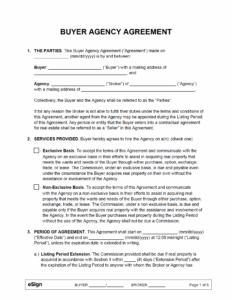

In the world of business, especially when dealing with suppliers and vendors, establishing clear payment terms is absolutely crucial. It sets the foundation for a smooth and predictable financial relationship. One common arrangement is the “net 15” terms, which essentially means the buyer has 15 days from the invoice date to make the full payment. While it sounds simple enough, having a formal agreement in place outlining these terms is essential for avoiding misunderstandings and potential disputes down the line.

Think of a net 15 terms agreement template as your business’s financial handshake. It formally documents the agreement between you and your supplier (or customer, if you’re the one extending the credit) regarding payment deadlines. This template will lay out all the necessary information related to the payment schedule. It might seem like extra paperwork, but it can save you from headaches and potential late payment issues. Imagine trying to chase down payments without anything in writing – it’s a recipe for frustration!

Using a well-drafted net 15 terms agreement template isn’t just about setting payment deadlines; it’s about establishing trust and professionalism. It clearly defines expectations, minimizing ambiguity and fostering a positive business relationship. Whether you’re a small startup or a large corporation, a clear and concise agreement is invaluable for maintaining financial stability and ensuring everyone is on the same page.

Why You Need a Solid Net 15 Agreement

Having a well-defined agreement around your payment terms, especially net 15, is much more than just a formality – it’s a cornerstone of good business practice. Without a clear agreement, you open yourself up to a whole host of potential problems, from late payments and cash flow issues to damaged relationships with your suppliers or customers.

One of the biggest benefits of using a net 15 terms agreement template is that it eliminates any ambiguity surrounding payment deadlines. It clearly states the date by which payment is expected, leaving no room for interpretation. This is especially important when dealing with new clients or suppliers where a level of trust hasn’t been fully established yet. A clear agreement sets expectations from the start and prevents any misunderstandings regarding payment timing.

Beyond simply setting deadlines, a comprehensive net 15 terms agreement template can also address other important considerations. For example, it can outline the accepted methods of payment, such as electronic transfers, checks, or credit card payments. It might also specify any penalties for late payments, such as interest charges or suspension of services. By addressing these details upfront, you can prevent potential conflicts and ensure everyone is aware of the consequences of not meeting the payment terms.

Think about it from the perspective of a supplier. They’re providing you with goods or services and trusting you to pay them in a timely manner. A clear net 15 agreement demonstrates your commitment to fulfilling your financial obligations and builds confidence in your business relationship. This can lead to better pricing, more favorable terms, and a stronger overall partnership.

Furthermore, in the unfortunate event of a dispute over payment, a written net 15 terms agreement template provides you with a strong legal basis to support your claim. It serves as evidence of the agreed-upon terms and can be invaluable in resolving disagreements and protecting your financial interests. It’s a small investment that can save you a lot of time, money, and stress in the long run.

Key Elements of a Net 15 Terms Agreement Template

Creating a robust net 15 terms agreement template involves carefully considering several crucial elements that protect both parties involved. While templates are available, understanding what each section entails will help you tailor it to your specific needs. It’s not just about plugging in information; it’s about crafting a document that truly reflects your business relationship and safeguards your interests.

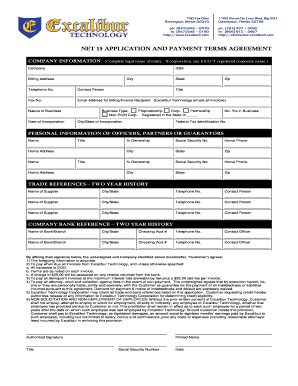

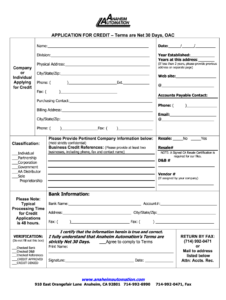

First and foremost, the agreement must clearly identify the parties involved. This means including the full legal names and addresses of both the supplier (or service provider) and the customer (or client). This information is crucial for legal purposes and ensures that there is no confusion about who is bound by the agreement. Double-check these details to avoid any future complications. You would want to be 100% sure you have the correct legal entity written in your agreement.

Next, the agreement should clearly define the scope of the goods or services being provided. This section should describe in detail the specific products or services that are covered by the agreement. The description has to be comprehensive enough to avoid any ambiguity about what is included. For instance, if you’re a software company licensing a specific program, spell out the name, version number, and any included support services. This will eliminate debates about whether a particular item or service falls within the agreement.

The heart of the agreement, of course, is the payment terms section. This section explicitly states that the payment terms are “net 15,” meaning that the customer has 15 days from the date of the invoice to make full payment. It should also specify the currency of payment and the accepted methods of payment. If there are any late payment penalties, such as interest charges, these should be clearly stated here. It is also good practice to include the details of where the payment should be sent. This reduces confusion and ensures timely payments.

In addition to the core payment terms, consider including a section addressing dispute resolution. This clause outlines the process for resolving any disagreements that may arise regarding the agreement. It could involve mediation, arbitration, or litigation. Having a clear dispute resolution process can save time and money by providing a framework for resolving conflicts without resorting to costly court battles. It’s essentially a pre-agreed method for navigating disagreements and maintaining a professional relationship.

Finally, make sure the agreement includes a governing law clause. This specifies which state or country’s laws will govern the interpretation and enforcement of the agreement. Choosing a governing law that is familiar to both parties can simplify legal proceedings if a dispute arises. It provides a clear legal framework for the agreement and ensures that both parties understand the legal context in which it will be interpreted. The net 15 terms agreement template is not just a payment plan, but a document outlining the expected behavior of all involved.

Understanding the value of a “net 15 terms agreement template” and integrating it into your business operations is something you won’t regret. This simple addition can prevent possible confusions about the payment schedule that are expected from both sides.

By setting clear expectations for payment, you are encouraging timely payments, as well as a clearer, more friendly business relationship. With these easy steps, you will find an improvement in your cash flow and the way you relate with your partners.