So, you’re diving into the exciting, and sometimes daunting, world of mergers and acquisitions. That’s fantastic! Whether you’re buying a business, selling one, or merging with another, you’re likely going to need a solid merger and acquisition agreement. This document is essentially the roadmap for the entire transaction, outlining everything from the purchase price to the closing date. Think of it as the binding contract that protects both parties involved and ensures everyone is on the same page.

Navigating the complexities of a merger and acquisition (M&A) deal can feel overwhelming, especially when it comes to legal jargon. That’s why having a reliable merger and acquisition agreement template is crucial. It gives you a head start, providing a framework to build upon. Of course, it’s always best to consult with legal and financial professionals to tailor the template to your specific situation. This article will delve into the key components of such a template and explain why it’s an indispensable tool in any M&A transaction.

In this article, we’ll break down the essential elements of a merger and acquisition agreement template in a clear and conversational way. We’ll explore why this document is so important and provide guidance on how to use it effectively. We’ll cover the key sections, explain the legal implications, and highlight potential pitfalls to avoid. Whether you’re a seasoned dealmaker or a first-timer, this guide will equip you with the knowledge to navigate the M&A process with confidence.

Understanding the Key Components of a Merger and Acquisition Agreement Template

A merger and acquisition agreement template isn’t just a document; it’s a comprehensive blueprint for the entire M&A transaction. It covers a wide array of crucial aspects, from defining the parties involved to detailing the closing conditions. Let’s take a closer look at some of the fundamental components you’ll find in a typical template.

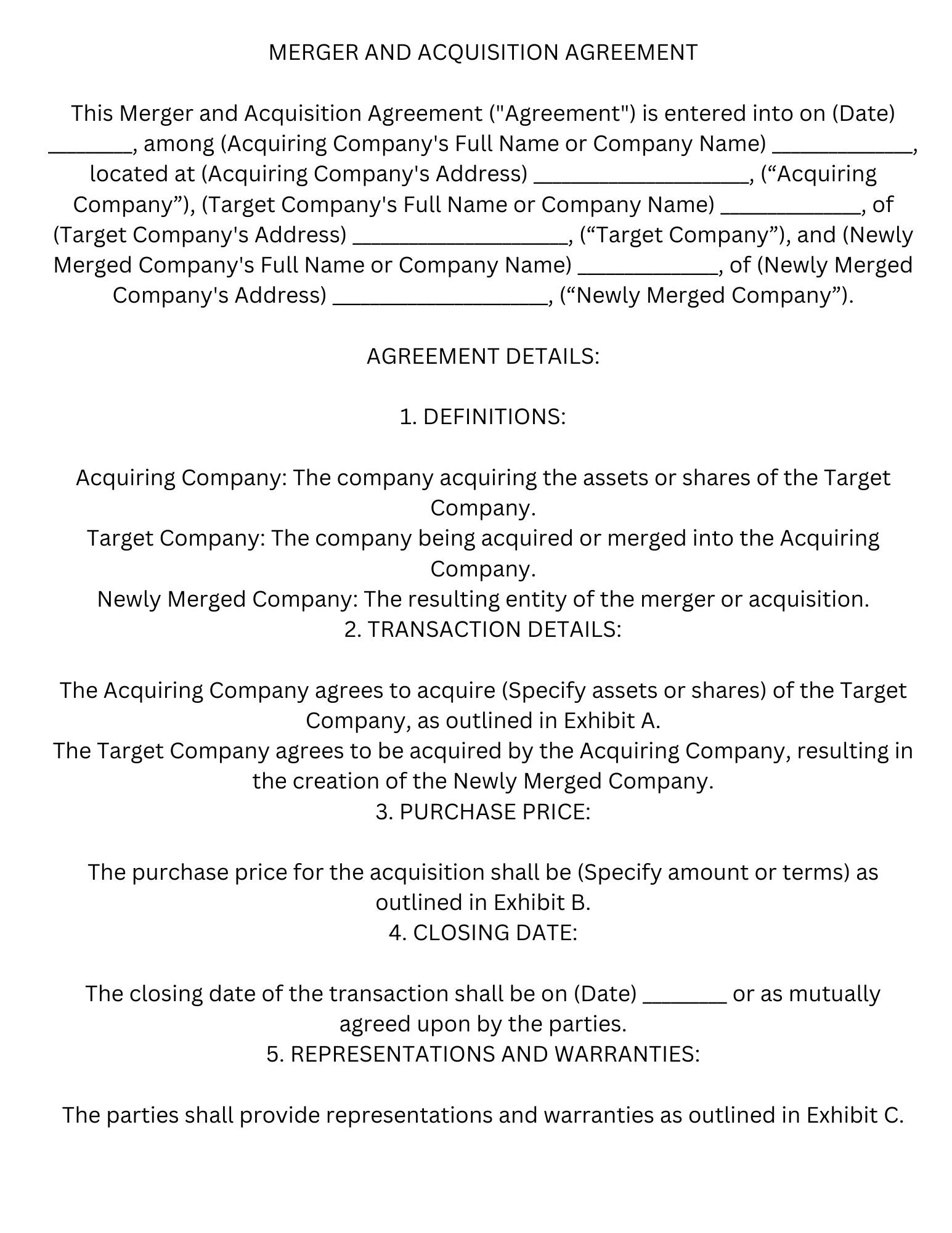

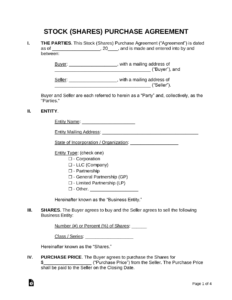

First and foremost, the agreement will clearly identify the buyer and the seller. This seems obvious, but accuracy is paramount. It’s not just about names; it includes legal entities, addresses, and other identifying information. This section also spells out the type of transaction involved – is it a merger, an asset purchase, or a stock purchase? This distinction is critical as it impacts the legal and tax implications of the deal.

Next, the agreement will outline the assets being transferred. This is where you get specific. If it’s an asset purchase, the agreement lists exactly which assets are included in the sale. This might involve equipment, inventory, intellectual property, real estate, and contracts. If it’s a stock purchase, the agreement will specify the number and class of shares being transferred. The more detailed and precise this section is, the fewer opportunities there will be for disputes down the line.

One of the most important elements is the purchase price and payment terms. This section details the total amount the buyer will pay for the business or assets. It also outlines how that payment will be made – whether it’s a lump sum, installments, or a combination of cash and equity. It might also include provisions for an earnout, where a portion of the purchase price is contingent on the future performance of the business. This section needs to be crystal clear to avoid any ambiguity or misunderstandings.

Representations and warranties are another key component. These are statements made by the seller about the condition of the business. They essentially guarantee certain facts about the business, such as its financial health, legal compliance, and the accuracy of its financial statements. If these representations turn out to be false, the buyer may have grounds to sue the seller for breach of contract. This section is designed to protect the buyer from hidden liabilities or misrepresentations.

Closing Conditions and Termination

Finally, the agreement will specify the closing conditions and termination provisions. Closing conditions are the requirements that must be met before the transaction can be finalized. These might include obtaining regulatory approvals, completing due diligence to the buyer’s satisfaction, or securing financing. Termination provisions outline the circumstances under which either party can terminate the agreement before closing. This might include a material adverse change in the business, failure to meet closing conditions, or a breach of the agreement.

Why a Merger and Acquisition Agreement Template is Essential

Using a merger and acquisition agreement template can be a game-changer in simplifying and streamlining the entire deal process. Let’s explore the many benefits that this valuable resource offers. It can save you time, money, and potentially a lot of headaches in the long run.

First and foremost, a template provides a structured framework. M&A transactions are complex, involving numerous legal and financial considerations. A template offers a pre-built outline, ensuring that all the essential elements are addressed. It prevents you from overlooking crucial clauses or provisions, helping you stay organized and on track throughout the negotiation process.

Secondly, templates can significantly reduce legal costs. Hiring attorneys to draft an agreement from scratch can be expensive. A template provides a starting point, allowing attorneys to focus on customizing the document to your specific circumstances, rather than building it from the ground up. This can lead to substantial cost savings without compromising the quality of the agreement. Using a merger and acquisition agreement template, you can save money on legal fees.

Furthermore, templates help ensure fairness and balance. A well-drafted template will typically include provisions that protect both the buyer and the seller. It ensures that neither party is unfairly disadvantaged and that the agreement reflects a reasonable allocation of risk. This can foster a more collaborative and constructive negotiation process, leading to a smoother and more successful transaction.

Another advantage is that templates promote clarity and transparency. They use clear and concise language, making it easier for all parties to understand their rights and obligations. This minimizes the potential for misunderstandings or disputes down the line. A well-written template also includes definitions for key terms, further enhancing clarity and reducing ambiguity.

Finally, templates can accelerate the deal timeline. By providing a ready-made framework, they streamline the drafting process, allowing you to move more quickly toward closing. This is particularly important in competitive situations, where speed can be a key differentiator. A template can help you get the deal done faster, increasing your chances of success.

By using a well-structured template, you can navigate the complexities of M&A transactions with greater ease and confidence, ultimately increasing the likelihood of achieving a successful outcome. Always remember to tailor it to your specific needs and seek professional advice along the way.

Navigating the M&A landscape doesn’t have to feel like charting unknown territory. With the right tools and preparation, you can approach these transactions with confidence and increase your chances of success. A merger and acquisition agreement template, used wisely and in consultation with experts, is a vital component of that success.

Remember, every deal is unique. Take the time to customize your template to fit the specific circumstances, and don’t hesitate to seek professional guidance. This proactive approach will set you on the path to a successful M&A transaction.