So, you’re diving into the exciting world of Michigan real estate, huh? Whether you’re a first-time homebuyer or a seasoned investor, one thing is certain: you’re going to need a solid purchase agreement. This document is your roadmap to a successful transaction, outlining the terms and conditions of the sale. Think of it as the rulebook for buying or selling property in the Great Lakes State. It might sound daunting, but with a little understanding and the right resources, you can navigate it like a pro.

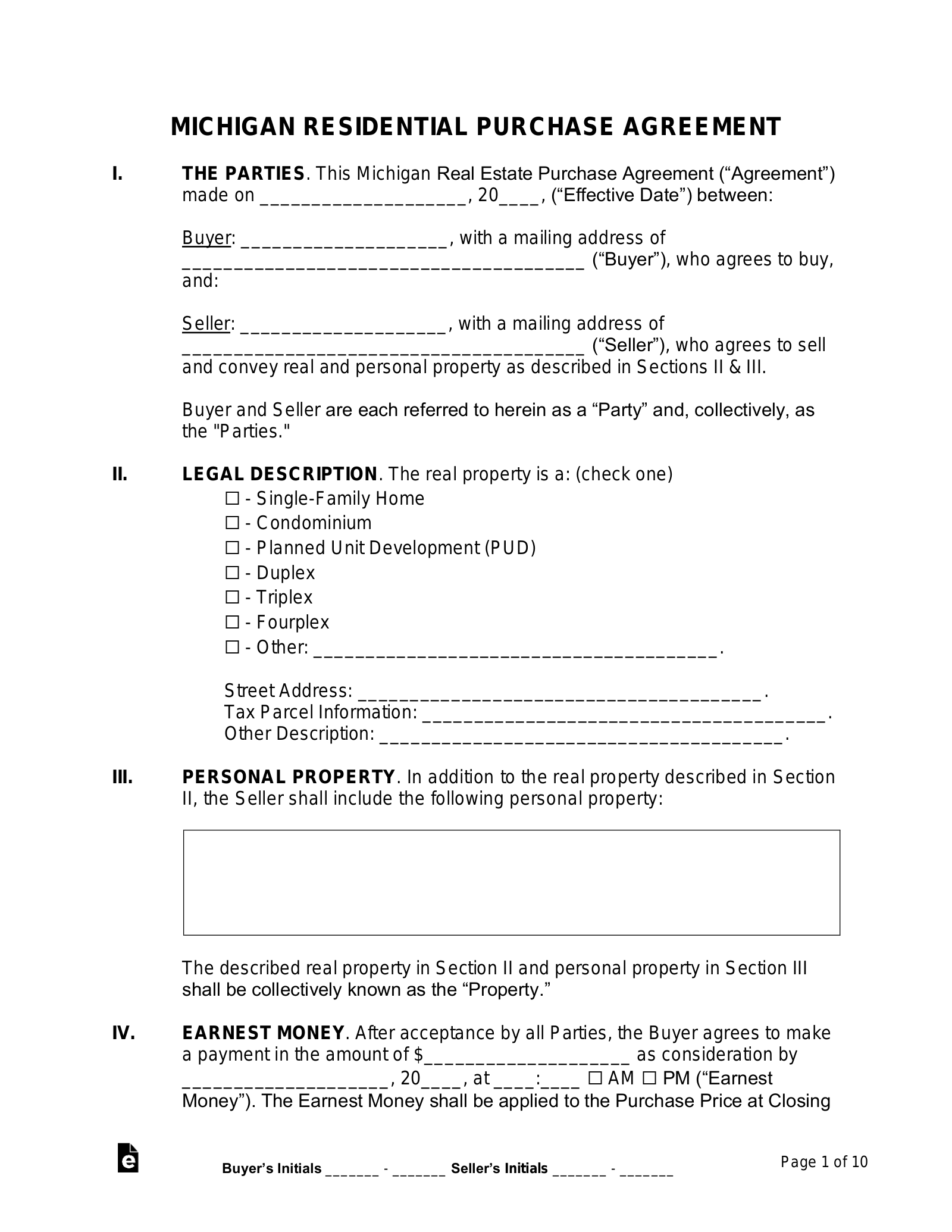

In Michigan, a real estate purchase agreement is a legally binding contract between the buyer and seller. It details everything from the purchase price and financing terms to the closing date and contingencies. It’s crucial to get this document right, as it protects the interests of both parties and sets the stage for a smooth closing. But where do you start? Many people turn to a Michigan real estate purchase agreement template to get the ball rolling. These templates provide a basic framework that can be customized to fit your specific situation.

Using a template can save you time and money, but it’s important to remember that it’s just a starting point. You’ll still need to carefully review the document and make sure it accurately reflects your agreement with the other party. If you’re unsure about anything, it’s always best to consult with a real estate attorney. They can provide legal advice and ensure that your interests are protected throughout the transaction. Let’s delve into what you need to know about these crucial documents.

Understanding the Michigan Real Estate Purchase Agreement

The Michigan real estate purchase agreement is a comprehensive document that covers all the essential aspects of a property sale. It’s designed to protect both the buyer and the seller by clearly defining their rights and obligations. Think of it as the foundation upon which the entire transaction is built. Without a well-drafted agreement, misunderstandings can arise, leading to costly disputes and delays. Therefore, understanding the key components of this document is absolutely crucial.

One of the first things you’ll find in a purchase agreement is the identification of the parties involved. This includes the full legal names and addresses of both the buyer and the seller. The agreement will also clearly describe the property being sold, including its street address, legal description, and any included fixtures or personal property. This section is incredibly important, as it ensures that there’s no confusion about exactly what is being bought and sold. Any ambiguities here can lead to serious problems down the line.

The purchase price and financing terms are another critical component of the agreement. This section outlines the agreed-upon price for the property, as well as how the buyer intends to finance the purchase. Will they be obtaining a mortgage? If so, the agreement may include a financing contingency, which allows the buyer to back out of the deal if they are unable to secure financing. This protects the buyer from being obligated to purchase the property if they can’t get a loan. It is important to list all the fees associated with closing in this section.

Another key element of the Michigan real estate purchase agreement is the inclusion of contingencies. Contingencies are conditions that must be met before the sale can proceed. Common contingencies include a home inspection contingency, which allows the buyer to have the property inspected for defects, and an appraisal contingency, which ensures that the property appraises for at least the purchase price. If these contingencies are not met, the buyer typically has the right to terminate the agreement and receive their earnest money back. Make sure you understand each contingency and how it impacts your obligations.

Finally, the purchase agreement will specify the closing date, which is the date on which the property title is transferred to the buyer and the seller receives their payment. It will also outline other important details, such as who is responsible for paying closing costs, what happens if either party defaults on the agreement, and how disputes will be resolved. A clear and well-defined closing date is essential for ensuring a smooth and timely transaction.

Key Sections of a Michigan Real Estate Purchase Agreement Template

When working with a Michigan real estate purchase agreement template, it’s essential to understand the purpose and significance of each section. While templates provide a helpful starting point, they are not one-size-fits-all solutions. Each transaction is unique, and you’ll need to carefully review and customize the template to accurately reflect your specific circumstances. Pay close attention to the following key sections.

First and foremost, the “Offer to Purchase” section outlines the buyer’s intention to purchase the property at a specified price and under certain conditions. This section typically includes the buyer’s earnest money deposit, which is a good faith gesture demonstrating their commitment to the transaction. The amount of the earnest money deposit can vary, but it’s typically a percentage of the purchase price. This section also states that this is just an offer and not binding until signed by the seller.

Next, the “Property Description” section provides a detailed description of the property being sold. As mentioned earlier, this section should include the street address, legal description, and a list of any personal property or fixtures that are included in the sale. Be as specific as possible in this section to avoid any ambiguity. For example, instead of simply saying “appliances,” list each appliance individually (e.g., refrigerator, stove, dishwasher, etc.).

The “Financing” section details how the buyer plans to finance the purchase. If the buyer is obtaining a mortgage, this section will specify the type of mortgage, the loan amount, and the interest rate. It may also include a financing contingency, as discussed earlier. If the buyer is paying cash, this section will simply state that the purchase is not contingent on financing. However, the seller may want to verify proof of funds. The most common proof of funds is a bank statement.

Contingencies are conditions that must be met before the sale can proceed. Common contingencies include a home inspection contingency, an appraisal contingency, and a title contingency. The “Contingencies” section of the template will outline these contingencies in detail, specifying the timeframe for meeting each condition and the consequences of not meeting them. Make sure you fully understand the implications of each contingency before signing the agreement.

Finally, the “Closing and Possession” section specifies the closing date, as well as the date on which the buyer will take possession of the property. It also outlines other important details related to the closing process, such as who is responsible for paying closing costs and how property taxes will be prorated. This section is crucial for ensuring a smooth and timely transfer of ownership.

It is vital to know that while using a michigan real estate purchase agreement template can be helpful, it’s no replacement for personalized legal advice. Consult a real estate attorney to ensure the agreement adequately protects your interests.

Remember, buying or selling property is a significant financial transaction. Taking the time to understand the purchase agreement is an investment in your future. By carefully reviewing the template, customizing it to your specific situation, and seeking professional advice when needed, you can navigate the real estate process with confidence and achieve a successful outcome.