So, you’re thinking of starting a multi member LLC in the great state of Texas? Awesome! That’s a fantastic way to structure your business and protect your personal assets. But before you jump in headfirst, there’s one crucial document you need to nail down: the operating agreement. Think of it as the rulebook for your business, laying out how things will run, who’s responsible for what, and how you’ll handle disagreements. It’s not just a formality; it’s the foundation for a smooth and successful partnership.

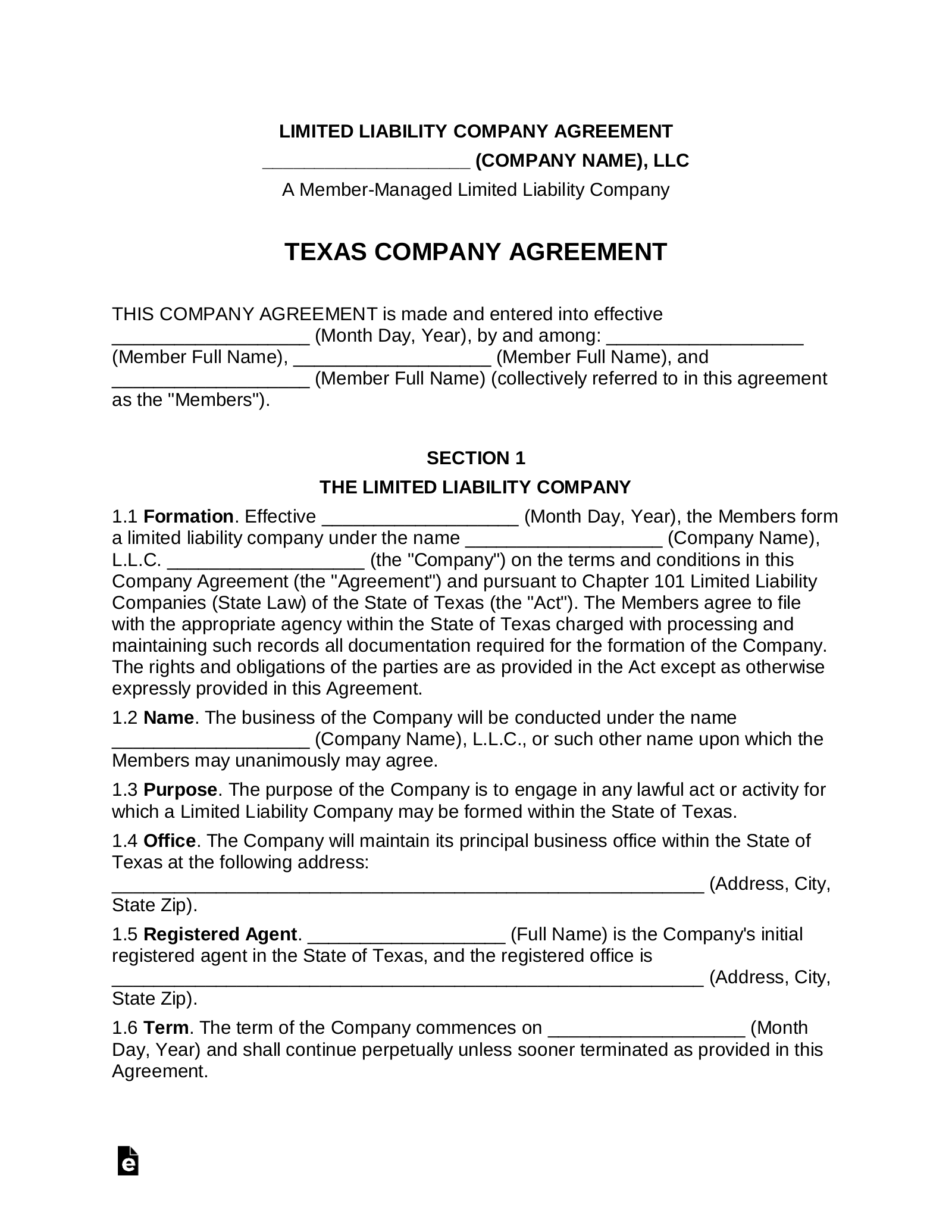

Now, drafting an operating agreement from scratch can feel overwhelming, especially with all the legal jargon floating around. That’s where a multi member llc operating agreement template texas comes in handy. It provides a solid starting point, outlining the key provisions you need to consider. Of course, you’ll want to customize it to fit your specific business needs, but having a template helps you avoid missing critical details and ensures you’re compliant with Texas law.

In this guide, we’ll break down the importance of an operating agreement for your multi member LLC in Texas. We’ll also discuss what essential elements to include in the template and highlight why customizing it to your unique circumstances is crucial. By the end, you’ll have a better understanding of how to create a solid operating agreement that protects your business and sets you up for success. Let’s dive in!

Why You Absolutely Need an Operating Agreement for Your Texas Multi Member LLC

Okay, let’s get real. You might be thinking, “Do I *really* need an operating agreement? We’re all friends here!” While that’s a great sentiment, relying on handshakes and verbal agreements can lead to major headaches down the road. An operating agreement isn’t about distrust; it’s about clarity, foresight, and protecting everyone’s interests. It is especially critical for a multi member LLC, where multiple people are involved in the business decisions.

First and foremost, an operating agreement reinforces the “limited liability” aspect of your LLC. It helps demonstrate that your business is a separate legal entity from its owners (the members). Without a clear operating agreement, a court might view your LLC as a sole proprietorship or partnership, which means your personal assets could be at risk if your business gets sued or incurs debt. That’s a risk you definitely want to avoid.

Beyond liability protection, the operating agreement spells out the financial and operational aspects of your business. It defines each member’s ownership percentage, how profits and losses will be distributed, and how decisions will be made. This prevents potential disputes down the line and provides a clear framework for resolving disagreements if they do arise. Think of it as a prenuptial agreement for your business partnership. No one goes into business expecting conflict, but planning for it is smart business practice.

Furthermore, a well-drafted operating agreement can help your LLC navigate potential challenges, such as the departure of a member, the addition of a new member, or the sale of the business. It can outline procedures for these situations, ensuring a smooth transition and preventing unnecessary disruptions. Without these provisions, you could be left scrambling to figure things out on the fly, which can be time-consuming and costly.

In Texas, while not legally mandated to have an operating agreement, it’s considered a best practice for any multi member LLC. It offers clarity, protection, and a solid foundation for your business to thrive. Using a multi member llc operating agreement template texas to get started is a smart move. Just remember to tailor it to fit your specific business circumstances and consult with an attorney to ensure it complies with all applicable laws.

Key Elements to Include in Your Multi Member LLC Operating Agreement Template Texas

Alright, so you’re convinced that an operating agreement is a must-have. Now, let’s talk about what should actually be included in your multi member llc operating agreement template texas. While every business is unique, there are certain key elements that should be addressed in every agreement. Here’s a breakdown of the essential components:

Company Information: This section should clearly state the name of your LLC, its principal place of business, its registered agent, and its purpose. Make sure the name matches the one filed with the Texas Secretary of State. Also, be specific about the purpose of your business to avoid any ambiguity later on.

Member Information: Clearly identify each member of the LLC, including their names, addresses, and ownership percentages. This is crucial for determining profit and loss allocations and voting rights. Specify how ownership percentages are determined and whether they can be transferred or sold.

Capital Contributions: Detail the initial contributions each member is making to the LLC, whether it’s cash, property, or services. This section should also address how future capital contributions will be handled and what happens if a member fails to contribute their agreed-upon share.

Management and Voting: Outline how the LLC will be managed. Will it be member-managed, where all members participate in day-to-day operations? Or will it be manager-managed, where one or more designated managers make the decisions? This section should also specify how voting rights are allocated and how decisions will be made (e.g., majority vote, unanimous consent). Also specify any titles such as President or CEO any member will hold, along with the duties they perform in this role.

Distributions and Allocations: Clearly define how profits and losses will be distributed among the members. This is often based on ownership percentages, but you can also agree on alternative methods. Ensure that the allocation method complies with IRS regulations to avoid any tax issues. This is a crucial part to get right.

Dissolution: Outline the process for dissolving the LLC. This should include the events that would trigger dissolution, such as the death or withdrawal of a member, the sale of the business, or a decision by the members to terminate the LLC. Specify how assets will be distributed upon dissolution.

Amendment Procedures: Explain how the operating agreement can be amended in the future. Typically, this requires a certain percentage of member approval (e.g., majority vote, unanimous consent). This provides flexibility to adapt the agreement as your business evolves.

It’s always wise to have a legal professional review your operating agreement. Although a template provides a good starting point, it is important that it is specifically tailored to the unique needs of your company.

Your operating agreement sets the stage for a smooth business relationship. Making sure it is comprehensive and well-written is vital to the long-term success of your multi member LLC.

Starting a business is an exhilarating endeavor. Doing your homework will give you peace of mind and safeguard the future of your organization.