So, you’re starting a Limited Liability Company (LLC) in Maryland? Congratulations! That’s a fantastic step toward building your business. But before you dive headfirst into the exciting world of entrepreneurship, there’s a crucial piece of paperwork you’ll want to take care of: the operating agreement. Think of it as the instruction manual for your LLC, outlining how things will run, who’s responsible for what, and what happens if things change down the line. It might sound daunting, but it’s actually a really valuable tool for protecting your business and ensuring smooth operations.

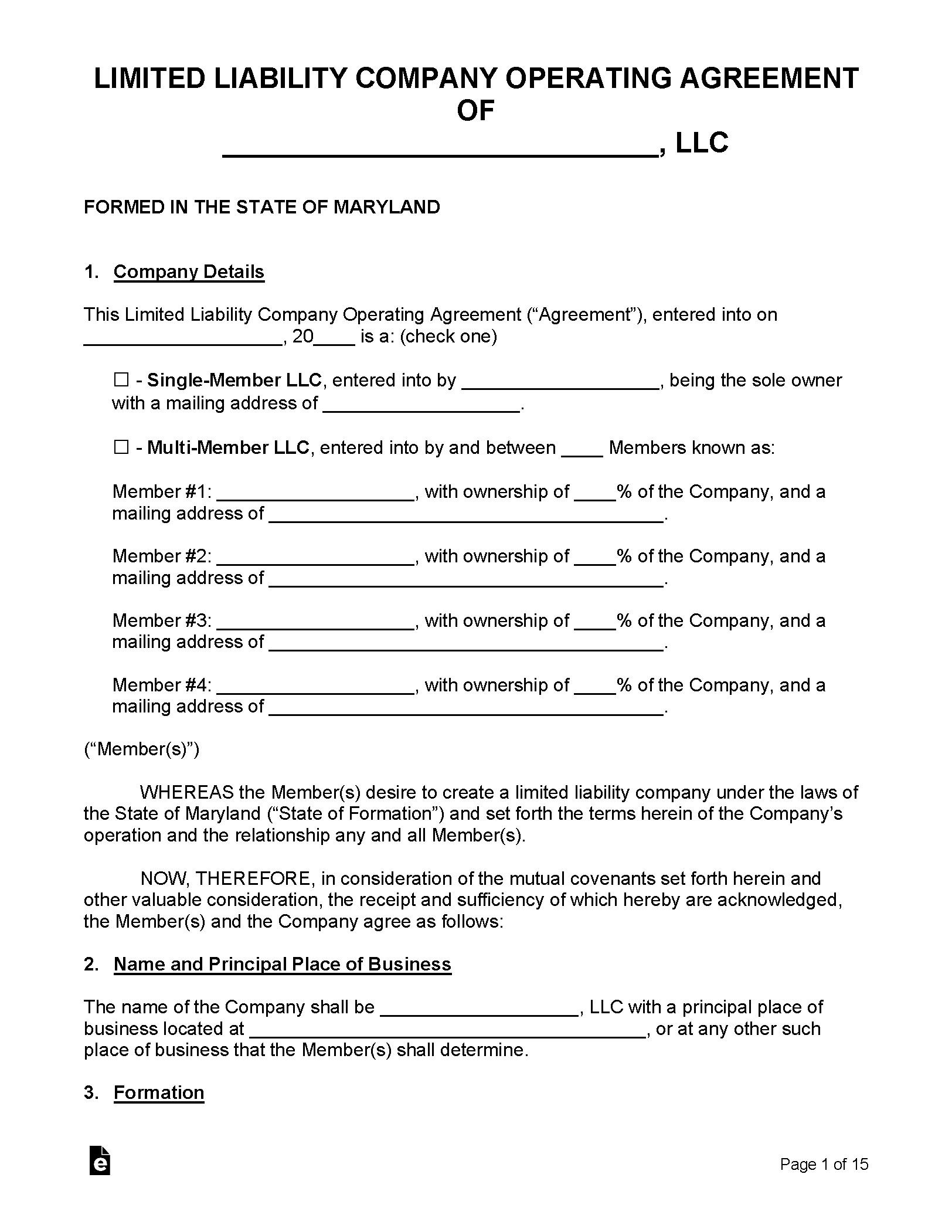

Finding the right maryland llc operating agreement template can feel like navigating a maze, but don’t worry, we’re here to help. This document isn’t just some legal mumbo jumbo; it’s a blueprint for your business’s future. It helps avoid potential conflicts between members, clarifies financial arrangements, and solidifies the legal structure of your LLC. Without one, you’re basically operating without a clear roadmap, leaving your business vulnerable to misunderstandings and legal challenges.

In this article, we’ll break down why an operating agreement is essential for your Maryland LLC, what it should include, and where you can find a reliable maryland llc operating agreement template to get you started. We’ll make the process easy to understand, so you can focus on what you do best: building your business. Let’s get started!

Why You Absolutely Need a Maryland LLC Operating Agreement

Let’s face it: paperwork isn’t the most thrilling part of starting a business. However, an operating agreement is one document you simply can’t skip. While Maryland doesn’t legally require an LLC to have an operating agreement, not having one is like sailing a ship without a rudder. It leaves your business directionless and susceptible to the whims of outside forces and internal disputes.

One of the biggest benefits of an operating agreement is that it clearly defines the roles and responsibilities of each member. Who’s in charge of managing the day-to-day operations? Who has the authority to sign contracts? How will profits and losses be divided? These are all critical questions that an operating agreement answers, preventing misunderstandings and disagreements down the road. Imagine two members both believing they have the authority to make a certain decision, leading to conflicting actions and potentially damaging the business relationship. A well-drafted operating agreement eliminates this ambiguity.

Beyond internal management, an operating agreement provides a shield against personal liability. It reinforces the separation between your personal assets and your business’s assets. This is crucial because one of the primary reasons people choose to form an LLC is to protect themselves from personal liability for business debts or lawsuits. By clearly outlining the LLC’s structure and operation, the operating agreement strengthens this liability protection. It demonstrates that your LLC is a separate and distinct entity, not just an extension of your personal finances.

Furthermore, an operating agreement anticipates future scenarios, such as the departure of a member, the addition of a new member, or the dissolution of the LLC. It specifies the procedures for handling these situations, ensuring a smooth transition and avoiding potential legal battles. For example, what happens if a member wants to sell their ownership stake? The operating agreement can outline the process for valuation, right of first refusal, and other important details. Without these provisions, you could find yourself in a messy legal dispute that could have easily been avoided.

Finally, even if you’re the sole member of your LLC, an operating agreement is still valuable. It demonstrates to banks, creditors, and other third parties that your LLC is a legitimate business entity. It can also help solidify the limited liability protection you receive as a single-member LLC. Think of it as an extra layer of security and professionalism for your business.

What to Include in Your Maryland LLC Operating Agreement Template

Now that you understand why an operating agreement is crucial, let’s dive into what should be included in your maryland llc operating agreement template. While every business is unique, there are certain key provisions that should be present in almost every operating agreement.

First and foremost, you’ll need to clearly identify the members of the LLC, including their names, addresses, and ownership percentages. This section also specifies the initial capital contributions of each member, which is the amount of money or assets they invested in the business. This establishes each member’s stake in the company and their rights to profits and losses.

Next, the operating agreement should outline the management structure of the LLC. Will it be member-managed, where all members participate in day-to-day operations, or manager-managed, where one or more designated managers are responsible for running the business? This section should also specify the powers and responsibilities of the managers or members, as well as the procedures for making decisions.

Another critical component is the allocation of profits and losses. How will the LLC’s profits and losses be divided among the members? Will it be based on their ownership percentages, or will there be a different arrangement? The operating agreement should clearly define this allocation method to avoid any confusion or disputes. This section might also cover how taxes will be handled.

The operating agreement should also address procedures for adding or removing members. What happens if a member wants to leave the LLC, or if you want to bring in a new partner? This section should outline the process for transferring ownership interests, including any restrictions or requirements. It should also specify the procedures for handling the death or disability of a member.

Finally, the operating agreement should include provisions for dissolution. Under what circumstances will the LLC be dissolved? How will the assets be distributed upon dissolution? This section ensures that the LLC can be wound up in an orderly manner, minimizing potential conflicts and legal complications. By addressing these key elements in your maryland llc operating agreement template, you’ll create a strong foundation for your business and protect it from potential risks.

Taking the time to draft a thorough operating agreement is an investment in the long-term success of your Maryland LLC. It clarifies expectations, prevents disputes, and provides a framework for navigating the challenges of running a business. It gives everyone a clear understanding and a point of reference, which in turn keeps the business running smoothly.

Ultimately, a well-crafted operating agreement is more than just a legal document; it’s a testament to your commitment to building a solid and sustainable business.