So, you’re thinking about the future of your Montana business, huh? That’s smart. Whether you’re a rancher in Big Sky Country, a small business owner in Bozeman, or running a tech startup in Missoula, having a solid plan for what happens if a partner wants to leave, retires, or something unexpected happens is crucial. That’s where a Montana buy sell agreement template comes in. It’s essentially a prenuptial agreement for your business, outlining how ownership will be transferred and valued if certain triggering events occur.

Think of it this way: you’ve poured your heart and soul into building your business. You want to protect it, right? A buy sell agreement can prevent messy legal battles, ensure a smooth transition of ownership, and provide financial security for all parties involved. It’s not the most exciting topic, but it’s absolutely vital for long-term success and peace of mind. Nobody wants disagreements regarding the direction of a business when there are multiple owners.

Essentially, the document sets out the rules of the game early on. It defines how ownership will be valued, who has the right to buy out departing partners, and how the payment process will work. It’s a safety net that prevents future disputes and helps maintain stability within the company, regardless of what life throws your way. Without one, you’re leaving the fate of your business to chance and potentially setting yourself up for unnecessary heartache. Getting your hands on a usable montana buy sell agreement template can alleviate some of that stress.

Understanding the Nuances of a Montana Buy Sell Agreement Template

Let’s dive deeper into what makes a Montana buy sell agreement template so important. It’s more than just a legal document; it’s a framework for the future of your business and the relationships you have with your partners. Several types of agreements exist, each catering to different business structures and priorities. The right choice for you will depend on the specifics of your situation, your business goals, and the relationships between the business owners.

One common type is the “cross-purchase” agreement. In this scenario, each owner agrees to purchase the share of a departing owner. This works well for businesses with a small number of owners because as the number of owners increases, it can quickly become complicated to manage as each owner needs to have funds available to purchase shares from every other owner. The “entity purchase” or “redemption” agreement is another popular option. Here, the business itself buys back the ownership interest from the departing owner. This is often simpler to administer, especially in companies with more than a few owners, and is frequently preferred.

The agreement must also clearly define the triggering events that activate the buy-sell provisions. These can include retirement, death, disability, divorce, or even a partner’s desire to simply leave the business. Clearly defining these events prevents ambiguity and potential disputes down the road. What happens if an owner is deemed mentally unfit to continue managing the business? The agreement will need to address these contingencies. How is the departing partner, or their estate, compensated if there is a disagreement? That must be determined ahead of time to avoid major problems.

Another critical aspect is the valuation method. How will the business’s worth be determined when a triggering event occurs? There are several approaches, including a fixed price, a formula based on earnings or assets, or an independent appraisal. Selecting the right valuation method is crucial to ensure fairness and avoid disputes. It might be wise to account for things like inflation or the overall economy. Nobody wants to feel cheated and a third-party appraisal is frequently the way to go to ensure everyone feels they are getting a fair deal.

Finally, the agreement should outline the payment terms for the buyout. Will the departing owner (or their estate) be paid in a lump sum, or will the payments be spread out over time? What interest rate, if any, will be applied to the payments? These details should be clearly defined to ensure a smooth and predictable transaction. Considerations should also be given for how payments will be handled in the event of the death of a business owner who is receiving payouts from the business.

Key Considerations for Your Agreement

When drafting your Montana buy sell agreement template, don’t forget to consider the potential tax implications of different buyout structures. Consult with a tax advisor to understand the impact on both the departing owner and the remaining owners.

Essential Elements to Include in Your Montana Buy Sell Agreement Template

Creating a comprehensive Montana buy sell agreement template requires careful consideration of several key elements. These components work together to ensure clarity, fairness, and enforceability, protecting the interests of all parties involved. You might think you have a handshake deal worked out with your business partners, but without these items put in writing, you could find yourself in trouble in the future. Remember to consult with a qualified attorney to make sure your Montana buy sell agreement template is legally sound and compliant with Montana law.

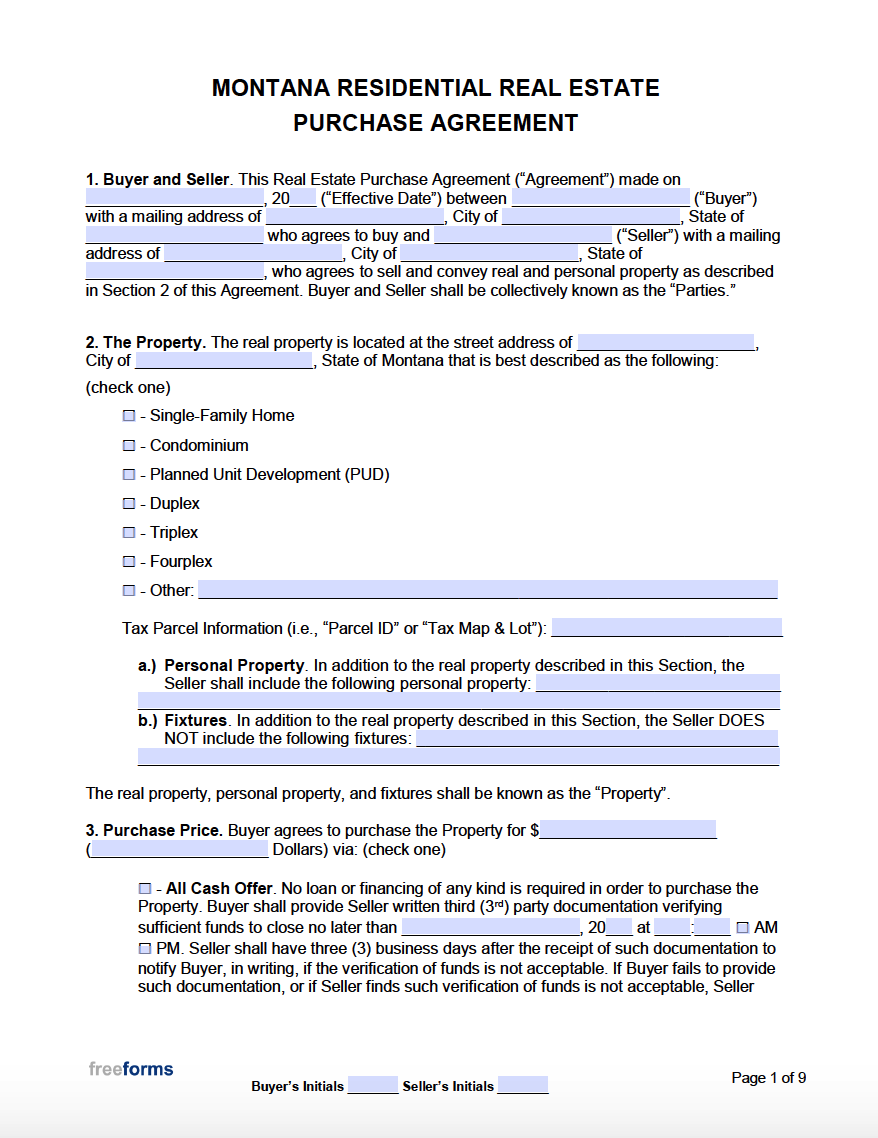

First and foremost, clearly identify all parties involved. This includes the names and contact information of all business owners and the legal name and structure of the business entity. Specifying the type of business is important and each partner’s share of the company should be spelled out so there are no misunderstandings. Ensure that the definition of key terms, such as “disability” or “retirement,” is unambiguous and leaves no room for misinterpretation. Clarity is key when outlining the obligations of each party. Think about unusual or rare events that could trigger a buy-out situation and be sure to address them in this section.

Secondly, detail the triggering events that will activate the buy-sell provisions. As mentioned earlier, these can include death, disability, retirement, termination of employment, divorce, bankruptcy, or any other event that necessitates a change in ownership. Be as specific as possible in defining each triggering event to avoid any ambiguity or disputes. It is also wise to include a clause that provides a method to add or modify the buy sell agreement when needed. What happens when a new owner joins the partnership? The agreement will need to be adjusted and everyone needs to be on the same page.

Thirdly, establish a fair and accurate valuation method for the business. This is perhaps the most contentious aspect of a buy-sell agreement, so it’s crucial to choose a method that is both objective and realistic. Common valuation methods include fixed price, formula-based valuation, appraisal, or a combination of these. Make sure the chosen method reflects the true value of the business and is acceptable to all parties. If you want to keep things simple, an agreed-upon appraisal system is your best bet. The cost of hiring a qualified appraiser is usually well worth it and can save everyone involved a lot of headaches.

Fourthly, outline the purchase terms for the buyout. This includes the price to be paid for the ownership interest, the payment method (lump sum or installments), the interest rate (if any), and the timeline for payment. Ensure that the purchase terms are financially feasible for both the buyer and the seller. It’s important to be realistic about the company’s finances and ability to make payments. The agreement should also address what happens if the buyer defaults on the payment schedule.

Lastly, include provisions for dispute resolution. Inevitably, disagreements may arise regarding the interpretation or implementation of the buy-sell agreement. Include a clause that outlines the process for resolving disputes, such as mediation or arbitration. This can help avoid costly and time-consuming litigation. It’s always best to try to resolve disputes amicably, but having a clear process in place can prevent matters from escalating. Be sure to consult with a qualified attorney to ensure your Montana buy sell agreement template is legally sound and compliant with Montana law.

Creating a Montana buy sell agreement template may seem daunting, but it’s a crucial step in protecting your business and securing its future. Take the time to carefully consider all the elements involved and seek professional guidance to ensure that your agreement is comprehensive, fair, and legally binding.

The effort you put into creating a solid Montana buy sell agreement template today will pay dividends in the long run, providing peace of mind and ensuring a smooth transition of ownership whenever the time comes. Your business is worth the effort and so is protecting your investment and the relationships with your business partners.