Life throws curveballs, doesn’t it? Sometimes, those curveballs come in the form of unexpected expenses, and suddenly, making ends meet becomes a real challenge. If you’re a business owner or freelancer, you might find yourself in a situation where a client can’t afford to pay the full amount upfront. Or perhaps you’re an individual needing to settle a debt with a friend or family member. That’s where a monthly payment plan agreement template can be a lifesaver.

Think of it as a structured roadmap for repayment. Instead of a lump sum, the debt is broken down into manageable monthly installments. This benefits both parties: the person owing money gets breathing room, and the person owed receives consistent payments over time. It’s a win-win situation, promoting financial stability and maintaining positive relationships.

But simply agreeing verbally isn’t enough. To protect yourself and ensure everyone is on the same page, you need a written agreement. A well-drafted monthly payment plan agreement template outlines all the crucial details, leaving no room for misunderstandings or disputes down the road. This document acts as a formal record of the agreed-upon terms, making the repayment process smooth and transparent.

Why You Need a Solid Monthly Payment Plan Agreement

A monthly payment plan agreement is more than just a piece of paper; it’s a foundation for a healthy financial arrangement. Without a clear agreement, confusion and disagreements can easily arise. Imagine lending a significant sum of money to a friend without specifying the repayment terms. What happens if they start missing payments or disagree about the interest rate? Suddenly, a friendly gesture turns into a source of stress and conflict. A legally sound monthly payment plan agreement template prevents this.

One of the key benefits is its clarity. The agreement clearly outlines the total amount owed, the amount of each monthly payment, the due date for each payment, and any applicable interest or late fees. This eliminates ambiguity and ensures that both parties have a shared understanding of their obligations. Think of it as a financial GPS, guiding both parties towards successful repayment.

Moreover, a written agreement provides legal protection. In the unfortunate event that the borrower defaults on the payment plan, the lender has a legally binding document that can be used to pursue legal action. This significantly increases the chances of recovering the outstanding debt and minimizes potential financial losses. It acts as a safeguard for the lender, providing recourse in case of non-compliance.

Consider a scenario where a small business owner offers a monthly payment plan to a client who is struggling to afford a large project upfront. The written agreement not only formalizes the repayment schedule but also protects the business owner from potential financial risks. It’s a proactive measure that ensures the business gets paid for its services while accommodating the client’s financial limitations.

Furthermore, having a formal agreement encourages responsible financial behavior. When individuals or businesses commit to a structured payment plan, they are more likely to prioritize their financial obligations and adhere to the agreed-upon terms. This fosters a sense of accountability and reduces the likelihood of missed payments or defaults. It promotes financial discipline and mutual respect.

Key Elements of an Effective Monthly Payment Plan Agreement Template

Creating a robust monthly payment plan agreement template requires careful consideration of several key elements. It’s not just about filling in the blanks; it’s about ensuring that the agreement accurately reflects the specific terms of the arrangement and protects the interests of both parties. Let’s explore some of the essential components:

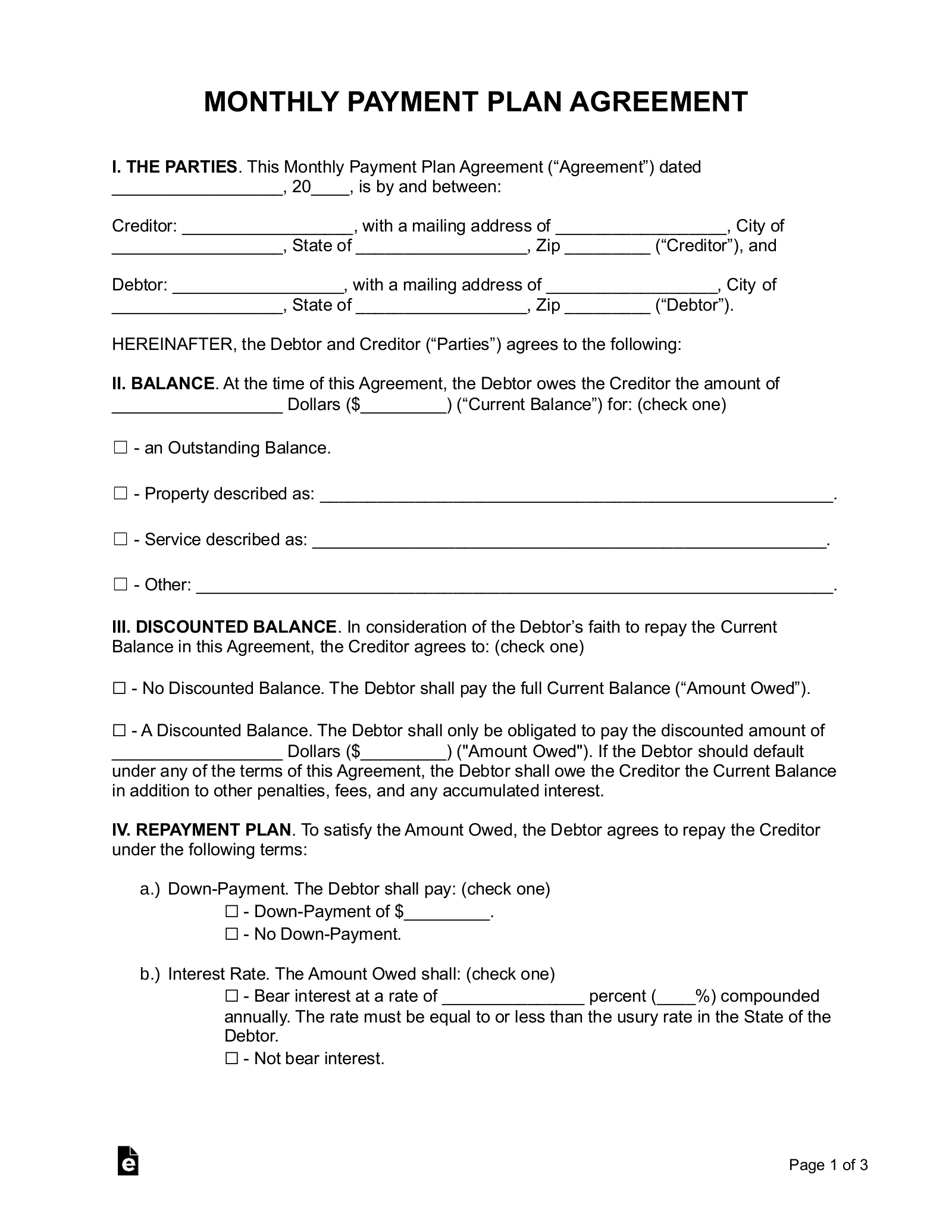

First and foremost, the agreement must clearly identify the parties involved. This includes the full legal names and addresses of both the lender and the borrower. This information is crucial for establishing the legal identity of each party and ensuring that any legal notices or correspondence can be properly delivered. Accuracy is paramount in this section.

Next, the agreement must specify the total amount owed. This should be a precise figure, reflecting the outstanding debt or the value of the goods or services provided. Clarity is essential in this section, avoiding any ambiguity or potential disputes about the principal amount. Including a brief description of what the debt is for can also be helpful.

The heart of the agreement lies in the repayment schedule. This section should clearly outline the amount of each monthly payment, the due date for each payment, and the method of payment. Be specific about whether payments should be made via check, electronic transfer, or another agreed-upon method. Consistency and predictability are key to a successful repayment plan.

Interest rates and late fees should also be clearly addressed. If interest is being charged on the outstanding balance, the agreement must specify the interest rate and how it will be calculated. Similarly, if late fees will be assessed for missed or delayed payments, the agreement must clearly outline the amount of the late fee and the circumstances under which it will be applied. Transparency is crucial for maintaining trust and avoiding misunderstandings.

Finally, the agreement should include a clause addressing default. This section should outline the consequences of failing to make timely payments, such as the acceleration of the debt or the pursuit of legal action. It’s a crucial safeguard for the lender, providing recourse in the event of non-compliance. A well-defined default clause protects the lender’s interests and ensures that the borrower understands the potential ramifications of failing to adhere to the agreement.

Crafting a monthly payment plan agreement template doesn’t have to be daunting. With a clear understanding of the essential components, you can create a document that protects your interests, promotes financial stability, and fosters positive relationships. It provides a clear framework for repayment, ensuring transparency and minimizing the risk of misunderstandings. And remember, a solid agreement built around a monthly payment plan agreement template helps to maintain positive relations.

By providing a structured framework for repayment, you’re not only securing your financial interests but also fostering a sense of trust and cooperation. It’s a practical solution that promotes financial stability and maintains positive relationships, whether you’re dealing with clients, friends, or family members.