Running a business can feel like a constant juggling act, especially when it comes to finances. Sometimes, you need a quick boost of capital to cover unexpected expenses, seize a promising opportunity, or simply smooth out the cash flow during a slow season. That’s where a merchant cash advance (MCA) can come in handy. Unlike a traditional loan, an MCA isn’t based on your credit score but rather on your future credit card sales. This makes it a more accessible option for many businesses, especially those that might not qualify for conventional financing.

However, before you jump in, it’s absolutely crucial to understand the terms and conditions involved. An MCA agreement is a legally binding document, and you need to be crystal clear about what you’re signing up for. Think of it as a map for your financial journey with the MCA provider. It outlines everything from the advance amount and repayment schedule to potential fees and default clauses. Carefully reviewing and understanding every aspect of this agreement is vital to protect your business and avoid any unwanted surprises down the road.

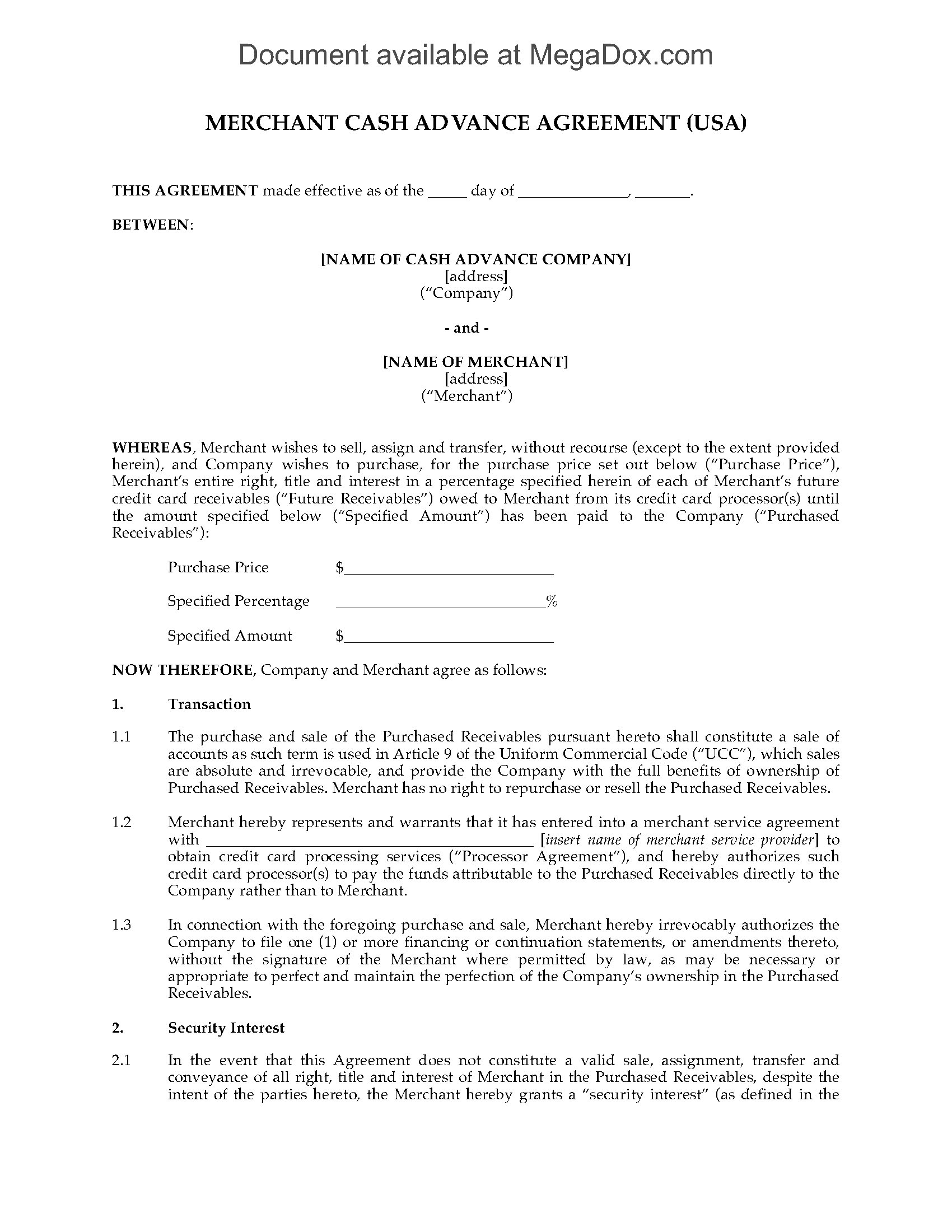

Many business owners find themselves searching for a merchant cash advance agreement template to get a head start. While a template can be a useful starting point, it’s important to remember that every business and every MCA provider is different. A generic template might not adequately address your specific needs or the unique terms offered by the provider. Therefore, you should always tailor the template or, even better, have an attorney review the final agreement to ensure it aligns with your best interests and protects your business. This article will delve into the essential components of an MCA agreement and highlight key considerations to keep in mind when reviewing one.

Understanding the Key Components of a Merchant Cash Advance Agreement

A merchant cash advance agreement is a comprehensive document that outlines the entire relationship between the MCA provider and the business receiving the advance. It’s more than just a simple loan agreement; it’s a detailed roadmap of the financial arrangement. Therefore, understanding the different parts of this roadmap is critical. Let’s break down some of the most important components you’ll find in a typical agreement.

First and foremost, the agreement will clearly state the advance amount. This is the total sum of money the MCA provider is advancing to your business. Make sure this number matches what you expect to receive. Closely related to the advance amount is the factor rate. Instead of an interest rate, MCAs use a factor rate, typically expressed as a decimal (e.g., 1.2, 1.4). This number is multiplied by the advance amount to determine the total repayment amount. For example, if you receive an advance of $10,000 with a factor rate of 1.3, you’ll need to repay $13,000 ($10,000 x 1.3). It is crucial to fully understand how this factor rate translates to the total cost of the advance.

The agreement will also detail the method of repayment. Typically, MCA providers take a percentage of your daily credit card sales. This percentage, known as the holdback, is deducted automatically until the total repayment amount is reached. For instance, the agreement might state that the provider will take 15% of your daily credit card receipts. It’s vital to consider how this holdback percentage will impact your daily cash flow. A high holdback percentage could strain your business if sales fluctuate.

Furthermore, the agreement should outline the terms related to default. What constitutes a default, and what are the consequences? Common default triggers might include a significant drop in sales, bankruptcy, or failing to remit the agreed-upon percentage of credit card sales. The consequences of default can be severe, potentially including accelerated repayment, legal action, and damage to your credit rating. Carefully examine these clauses to understand your obligations and the potential risks.

Finally, pay attention to any additional fees mentioned in the agreement. These might include origination fees, processing fees, or late payment fees. These fees can add significantly to the overall cost of the MCA, so it’s important to be aware of them upfront. Scrutinize the entire agreement to avoid surprises and to be fully informed of the cost of obtaining the merchant cash advance. A merchant cash advance agreement template should give you a good base to work from when evaluating an offer.

Important Considerations Before Signing a Merchant Cash Advance Agreement

Before you sign on the dotted line, taking a step back and carefully evaluating the implications of the agreement is paramount. Getting a merchant cash advance can be a useful tool, but it should be a calculated decision. Ask yourself some crucial questions. Does the amount of the advance truly address your business needs? Can your business comfortably handle the repayment schedule without jeopardizing your day-to-day operations? Are you fully aware of the total cost of the advance, including the factor rate and any additional fees? If you have any doubts or uncertainties, seek professional advice from an accountant or attorney.

Consider alternative financing options. While MCAs offer quick access to capital, they often come with higher costs compared to traditional loans or lines of credit. Explore whether you might qualify for a small business loan from a bank or credit union. These options typically offer lower interest rates and more flexible repayment terms. Another alternative is to consider invoice financing or factoring, which allows you to leverage your outstanding invoices to access immediate cash flow.

Negotiate the terms. Don’t be afraid to negotiate the terms of the agreement with the MCA provider. You might be able to negotiate a lower factor rate, a smaller holdback percentage, or more favorable repayment terms. Remember, you have the power to walk away if the terms don’t align with your needs and budget. A reputable MCA provider should be willing to discuss and potentially adjust the terms to find a mutually beneficial agreement.

Read the fine print. This might seem obvious, but it’s worth emphasizing. Don’t skim over the agreement; read every clause carefully. Pay particular attention to the sections dealing with default, termination, and dispute resolution. Understand your rights and obligations under the agreement. If you encounter any language that is unclear or confusing, don’t hesitate to ask the MCA provider for clarification.

Finally, remember the importance of protecting your business. Before securing a merchant cash advance agreement template or signing an agreement, consult with a qualified legal professional. An attorney can review the agreement and advise you on the potential risks and benefits. They can also help you negotiate more favorable terms and ensure that your business is adequately protected. Investing in legal advice upfront can save you from potential headaches and financial losses down the road.

Ultimately, understanding every facet of a merchant cash advance agreement is crucial. It empowers you to make informed decisions that serve your business best. Due diligence can shield you from unforeseen financial burdens.

Careful planning is your best strategy to successfully navigate a merchant cash advance. With the right preparation, you can strategically use the advance to propel your business forward, setting a path for sustained growth and prosperity.