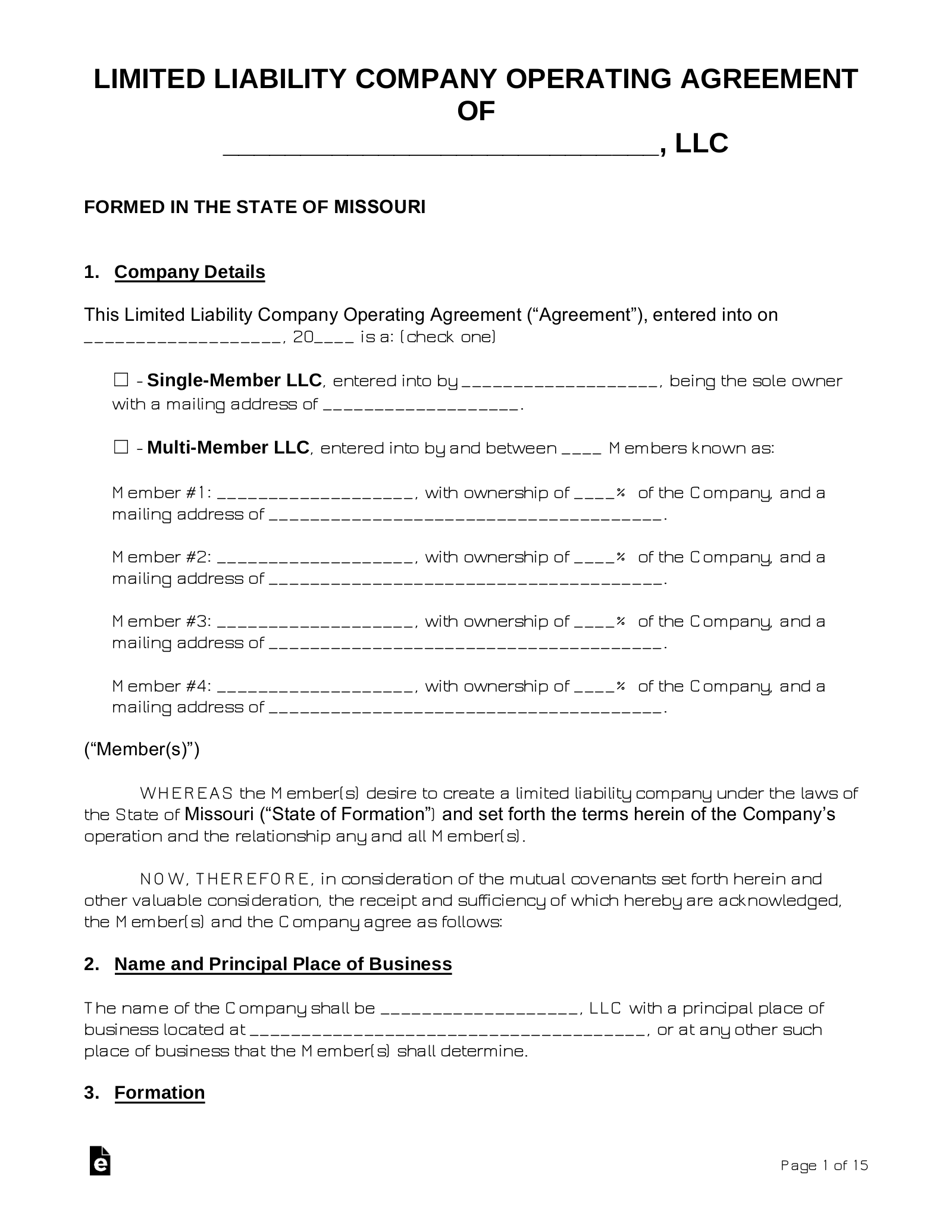

So, you’re starting an LLC in Missouri? That’s fantastic! Setting up a Limited Liability Company is a smart move for protecting your personal assets and structuring your business. But before you dive headfirst into the world of entrepreneurship, there’s a crucial document you need to get your hands on: a Missouri LLC operating agreement template. Think of it like the constitution for your company, laying out the rules of the game and ensuring everyone is on the same page.

An operating agreement might sound intimidating, but it doesn’t have to be. Essentially, it’s a written agreement that details how your LLC will be run. While Missouri doesn’t legally mandate that LLCs have one, skipping it is like navigating without a map. It helps prevent misunderstandings between members, clarifies ownership percentages, and outlines procedures for everything from decision-making to handling profits and losses. It’s especially important if you have multiple members, but even single-member LLCs benefit from having one.

Without a solid operating agreement in place, Missouri law will dictate how your LLC operates, which might not align with your specific needs or vision. Using a Missouri LLC operating agreement template gives you control over your business and sets the foundation for a successful and smoothly run operation. Let’s explore why it’s so important and what goes into crafting one that fits your unique business situation.

Why You Absolutely Need a Missouri LLC Operating Agreement

Okay, so we’ve established that having an operating agreement is a good idea, but let’s really drill down into why it’s so vital for your Missouri LLC. Think of it as an insurance policy against future disagreements and a roadmap for how your business will function day-to-day.

First and foremost, an operating agreement clarifies ownership. If you have multiple members in your LLC, this document spells out exactly what percentage of the company each person owns. This is crucial for determining profit distribution, voting rights, and liability responsibilities. Without this clarity, you could run into serious disputes down the road, potentially leading to costly legal battles.

Beyond ownership, a well-drafted operating agreement outlines the management structure of your LLC. Will it be member-managed, where the members themselves run the day-to-day operations, or will it be manager-managed, where you designate a specific individual or entity to handle the business’s affairs? The operating agreement defines these roles and responsibilities, ensuring everyone knows who is in charge of what.

Another key aspect of the operating agreement is detailing how profits and losses will be allocated. While it’s often proportional to ownership percentages, you can customize this to suit your specific business needs. Maybe you want to allocate profits based on individual contributions or effort. The operating agreement allows you to create a fair and equitable system for distributing financial rewards.

Finally, and perhaps most importantly, an operating agreement can help protect your personal assets. By clearly separating your business from your personal life, it reinforces the limited liability aspect of an LLC. This means that if your business incurs debt or faces legal action, your personal assets, like your home or car, are typically shielded from creditors or lawsuits. It provides a crucial layer of protection for your financial well-being.

Key Elements of a Missouri LLC Operating Agreement Template

Now that you understand the importance of an operating agreement, let’s take a closer look at the key sections you’ll typically find in a Missouri LLC operating agreement template. Understanding these elements will help you tailor the template to your specific business needs.

First, you’ll need to include basic information about your LLC, such as its name, registered agent, and principal place of business. This information is essential for identifying your company and ensuring it’s properly registered with the state of Missouri.

Next, the operating agreement should clearly define the purpose of your LLC. What specific business activities will it engage in? Being specific here can help prevent future disputes over the scope of your business operations.

The section on membership details should include the names and addresses of all members, their ownership percentages, and their initial contributions to the LLC. As mentioned earlier, this section is crucial for clarifying ownership and responsibility within the company.

The operating agreement should also outline the voting rights of each member. How will decisions be made? Will it be a simple majority vote, or will certain decisions require unanimous consent? Clearly defining voting procedures ensures fair and efficient decision-making within your LLC.

Finally, the operating agreement should address procedures for amending the document, admitting new members, and dissolving the LLC. These provisions provide a roadmap for the future of your company and ensure a smooth transition in case of changes or unforeseen circumstances.

Crafting a comprehensive operating agreement might seem daunting, but remember, it’s an investment in the long-term success and stability of your Missouri LLC. It’s about protecting your vision and securing your future.

So, before you get too deep, remember that the operating agreement for your Missouri LLC is there for your protection and clarity. A good Missouri LLC operating agreement template is going to guide you to the right path.