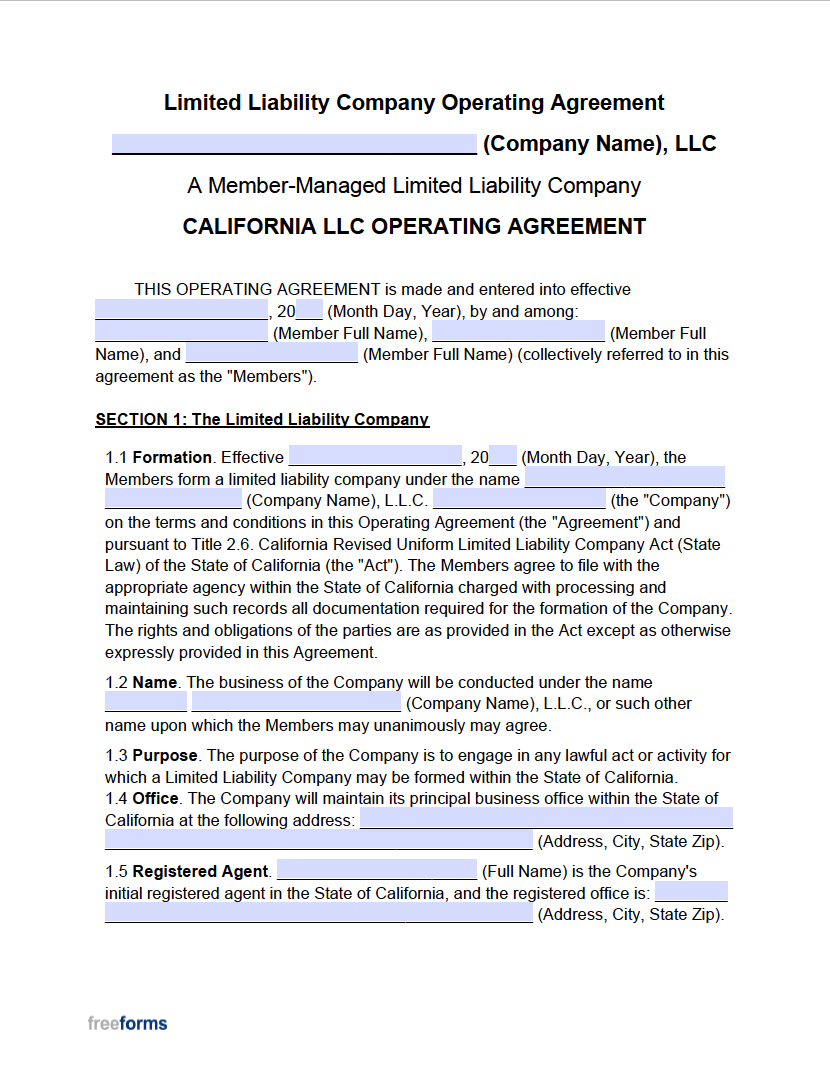

So, you’re thinking about starting a multi member LLC in California? Awesome! You’ve probably got the big picture in mind: the awesome product, the dedicated team, and maybe even the office space. But before you dive headfirst into the exciting world of entrepreneurship, there’s some essential paperwork you need to get sorted. Think of it as the unglamorous, but oh-so-important, foundation upon which your business empire will be built. We’re talking about the multi member LLC operating agreement template california.

An operating agreement might sound intimidating, but it’s really just a document that outlines how your LLC will be run. It’s like the instruction manual for your business, clarifying the roles and responsibilities of each member, how profits and losses are distributed, and what happens if someone wants to leave the company. Without one, you’re essentially running your business without a clear roadmap, and that can lead to disagreements and headaches down the line. Trust me, spending the time to create a solid operating agreement now can save you a lot of trouble later.

Creating a well-defined multi member LLC operating agreement in California is important for a number of reasons. It provides clarity, protects your personal assets, and prevents misunderstandings among members. In California, while an operating agreement isn’t legally required to form an LLC, it is highly recommended. This document acts as a binding agreement between the members, clearly defining their rights and obligations. It’s also a key component when applying for business loans or attracting investors, as it demonstrates that your LLC is structured and well-organized.

Why You Absolutely Need a Multi Member LLC Operating Agreement in California

Think of your multi member LLC operating agreement as the constitution for your business. It’s the document that lays out the ground rules and ensures everyone is on the same page. Without it, you’re essentially relying on the default rules provided by California state law, which might not be suitable for your specific situation. These default rules can be quite rigid and might not reflect the unique needs and desires of your members. For instance, California law dictates how profits and losses are shared if you don’t specify it in an operating agreement. What if you want a different distribution method? An operating agreement allows you to customize these aspects.

One of the most important functions of an operating agreement is to protect your personal assets. By clearly outlining the LLC’s status as a separate legal entity, the agreement helps shield your personal belongings from business debts and liabilities. This is a key advantage of forming an LLC in the first place. Without a well-defined operating agreement, it could be easier for creditors to blur the lines between your personal and business finances, putting your personal assets at risk. It also establishes the process for making important decisions, like adding or removing members, selling the business, or dissolving the LLC. A good operating agreement defines the voting rights of each member and outlines the procedures for resolving disputes, which can be invaluable in preventing conflicts.

Moreover, a solid operating agreement significantly reduces the potential for future disputes between members. It addresses key issues upfront, such as capital contributions, management responsibilities, and procedures for handling disagreements. By clearly defining these aspects, you can avoid misunderstandings and potential legal battles down the road. Imagine a scenario where one member wants to sell their share of the company. The operating agreement can specify the process for doing so, including valuation methods and rights of first refusal for the other members. This prevents one member from unilaterally selling their share to an undesirable third party, which could disrupt the business. Even with the best of intentions, business partnerships can sometimes lead to disagreements. Having a robust operating agreement in place provides a framework for resolving these disputes fairly and efficiently.

Consider these scenarios: What happens if a member becomes incapacitated? What if a member wants to leave the LLC? What if the members disagree on a major business decision? A well-drafted operating agreement addresses these contingencies, ensuring a smooth transition and minimizing disruption to the business. It provides a roadmap for handling unexpected events and protects the interests of all members. The agreement also dictates what happens if a member dies. It will specify whether the member’s interest in the LLC passes to their heirs, or whether the other members have the right to purchase their share. This prevents potential conflicts with the deceased member’s family and ensures the continued stability of the business.

In essence, your multi member LLC operating agreement is an essential tool for establishing a clear framework for your business and protecting the interests of all members. It’s an investment that can save you significant time, money, and stress in the long run. Don’t be tempted to skip this step or use a generic template without tailoring it to your specific needs. Seek legal advice to ensure that your operating agreement accurately reflects your intentions and complies with California law. A well-drafted operating agreement is a cornerstone of a successful and well-managed LLC.

Key Provisions to Include in Your California Multi Member LLC Operating Agreement

When drafting your multi member LLC operating agreement template california, there are several essential provisions you’ll want to include to ensure comprehensive coverage and legal protection. First and foremost, clearly define the purpose of your LLC. What specific business activities will it engage in? This helps to limit the scope of your LLC’s activities and protects you from liability for actions outside of that defined purpose. For example, if your LLC is formed to operate a restaurant, the operating agreement should clearly state that purpose. This prevents a member from unilaterally engaging in unrelated activities, such as starting a real estate business under the LLC’s umbrella.

Another crucial provision is outlining the capital contributions of each member. How much money, property, or services is each member contributing to the LLC? Clearly document these contributions, as they often determine each member’s ownership percentage and share of profits and losses. The operating agreement should also specify how additional capital contributions will be handled in the future. What happens if the LLC needs more funding down the line? Will members be required to contribute additional capital proportionally to their ownership percentage, or will there be other options, such as seeking outside investment? Moreover, specify how profits and losses will be allocated among the members. Will they be distributed proportionally to ownership percentages, or will there be a different arrangement? This can be particularly important if some members are more actively involved in the day-to-day operations of the business than others. It’s also important to clearly define the management structure of the LLC. Will it be member-managed, where all members are actively involved in decision-making, or manager-managed, where one or more designated managers are responsible for running the business?

The agreement must also include provisions for membership changes. What happens if a member wants to leave the LLC? Can they sell their membership interest to an outside party? Do the other members have a right of first refusal? The operating agreement should clearly outline the process for transferring membership interests, including any restrictions or limitations. The agreement should also address the death or incapacity of a member. What happens to their membership interest in that event? Will it pass to their heirs, or will the other members have the option to purchase it? Furthermore, establish a clear process for resolving disputes between members. This can include mediation, arbitration, or litigation. The operating agreement should specify the preferred method of dispute resolution and outline the procedures for initiating and conducting the process. Having a well-defined dispute resolution process can save significant time and money in the event of a disagreement.

In addition, make sure to include provisions regarding meetings and voting rights. How often will member meetings be held? What constitutes a quorum for a meeting? How will voting rights be allocated among the members? The operating agreement should clearly outline these procedures to ensure that decisions are made fairly and democratically. Finally, don’t forget to address the issue of dissolution. Under what circumstances will the LLC be dissolved? What is the process for winding up the LLC’s affairs and distributing its assets? The operating agreement should outline the procedures for dissolution to ensure a smooth and orderly termination of the business. Ensuring these provisions are carefully addressed will help guarantee your multi member LLC is operating efficiently.

In short, taking the time to carefully draft your multi member LLC operating agreement template california is an investment that will pay off in the long run. It will help you avoid disputes, protect your personal assets, and ensure that your business is operating on a solid foundation. So don’t delay, get started on your operating agreement today!

Starting an LLC with partners means building a business on trust and mutual understanding. A well-crafted operating agreement is the cornerstone of that understanding. It’s not just a piece of paper, but a dynamic tool that shapes the future of your company.

When forming your multi member LLC, prioritize creating a comprehensive and customized operating agreement. This document acts as your business blueprint, helping you navigate the complexities of partnership and ensuring long-term success.