Starting a Limited Liability Company (LLC) can feel like navigating a maze of paperwork and legal jargon. One of the most important documents you’ll need is an operating agreement. Think of it as the blueprint for your business, outlining how things will run, who’s in charge, and what happens if things change. For a member-managed LLC, where the owners directly manage the business, this agreement is even more crucial.

A member-managed LLC operating agreement template provides a solid foundation for setting up your company’s internal rules. It’s not just about ticking boxes to satisfy legal requirements; it’s about proactively defining roles, responsibilities, and decision-making processes to avoid future disagreements and ensure smooth operations. After all, clearly defined expectations are key to any successful partnership, and an LLC is essentially a business partnership.

This article will break down what a member-managed LLC operating agreement is, why you need one, and what key elements it should include. We’ll help you understand how a template can streamline the process and provide you with the knowledge you need to customize it for your specific business needs. So, let’s dive in and explore this essential document for your member-managed LLC.

Understanding the Member-Managed LLC Operating Agreement

An operating agreement is a legally binding document that outlines the ownership and operating procedures of a Limited Liability Company (LLC). It’s like the constitution for your business, guiding how it will be run and managed. While not always legally required by every state, it’s highly recommended for all LLCs, especially those that are member-managed. This is because it clarifies the roles, rights, and responsibilities of each member, which can prevent misunderstandings and disputes down the line.

In a member-managed LLC, the members themselves are actively involved in the day-to-day operations of the business. This is in contrast to a manager-managed LLC, where designated managers are responsible for running the company, and the members may not be as involved in the daily grind. Because members are directly managing the business, the operating agreement needs to clearly define their authority and decision-making power. It should specify how decisions are made, such as by majority vote or unanimous consent, and what types of decisions require a specific level of agreement.

The operating agreement also addresses crucial aspects like capital contributions, profit and loss allocation, and distributions. It outlines how much each member initially invests in the company and how profits and losses are shared among them. This is especially important when members contribute different amounts of capital or perform different roles within the business. The agreement should clearly state how distributions of profits will be made, whether it’s based on ownership percentage, a predetermined schedule, or some other formula.

Furthermore, the agreement handles the inevitable changes that occur over time. It should include provisions for adding new members, transferring membership interests, and what happens if a member decides to leave the company. These provisions ensure continuity and prevent disruption to the business. For example, the agreement may specify a process for valuing a departing member’s interest and a timeline for paying them out.

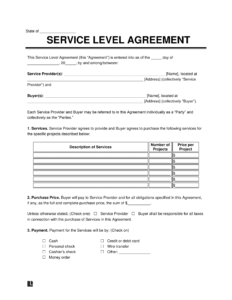

Using a member managed llc operating agreement template can significantly simplify the process of creating this crucial document. Templates provide a framework and ensure that all essential provisions are included. However, it’s important to remember that a template is just a starting point. You’ll need to customize it to reflect the specific circumstances of your business and the agreement among the members. Consulting with an attorney is always a good idea to ensure that your operating agreement complies with all applicable laws and adequately protects your interests.

Key Provisions in a Member-Managed LLC Operating Agreement Template

When working with a member managed llc operating agreement template, there are several key provisions you need to pay close attention to. These provisions form the foundation of your LLC’s operational framework and will govern how your business is managed.

First, clearly define the purpose of your LLC. This section outlines the specific business activities your LLC will engage in. While you might be tempted to keep it broad, being specific can help clarify the scope of your business and prevent future disputes about whether a particular activity falls within the LLC’s permitted operations. It’s also important to include the LLC’s registered agent and registered office address.

Another crucial provision covers membership interests and capital contributions. This section details the percentage ownership of each member and the amount of capital each member contributed to the LLC. It also specifies how additional capital contributions will be handled and what happens if a member fails to make a required contribution. This section directly impacts how profits and losses are distributed, so accuracy and clarity are paramount.

The section on management and voting rights is equally important for a member-managed LLC. It outlines how decisions are made, whether it’s by majority vote, unanimous consent, or some other method. It also defines the roles and responsibilities of each member, specifying who is responsible for what aspects of the business. Clearly defining these roles can prevent confusion and ensure that tasks are completed efficiently. This section also addresses how meetings are conducted and how records are maintained.

Transfer of membership interests is another critical provision. This section specifies the process for transferring ownership shares, whether it’s to another member, an outside party, or upon the death or disability of a member. It often includes restrictions on transfers to ensure that the remaining members retain control of the business. This section should also address valuation of membership interests in the event of a transfer or buyout.

Finally, the operating agreement should address dissolution and termination of the LLC. This section outlines the events that would trigger the dissolution of the LLC, such as the agreement of all members or a specific date. It also specifies the process for winding up the business, distributing assets, and terminating the LLC’s existence. Having a clear plan for dissolution can prevent disputes and ensure that the process is handled smoothly and legally.

Crafting an effective operating agreement doesn’t need to be daunting. Using a member managed llc operating agreement template as a starting point and carefully customizing it to your specific business needs can set your LLC up for success from the start. Remember to consult with legal counsel to ensure full compliance with all applicable state and federal regulations.

With a well-defined plan in place, members can move forward with confidence, knowing their roles, responsibilities, and future expectations are clearly laid out.

Ultimately, a well-crafted operating agreement provides peace of mind, allowing members to focus on growing their business rather than worrying about potential conflicts or legal uncertainties.