Dealing with medical bills can be incredibly stressful, especially when you’re already trying to recover from an illness or injury. Healthcare costs can quickly add up, and sometimes paying them all at once just isn’t feasible. That’s where a medical payment plan agreement can be a lifesaver. Instead of struggling to make a lump-sum payment, you can negotiate a plan to pay off your medical debt in smaller, more manageable installments over time. This not only eases the financial burden but also helps you avoid potential collection issues and protect your credit score.

A medical payment plan agreement template serves as a formal outline for this arrangement. It’s a legally binding document between you and the healthcare provider (or their billing department) that details the terms of your repayment. Think of it as a roadmap that ensures both parties are on the same page, preventing misunderstandings and providing a clear path toward resolving your medical debt. While it might seem daunting to create one, especially when you’re already feeling overwhelmed, it’s a worthwhile step to take control of your financial health and navigate the complexities of healthcare billing.

This article will guide you through the essential aspects of a medical payment plan agreement. We will cover what to consider before approaching your healthcare provider, the key components of the agreement itself, and tips for ensuring it works best for your specific situation. Our goal is to empower you with the knowledge and confidence to negotiate a payment plan that fits your budget and allows you to focus on your well-being, rather than stressing about overwhelming medical bills.

Understanding the Importance of a Medical Payment Plan Agreement

Why is a medical payment plan agreement so important? Well, without a formal agreement, you’re essentially relying on a verbal understanding, which can be easily misinterpreted or forgotten. A written agreement provides clarity and protection for both you and the healthcare provider. It outlines the agreed-upon payment schedule, the interest rate (if any), and the consequences of late or missed payments. This level of detail ensures that everyone is on the same page and reduces the risk of disputes down the road.

Imagine agreeing to pay $50 per month without specifying the total amount owed or the length of the payment plan. The healthcare provider might expect you to pay indefinitely, while you might believe you’ll be finished in a year. A written agreement eliminates this ambiguity by clearly stating all the relevant terms. It also serves as evidence of your commitment to paying your medical debt, which can be helpful if you ever need to dispute a bill or negotiate further.

Moreover, having a formal agreement in place can prevent your debt from being sent to collections. Healthcare providers are more likely to work with patients who are actively trying to resolve their financial obligations. By proactively establishing a payment plan, you demonstrate your willingness to pay and reduce the likelihood of more aggressive collection tactics. This can protect your credit score and prevent the added stress of dealing with collection agencies.

Another crucial aspect is the negotiation power it gives you. Armed with a clear understanding of your financial situation and a proposed payment plan, you’re in a stronger position to negotiate with the healthcare provider. You can explain your limitations and propose a payment amount that aligns with your budget. The healthcare provider might be more willing to compromise when they see that you’re taking proactive steps to address your debt.

Finally, a medical payment plan agreement provides peace of mind. Knowing that you have a structured plan to pay off your medical bills can significantly reduce stress and anxiety. You can focus on your health and recovery without constantly worrying about overwhelming debt. This is particularly important when you’re dealing with the physical and emotional challenges of illness or injury. A medical payment plan agreement can be a vital tool for managing your financial well-being during a difficult time.

Key Components of a Medical Payment Plan Agreement Template

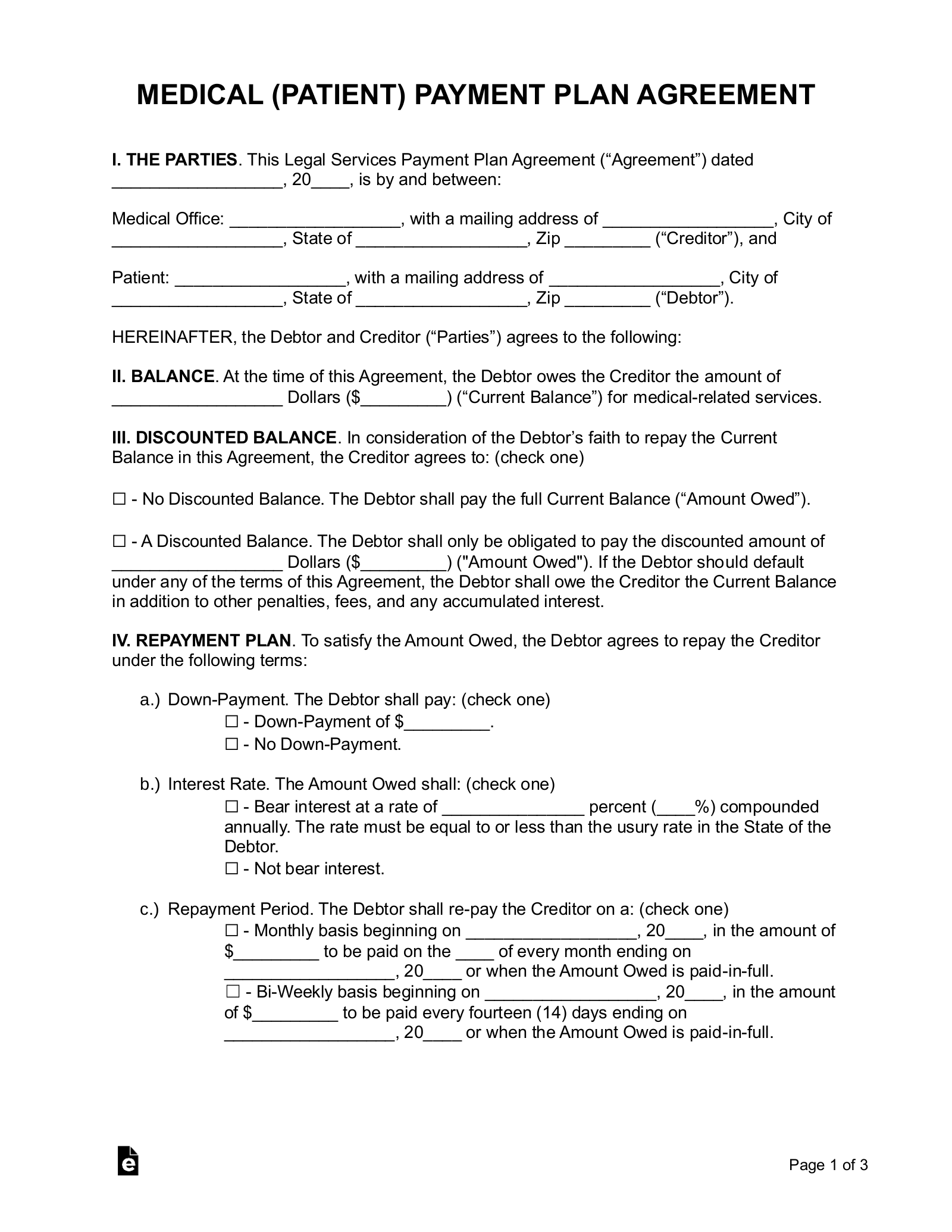

A comprehensive medical payment plan agreement template should include several key elements to ensure clarity and protect both parties involved. Let’s break down the essential components:

First and foremost, the agreement should clearly identify the parties involved: the patient (or responsible party) and the healthcare provider (or billing entity). Include full names, addresses, and contact information for both parties. This ensures that there’s no confusion about who is responsible for the debt and who is receiving the payments.

Next, the agreement must specify the total amount owed for the medical services rendered. This should be a clear and unambiguous number, including a breakdown of the services provided, if possible. It’s important to review the original bill carefully to ensure that the amount is accurate and that you’re not being charged for services you didn’t receive. If you have any questions or concerns about the bill, address them with the healthcare provider before finalizing the payment plan agreement.

The payment schedule is another critical component. This section should detail the amount of each payment, the frequency of payments (e.g., monthly, bi-weekly), and the due date for each payment. Be as specific as possible to avoid any misunderstandings. Consider setting up automatic payments to ensure that you never miss a deadline. The payment method should also be clearly specified (e.g., check, credit card, online payment). Be certain to clarify who the payments should be made out to.

The agreement should also address any interest charges or late payment fees. While some healthcare providers may not charge interest, others may include it in the payment plan. If interest is included, the agreement must specify the interest rate and how it will be calculated. It should also outline the consequences of late or missed payments, such as late fees or termination of the agreement. Be sure you understand the terms so you are aware of the consequences of not paying on time.

Finally, the medical payment plan agreement template should include a clause outlining the conditions for termination of the agreement. This might include scenarios such as failure to make timely payments, breach of any other terms of the agreement, or a change in the patient’s financial circumstances. The agreement should also specify the process for resolving disputes, such as mediation or arbitration. Both parties should sign and date the agreement, indicating their understanding and acceptance of the terms.

By creating a medical payment plan agreement using such a template you are ensuring transparency on both sides.

Navigating medical bills doesn’t have to be overwhelming. Remember, you have options, and a well-crafted payment plan can provide much-needed relief.

Take the time to understand your rights and be proactive in communicating with your healthcare provider. With a little effort, you can successfully manage your medical debt and focus on what truly matters: your health and well-being.