Ever found yourself needing to buy something significant but not quite having the funds upfront? Or maybe you’re selling something valuable and want to offer your buyer a more accessible payment option? That’s where a monthly payment installment payment agreement comes in handy. It’s essentially a formal agreement that outlines how a purchase will be paid for in smaller, manageable chunks over a period of time. It protects both the buyer and the seller, making sure everyone is on the same page and reducing the risk of misunderstandings or payment defaults.

Think of it like this: instead of dropping a large sum all at once, you’re breaking it down into bite-sized portions. This can be a lifesaver when dealing with big-ticket items like cars, furniture, or even services. From a seller’s perspective, offering installment plans can attract more customers who might otherwise be unable to afford the product or service outright. And from a buyer’s perspective, it allows them to acquire what they need without straining their immediate finances.

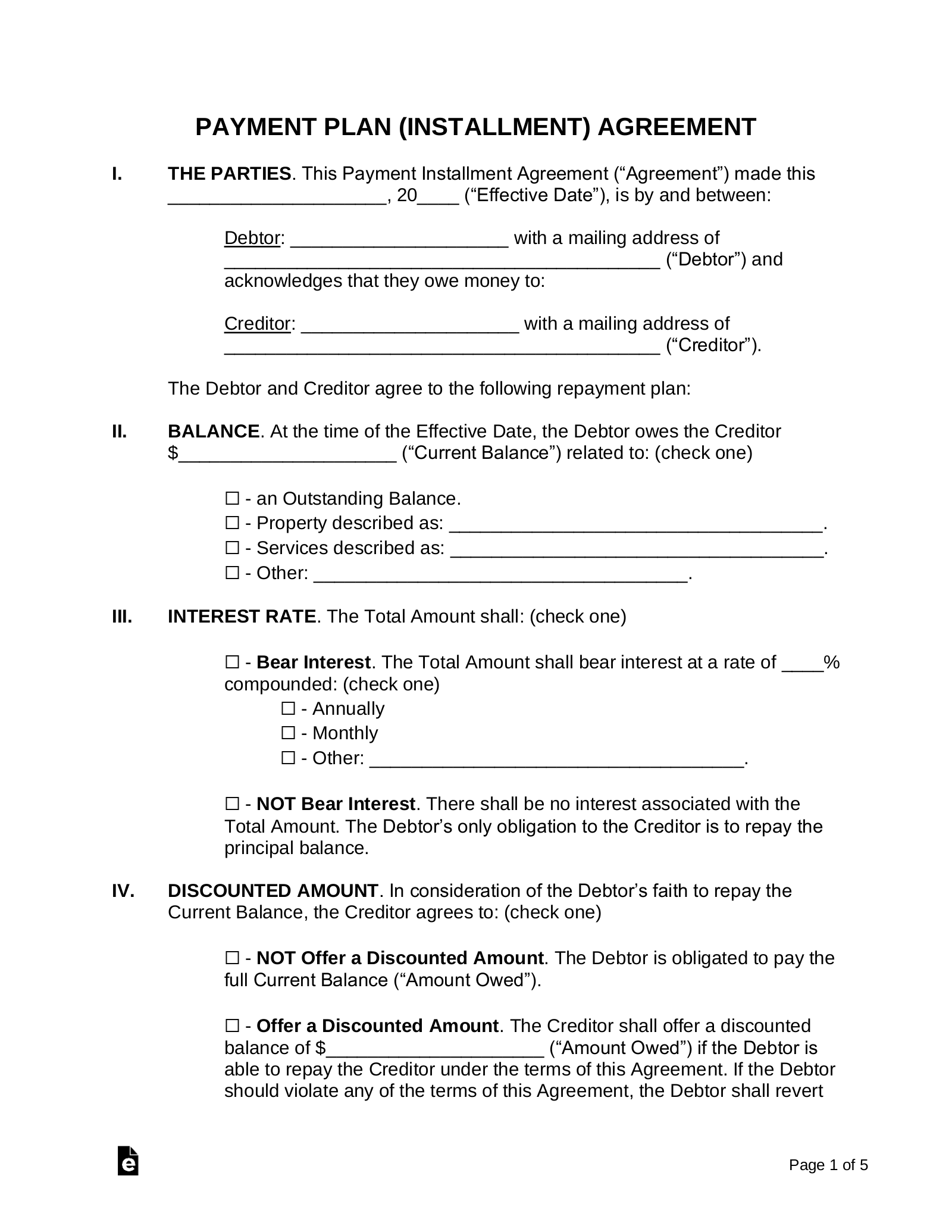

But creating this agreement from scratch can be daunting. That’s where a monthly payment installment payment agreement template swoops in to save the day. It provides a structured framework, ensuring you include all the necessary clauses and protect your interests. No more staring at a blank screen, wondering where to begin! It streamlines the process, making it easier and faster to formalize the payment arrangement. Let’s dive deeper into why using a template is such a smart move and what key elements it should contain.

Why Use a Monthly Payment Installment Payment Agreement Template?

Let’s face it: legal jargon can be intimidating. Trying to draft an agreement from scratch often leads to confusion, omissions, and potential loopholes that could come back to haunt you later. A well-designed template acts as your guide, leading you through the essential clauses and considerations. It provides a solid foundation, ensuring your agreement is comprehensive and legally sound. Think of it as having a mini-lawyer in your pocket, available whenever you need to formalize a payment plan.

One of the biggest advantages of using a template is the time it saves. Instead of spending hours researching legal requirements and trying to phrase everything correctly, you simply fill in the blanks with the relevant information. This is particularly helpful if you’re not a legal expert or if you need to create multiple agreements. It streamlines the entire process, allowing you to focus on other important aspects of your business or purchase.

Beyond saving time and ensuring legal soundness, a template helps prevent misunderstandings between parties. It clearly defines the payment schedule, interest rates (if applicable), late payment penalties, and other crucial details. By having everything in writing, you minimize the risk of disputes arising from differing interpretations or forgotten conversations. Clarity is key in any agreement, and a template helps you achieve that.

A quality template also provides a sense of security. Knowing that you’ve covered all the necessary bases gives you peace of mind and reduces the anxiety associated with financial transactions. It’s a proactive step that protects your interests and helps you avoid costly legal battles down the road. This security is invaluable, especially when dealing with significant purchases or sales.

Furthermore, many templates are customizable. You can tailor them to fit the specific circumstances of your agreement, adding or modifying clauses as needed. This flexibility ensures that the template aligns perfectly with your individual needs, providing a bespoke solution without the hefty price tag of custom legal drafting.

Key Elements to Include in Your Template

A solid monthly payment installment payment agreement template should cover all the bases to protect both the buyer and the seller. First and foremost, clearly identify the parties involved: the seller (or creditor) and the buyer (or debtor). Include their full legal names, addresses, and contact information. This establishes who is bound by the agreement.

Next, thoroughly describe the item or service being purchased. Include details such as model numbers, serial numbers, condition, and any relevant specifications. This ensures there’s no ambiguity about what’s being sold and what the buyer is receiving. Accuracy is crucial here.

The payment schedule is, of course, a critical element. Clearly state the total purchase price, the amount of each installment, the due dates for each payment, and the method of payment (e.g., check, electronic transfer). Be specific and avoid vague language. If interest is being charged, clearly state the interest rate and how it will be calculated.

Also include clauses addressing late payments. What are the penalties for missed payments? Is there a grace period? How will late fees be calculated? Having these details clearly outlined helps prevent disputes and encourages timely payments. It also protects the seller from financial losses due to delayed payments.

Finally, don’t forget about default clauses. What happens if the buyer fails to make payments? What recourse does the seller have? Can the seller repossess the item? These clauses outline the consequences of non-payment and protect the seller’s interests in the event of a breach of contract. A well-defined default clause can save significant time and money if things go south. You should also consider including clauses about governing law and dispute resolution, specifying which jurisdiction’s laws apply and how any disputes will be resolved (e.g., arbitration, mediation). These provisions help streamline the legal process if disagreements arise.

Using a monthly payment installment payment agreement template can be a game changer for anyone involved in selling or purchasing goods or services on payment plans. It’s a smart and effective way to protect yourself and ensure a smooth and transparent transaction.

So, next time you find yourself needing to formalize an installment payment arrangement, remember that a well-crafted template can be your best friend. It’s a tool that promotes clarity, reduces risk, and simplifies a potentially complex process.