So, you’re starting an LLC in Michigan, huh? Congratulations! That’s a fantastic step towards taking control of your business and protecting your personal assets. One of the most important documents you’ll need, though often overlooked, is the LLC operating agreement. Think of it as the internal rulebook for your company, laying out how things will be run and who’s responsible for what. It might sound intimidating, but it’s actually quite manageable, especially with a good Michigan LLC operating agreement template to guide you.

Without an operating agreement, your LLC’s operations could be subject to default state rules, which might not align with your specific needs or wishes. For example, if you have multiple members, the operating agreement will define profit and loss allocation, decision-making authority, and what happens if a member decides to leave. The absence of these details could lead to misunderstandings and even disputes down the road – something you definitely want to avoid when building your business.

This article will explore why a Michigan LLC operating agreement template is essential, what it typically includes, and how you can use it to create a solid foundation for your business. We will discuss the key provisions, address common concerns, and guide you through the process of tailoring a template to fit your unique circumstances. Let’s dive in and get your LLC properly documented!

Why You Absolutely Need a Michigan LLC Operating Agreement

Seriously, don’t skip this step! While Michigan doesn’t legally require you to have an operating agreement for your LLC, that doesn’t mean you shouldn’t have one. Think of it as an insurance policy against future disagreements or misunderstandings among members. Without a written agreement, you’re essentially leaving the governance of your company to chance, relying on default state laws that may not reflect your intentions. This is particularly important if you have multiple members. Even if you’re a single-member LLC, having an operating agreement can clarify the separation between you and your business, which can be crucial for liability protection.

An operating agreement defines the roles and responsibilities of each member, outlines how profits and losses are allocated, and establishes procedures for important decisions like admitting new members or selling the business. It can also address contingency plans for situations like the death or disability of a member. Imagine trying to sort out these issues after a significant event, without a clear agreement in place – it’s a recipe for conflict and potential legal battles.

Furthermore, a well-drafted operating agreement can help to reinforce the limited liability status of your LLC. By clearly defining the ownership structure and management procedures, you demonstrate that your LLC is a separate legal entity from its members. This separation is essential for protecting your personal assets from business debts and lawsuits. In the absence of a formal agreement, a court might be more likely to “pierce the corporate veil” and hold you personally liable.

Beyond legal protection, an operating agreement provides clarity and structure for your business operations. It serves as a roadmap for how the company will be run, ensuring that all members are on the same page and working towards common goals. This can be particularly helpful in resolving disputes and making decisions quickly and efficiently. Think of it as a proactive measure to prevent future headaches and keep your business running smoothly.

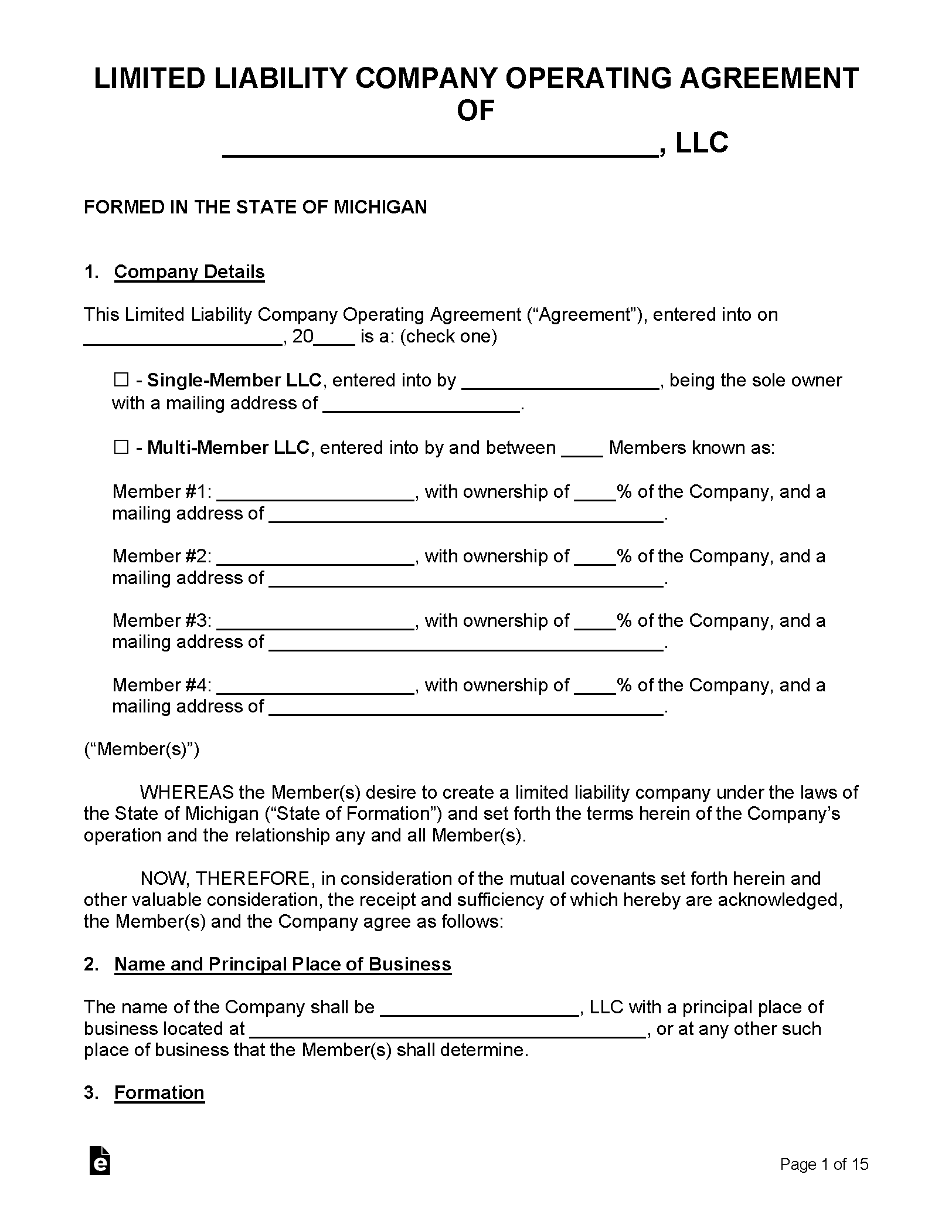

Finding the right Michigan LLC operating agreement template can be the first step to solidifying the groundwork for your business. There are many templates available online, and you can customize them to include specific provisions relevant to your business. Don’t just grab the first template you see. Take the time to review several options and choose one that is comprehensive and easy to understand. Consult with an attorney if needed, especially if your business has complex ownership or management structures.

What to Include in Your Michigan LLC Operating Agreement

A comprehensive operating agreement should cover a wide range of topics to ensure that all aspects of your LLC’s operations are clearly defined. While every business is unique, there are some key provisions that should be included in every agreement. These include:

Basic Information: This section should include the name of your LLC, its principal place of business, and the purpose for which it was formed. It should also specify the date the agreement was entered into and the names and addresses of all members.

Membership and Ownership: This section should clearly define the ownership percentages of each member, their initial capital contributions, and their rights and responsibilities. It should also outline the process for admitting new members or transferring ownership interests.

Management and Voting: Here, you’ll specify how the LLC will be managed – whether it will be member-managed or manager-managed. If it’s member-managed, you’ll need to outline the voting rights of each member and the procedures for making decisions. If it’s manager-managed, you’ll need to identify the manager(s) and their powers and responsibilities.

Profit and Loss Allocation: This is a crucial section that defines how profits and losses will be allocated among the members. Typically, profits and losses are allocated according to ownership percentages, but you can choose a different allocation method if you prefer. It is important to carefully consider the tax implications of your chosen allocation method.

Distributions: This section outlines how and when distributions will be made to the members. It should specify the frequency of distributions and the order in which they will be paid. It should also address the issue of tax distributions – distributions made to cover the members’ tax obligations arising from the LLC’s profits.

Dissolution: Finally, the operating agreement should outline the procedures for dissolving the LLC. This should include the events that will trigger dissolution, the process for winding up the business’s affairs, and the distribution of assets upon dissolution. It is also important to specify how disputes among members will be resolved, ideally through mediation or arbitration to avoid costly litigation.

Crafting a sound Michigan LLC operating agreement template doesn’t have to be a monumental task. There are a wealth of resources available to help you create a document that works for you and protects your interests. Remember to seek guidance from a legal expert if you have unique needs or concerns that need to be carefully addressed.

When building your business, you want to ensure you have covered all your bases for legal and financial security. That’s why it’s necessary to take the time to look over your document and see what suits your business best. Finding the right plan will help you have an organized structure to build your company.