (if any), repayment schedule, and consequences of default. This documentation can prevent future disagreements and ensure that both parties are on the same page. Consider it a roadmap for the lending process, guiding you both toward a successful repayment.

Let’s face it, talking about money can be awkward. A well-drafted agreement can streamline the conversation, allowing you to focus on the specifics without emotional baggage. It also serves as a record, providing a reference point in case questions or disputes arise down the line. By using a loan agreement template for friends, you’re demonstrating your seriousness and commitment to a fair and transparent transaction, strengthening the foundation of your friendship while safeguarding your finances.

Why You Need a Written Loan Agreement (Even for Friends)

We all like to think the best of our friends, and rightfully so. But life throws curveballs, and even the most well-intentioned people can face unexpected financial difficulties. A written agreement acts as a safety net, protecting you and your friend from potential misunderstandings and financial strain. It’s not about doubting their integrity; it’s about acknowledging that unforeseen circumstances can impact anyone.

Think of it like this: you’re lending a significant amount of money. Would you do that without any documentation if it were a stranger? Probably not. While the dynamic is different with a friend, the underlying principle remains the same: protect your investment and clearly define the terms of the loan. A written agreement doesn’t have to be cold or formal; it can be a friendly and understanding document that protects both of you.

A loan agreement template for friends helps formalize the arrangement. This provides legal protection. Though you hope never to need it, it is wise to protect the arrangement. Should there be a default in payment, or other conflict, the loan agreement can be used to come to resolution or to use in a court of law.

Moreover, having a written record can be incredibly helpful for tax purposes. If you’re charging interest on the loan (even a nominal amount), you’ll need to report that income. A loan agreement provides the necessary documentation for your tax filings. It ensures you’re compliant with regulations and avoid any potential issues with the IRS.

Ultimately, a written loan agreement promotes transparency and open communication. It encourages both the lender and the borrower to discuss their expectations and address any concerns upfront. This clarity can strengthen your friendship and prevent misunderstandings that could damage your relationship.

Key Elements of a Solid Loan Agreement

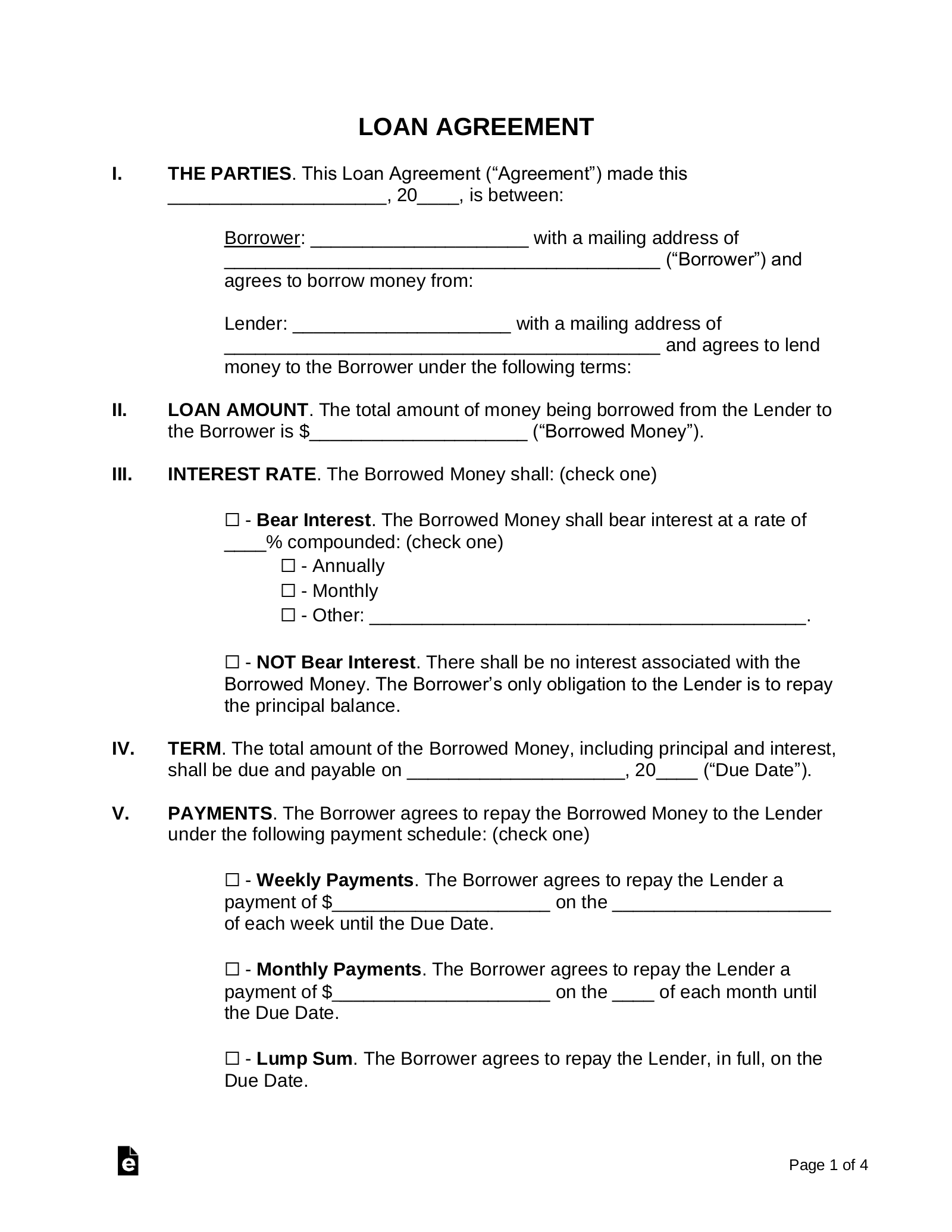

A good loan agreement will clearly state the principle loan amount, interest rate (if any), and repayment schedule. It should also detail the consequences of default, such as late fees or legal action. The agreement should include the full legal names and addresses of both parties, the date the loan was issued, and a clear statement that both parties agree to the terms.

Essential Components of a Loan Agreement Template for Friends

When crafting a loan agreement template for friends, several key elements should be included to ensure clarity and protect both parties. Start with clearly identifying the lender and the borrower, including their full legal names and addresses. This establishes who is providing the loan and who is receiving it.

Next, specify the principal loan amount – the exact sum of money being lent. This avoids any ambiguity and sets the foundation for the entire agreement. Clearly state whether interest will be charged, and if so, specify the interest rate and how it will be calculated. Be upfront about any fees associated with the loan, such as late payment fees or origination fees. Transparency is crucial for maintaining a healthy friendship.

Outline the repayment schedule in detail. This should include the frequency of payments (e.g., monthly, bi-weekly), the due date for each payment, and the method of payment (e.g., check, electronic transfer). Specify where the payments should be sent or deposited. Consider including a grace period for late payments before any penalties are applied. Be sure to have both parties sign and date the agreement. Ideally, have it witnessed by a neutral third party.

It’s also wise to include a section addressing what happens in the event of default. Define what constitutes a default (e.g., missing multiple payments) and outline the steps the lender can take, such as demanding immediate repayment of the entire loan balance. While it’s uncomfortable to think about, addressing this scenario upfront can prevent future conflicts. Consider adding a clause about governing law, specifying the state or jurisdiction whose laws will govern the agreement.

Finally, while a template provides a solid framework, tailor it to your specific circumstances. Consider adding any unique terms or conditions that are relevant to your situation. Remember, a well-crafted loan agreement for friends is a valuable tool for protecting your friendship and your financial interests.

Financial transactions with friends don’t need to damage your relationship. By using a carefully crafted agreement, you can make sure that expectations are established and that everyone is protected.

In the end, having a clear agreement will help ensure that your friendship will last long after the loan has been repaid.