So, you’re looking for a monthly car payment agreement template? Maybe you’re selling your beloved vehicle privately, or perhaps you’re helping a friend or family member out with financing. Either way, you’ve come to the right place. Navigating the world of car sales can be tricky, especially when money is involved. Having a clear and concise agreement is absolutely crucial to protect both the buyer and the seller and ensure everyone is on the same page.

Think of this agreement as a roadmap for your car loan. It outlines all the important details, leaving no room for misinterpretations or disputes down the line. This includes everything from the agreed-upon price of the vehicle and the down payment amount to the interest rate, the number of payments, and the consequences of late payments. A well-written template can save you a lot of headaches and potential legal battles in the future. It’s far better to have everything documented upfront than to rely on verbal agreements or handshakes.

This article will guide you through the ins and outs of using a monthly car payment agreement template effectively. We’ll cover what should be included, why it’s important, and where you can find reliable templates to use. By the end, you’ll have a solid understanding of how to create a legally sound and fair agreement that protects your interests and ensures a smooth transaction. Let’s dive in and get you set up for success.

What Should Be Included in Your Monthly Car Payment Agreement Template

A comprehensive monthly car payment agreement template should cover all essential aspects of the loan. Think of it as a detailed instruction manual for the financial side of your car sale. The goal is to make everything crystal clear to avoid any confusion or misunderstandings. Failing to address key elements could lead to disagreements, legal issues, and a whole lot of unnecessary stress. So, let’s break down the crucial components that should always be included:

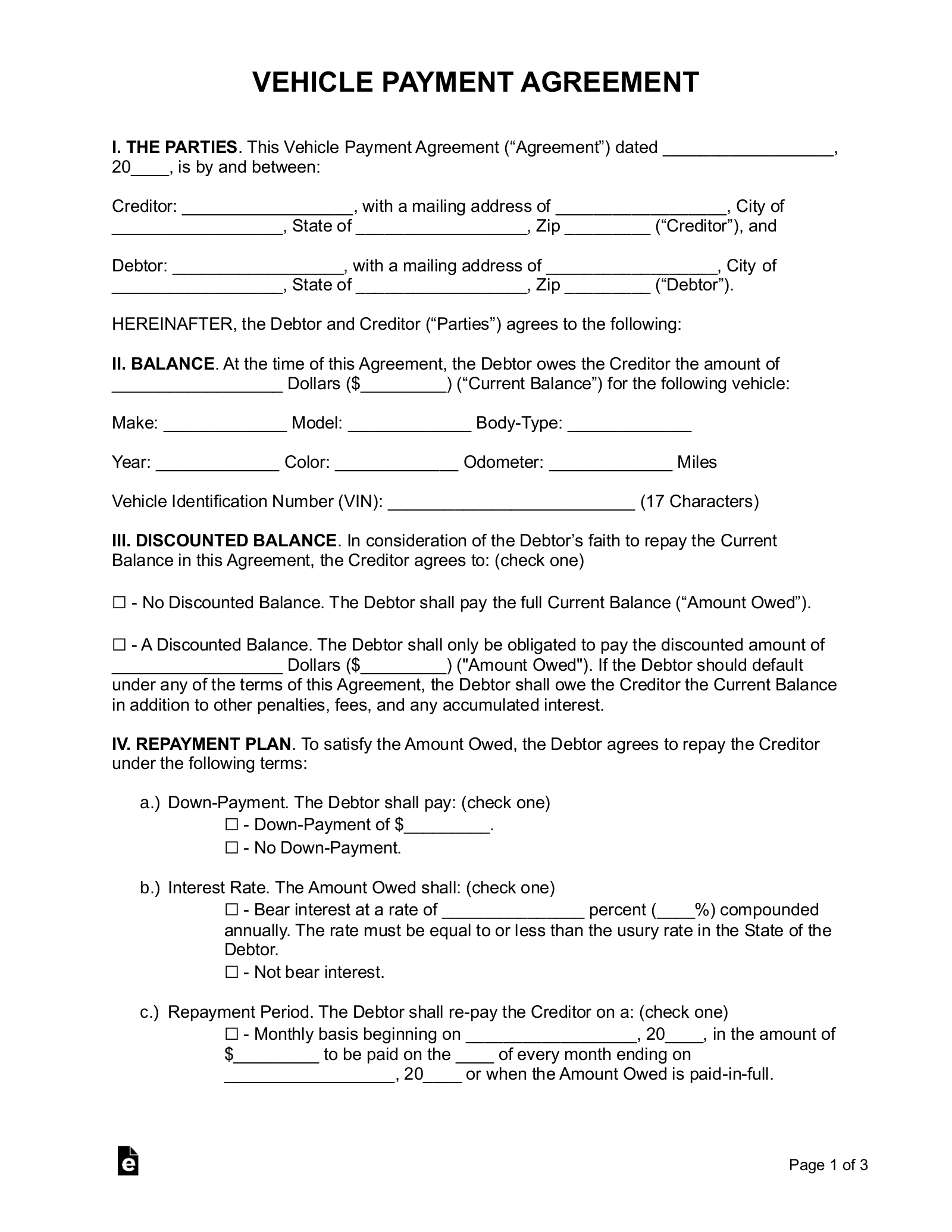

First and foremost, identify the parties involved. This means clearly stating the full legal names and addresses of both the buyer (the borrower) and the seller (the lender). This information is crucial for legal identification and ensures that the agreement is enforceable. You’ll also need to include the date the agreement is being made. This establishes a timeline and provides a reference point for future actions.

Next, provide a complete description of the vehicle. Include the year, make, model, Vehicle Identification Number (VIN), and mileage. This eliminates any ambiguity about which specific car is being sold. The VIN is especially important as it’s a unique identifier that ensures there’s no confusion. Accuracy is key here to avoid potential disputes later on.

Of course, the financial terms are the heart of the agreement. This section needs to be incredibly detailed and specific. Clearly state the total purchase price of the vehicle, the amount of any down payment, the annual interest rate (if any), the number of payments, the amount of each monthly payment, and the due date for each payment. It’s also smart to specify how payments should be made, such as by check, electronic transfer, or cash (though cash payments should be avoided if possible for record-keeping purposes). Consider including a late payment policy, outlining any fees or penalties for payments received after the due date.

Finally, don’t forget about default and repossession. The agreement should clearly state what constitutes a default (e.g., missing multiple payments) and what rights the seller has in the event of a default. This typically includes the right to repossess the vehicle. It’s wise to outline the process for repossession, including any required notices to the buyer. Consulting with a legal professional is highly recommended to ensure this section complies with local laws and regulations. Also, it’s a good practice to include a section regarding the transfer of ownership. This should specify when the title of the vehicle will be transferred to the buyer, typically after all payments have been made.

Adding Additional Clauses to Your Template

Beyond the essential elements, you might want to include additional clauses to address specific situations. For instance, you could add a clause specifying who is responsible for maintaining insurance on the vehicle during the loan period. You could also include a clause addressing what happens if the vehicle is damaged or destroyed before the loan is fully repaid. Carefully consider any unique circumstances and tailor the agreement accordingly to provide the most comprehensive protection.

Finding and Using a Suitable Monthly Car Payment Agreement Template

Now that you know what needs to be included in your monthly car payment agreement template, the next step is finding one that suits your needs. Fortunately, there are numerous resources available online where you can find pre-made templates. However, it’s important to exercise caution and choose a template from a reputable source. Avoid generic, one-size-fits-all templates that may not be compliant with local laws or fully address your specific situation. Look for templates that are customizable and allow you to add or modify clauses as needed.

A great starting point is to check with your local bar association or legal aid society. They often provide free or low-cost legal resources, including sample contracts and templates. These resources are typically vetted by legal professionals and are more likely to be accurate and reliable. You can also search online legal document providers, but be sure to read reviews and compare prices before committing to a specific service. Many reputable websites offer templates drafted by attorneys that can be tailored to your specific jurisdiction.

Before using any template, take the time to carefully review it and make sure you understand all the terms and conditions. If you’re unsure about anything, don’t hesitate to seek legal advice from an attorney. A small investment in legal consultation upfront can save you a lot of money and headaches down the road. An attorney can review the template to ensure it complies with all applicable laws and regulations in your state and that it adequately protects your interests.

Once you’ve selected a template, fill it out completely and accurately. Double-check all the information, especially the financial terms, to ensure there are no errors. It’s a good idea to have both the buyer and the seller review the agreement independently before signing it. Once everyone is satisfied with the terms, have both parties sign and date the agreement. It’s also wise to have the agreement notarized, as this provides an additional layer of legal validity.

Finally, make sure both the buyer and the seller retain a copy of the signed agreement. Store the agreement in a safe place where you can easily access it if needed. Regularly review the agreement to ensure compliance with its terms. Following these steps will help you create a legally sound and effective monthly car payment agreement, minimizing the risk of disputes and ensuring a smooth transaction.

Creating a monthly car payment agreement doesn’t need to be an intimidating task. With a bit of research, a reliable template, and careful attention to detail, you can protect yourself and ensure a fair and transparent transaction. Remember, clear communication and a well-documented agreement are the keys to a successful car sale.

Investing the time to create a thorough and legally sound agreement is an investment in your peace of mind. It allows you to proceed with confidence, knowing that you’ve taken the necessary steps to protect your interests and avoid potential problems down the road.