Ever been in a situation where you helped broker a deal, brought valuable parties together, and then…crickets? You’re left wondering if you’ll ever see a dime for your efforts. This is where a master fee protection agreement template comes into play. Think of it as your financial security blanket, ensuring you get compensated for the work you put in. It’s not just about the money; it’s about establishing trust and clear expectations right from the get-go.

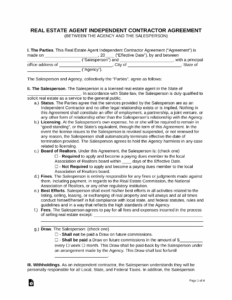

This type of agreement is commonly used in various industries, from real estate and finance to consulting and business brokerage. Basically, anytime you’re facilitating a transaction between two or more parties and expect to receive a fee or commission as a result, you’ll want to consider using one. It’s a formal way to document the agreed-upon fees and protect your interests. Imagine working tirelessly to connect a buyer with the perfect property, only to have the deal close behind your back and you get nothing. A properly executed agreement prevents such scenarios.

In this article, we’ll delve into the intricacies of the master fee protection agreement template, exploring its components, why it’s so crucial, and how to use it effectively. We’ll look at what makes it work, what sections are the most important and how it can help you avoid potential misunderstandings or disputes down the line. So, let’s break it down and see how you can safeguard your commissions and fees.

Understanding the Core Elements of a Master Fee Protection Agreement

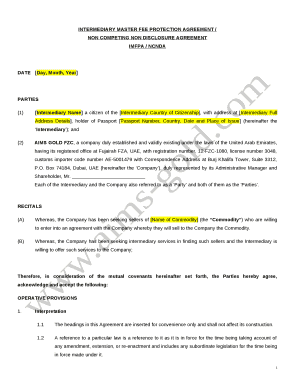

At its heart, a master fee protection agreement template is a legally binding contract that outlines the terms and conditions under which a fee or commission will be paid to a specific party (the “fee protector”) for their services in facilitating a transaction. This agreement usually involves three key parties: the fee protector (you), the payor (the party responsible for paying the fee), and the counterparty (the other party involved in the transaction, who may or may not be directly involved in the fee payment).

The agreement should clearly identify all parties involved, including their full legal names and addresses. It needs to specify the nature of the transaction for which the fee is being earned. This could be anything from a real estate sale to a business acquisition or a complex financial deal. The more detail you provide here, the better. Don’t leave any room for ambiguity. Include a brief description of what transaction you’re getting paid for and any deadlines for the closing of the deal.

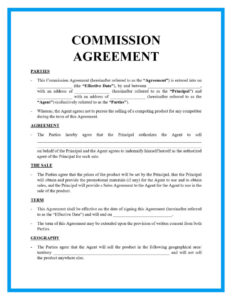

A critical component of the agreement is the fee structure. This needs to clearly state the amount of the fee, how it will be calculated (e.g., a percentage of the transaction value), and when it will be paid. The payment schedule should be explicit, outlining specific dates or milestones that trigger payment. For instance, the agreement might state that 50% of the fee is due upon signing the final contract and the remaining 50% is due upon completion of the transaction. Make sure to use clear and concise language, leaving no room for misinterpretation.

Furthermore, the master fee protection agreement template should address potential contingencies. What happens if the transaction falls through? What if the terms of the transaction change? The agreement should outline how the fee will be handled in such scenarios. For example, it might state that if the transaction is terminated due to a breach of contract by one of the parties, the fee protector is still entitled to a portion of the fee. Or, if the transaction value is reduced, the fee will be adjusted accordingly.

Finally, the agreement should include standard legal clauses, such as a governing law clause (specifying which jurisdiction’s laws will apply), a dispute resolution clause (outlining how disputes will be resolved, such as through arbitration), and a severability clause (stating that if one part of the agreement is found to be invalid, the rest of the agreement remains in effect). These clauses help ensure that the agreement is legally sound and enforceable.

Why a Master Fee Protection Agreement is Crucial for Your Business

Let’s be honest. Relying on a handshake agreement in today’s business world is like betting on a horse with three legs. A master fee protection agreement offers a solid, legally binding framework that protects your financial interests. It minimizes the risk of non-payment, disputes, and misunderstandings. It allows you to go in to brokering a deal with full knowledge and guarantee that you will be paid for the service that you perform. In many cases a fee protection agreement has the ability to save you from going to court.

One of the most significant benefits is the clarity it provides. By clearly defining the roles, responsibilities, and fee structure, the agreement eliminates ambiguity and sets clear expectations for all parties involved. This reduces the likelihood of misunderstandings or disagreements down the line. It helps foster a positive working relationship built on trust and transparency.

Another important aspect is the enforceability of the agreement. In the event of a dispute, a well-drafted agreement provides a strong legal basis for pursuing your rights. It serves as evidence of the agreed-upon terms and conditions, making it easier to resolve the dispute through negotiation, mediation, or litigation. Without a written agreement, you may find it difficult to prove your entitlement to the fee or commission.

Moreover, a master fee protection agreement can protect you from being circumvented. It prevents parties from cutting you out of the transaction after you’ve introduced them or facilitated the initial negotiations. The agreement makes it clear that you are entitled to the fee, regardless of whether the final deal is structured differently or closed at a later date.

Furthermore, having a master fee protection agreement in place enhances your professional image. It demonstrates that you are serious about your business and that you value your services. It shows potential clients and partners that you are organized, prepared, and committed to protecting your interests. This can help you build trust and credibility, leading to more opportunities in the long run. Using a master fee protection agreement template can give you peace of mind when closing deals.

Ultimately, while verbal agreements have their place, a written master fee protection agreement acts as a safety net. It’s the best way to ensure that your hard work and efforts are recognized and compensated fairly. It gives you the confidence to focus on what you do best – connecting people and facilitating successful transactions – without worrying about getting shortchanged.

So, take the time to create or obtain a solid master fee protection agreement template. Customize it to suit your specific needs and circumstances, and have it reviewed by an attorney to ensure it is legally sound and enforceable. It’s an investment that will pay off in the long run by protecting your financial interests and fostering stronger, more trusting relationships with your clients and partners.