So, you’re starting an LLC in the Big Apple? Congratulations! That’s a fantastic move, and you’re on your way to building something awesome. But before you dive headfirst into the world of business, there’s a crucial document you absolutely need to get right: your New York LLC Operating Agreement. Think of it as the constitution for your company, outlining the rules and responsibilities for everyone involved. It’s not just a piece of paper; it’s the foundation upon which your business will stand.

Now, you might be thinking, “Do I really need one?” The answer is a resounding YES. While New York doesn’t technically require an operating agreement for single-member LLCs, having one is incredibly beneficial. For multi-member LLCs, it’s even more vital. It helps prevent disputes, clarifies ownership percentages, and protects your personal assets. Trust me, taking the time to create a solid operating agreement now can save you a whole lot of headaches down the road.

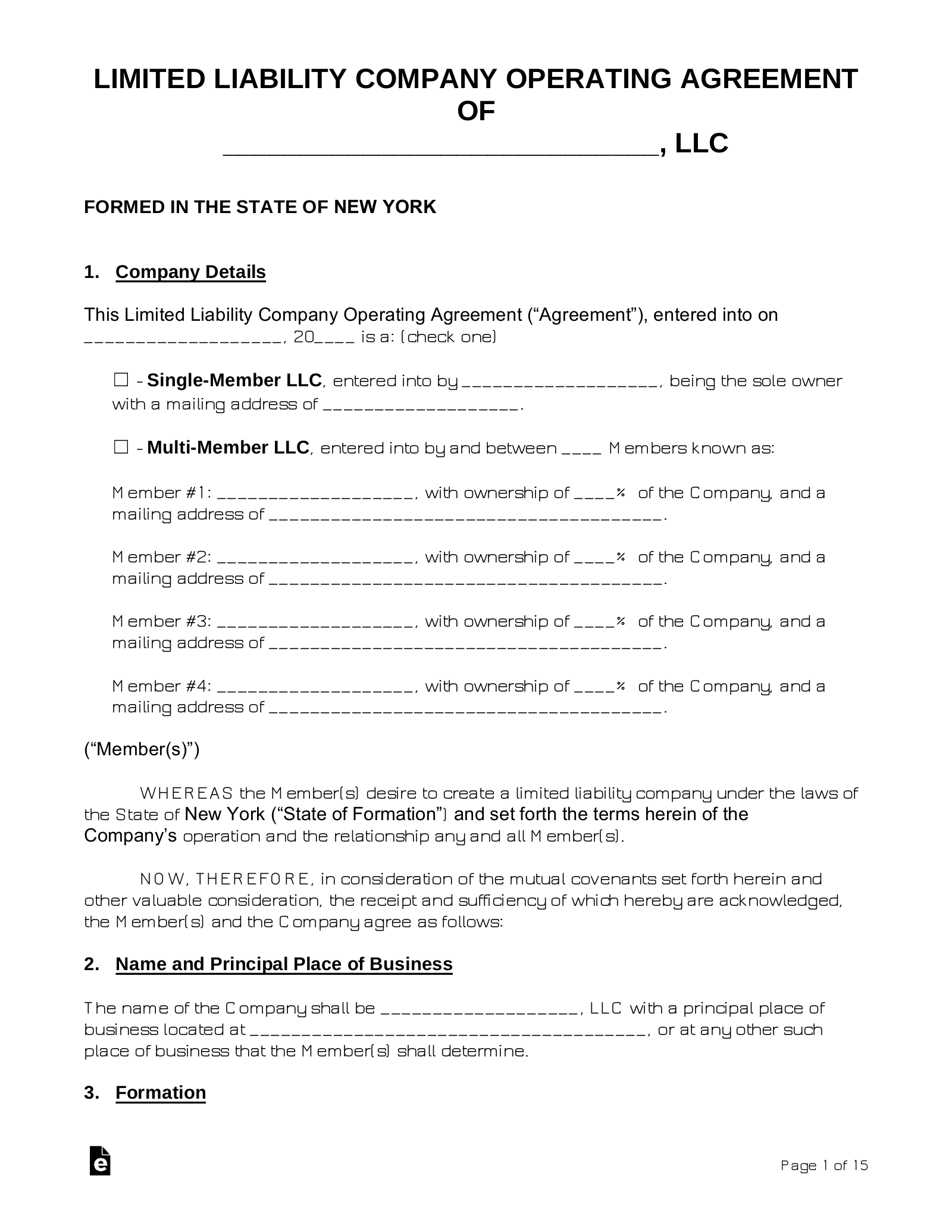

That’s where a New York LLC operating agreement template comes in handy. It provides a starting point, a framework that you can customize to fit the specific needs of your business. Of course, every business is unique, so you’ll want to ensure the template covers all the essential aspects while remaining flexible enough to adapt to your company’s particular situation. This article will guide you through the process of understanding and utilizing a New York LLC operating agreement template, ensuring your business is set up for success from the get-go.

Why Your New York LLC Needs a Solid Operating Agreement

Think of your New York LLC operating agreement as the ultimate rulebook for your company. It lays out the ground rules for how your business will be run, who’s responsible for what, and what happens if things don’t go according to plan. Without it, you’re essentially navigating the business world without a map, and that can lead to some serious problems down the line. Let’s explore why having a well-drafted operating agreement is so crucial.

First and foremost, an operating agreement clarifies ownership. It specifies each member’s percentage of ownership in the LLC, which directly affects how profits and losses are distributed. This is especially important for multi-member LLCs, where disagreements over ownership can quickly escalate into legal battles. By clearly defining ownership from the outset, you prevent misunderstandings and create a transparent framework for financial matters.

Beyond ownership, the operating agreement also outlines the roles and responsibilities of each member. Who’s in charge of making day-to-day decisions? Who’s responsible for managing the company’s finances? These details are essential for smooth operations and can prevent confusion and conflict. A clear division of labor ensures that everyone knows their duties and can perform them effectively. For example, it can explain how decisions will be made, whether through a majority vote or unanimous consent.

Furthermore, the operating agreement provides crucial protection for your personal assets. By establishing the LLC as a separate legal entity, the agreement helps shield your personal belongings from business debts and liabilities. This is one of the primary benefits of forming an LLC in the first place, but it’s crucial to have a solid operating agreement in place to reinforce that separation. Without it, a court might disregard the LLC structure, leaving your personal assets vulnerable.

Finally, an operating agreement helps ensure business continuity. What happens if a member leaves the LLC? What if someone becomes disabled or passes away? The operating agreement can outline procedures for these types of situations, ensuring that the business can continue to operate smoothly even in the face of unexpected events. This foresight can save you and your fellow members a lot of stress and uncertainty during challenging times.

Key Sections of a New York LLC Operating Agreement Template

A good New York LLC operating agreement template will cover a wide range of essential topics. It’s not just about filling in the blanks; it’s about understanding each section and tailoring it to your specific business needs. Here’s a breakdown of some of the key components you’ll find in a typical template:

Organization Information: This section covers the basics, such as the name of your LLC, its principal place of business, and its registered agent. Make sure this information is accurate and up-to-date.

Members and Ownership: As mentioned earlier, this section details each member’s ownership percentage and contribution to the LLC. It’s crucial to get this right, as it directly affects how profits, losses, and voting rights are distributed.

Management Structure: Will your LLC be member-managed or manager-managed? This section defines how the company will be run and who will be responsible for making decisions.

Capital Contributions: This section outlines the initial investments made by each member. It also addresses how additional capital can be raised in the future.

Distributions: How will profits and losses be distributed among the members? This section specifies the distribution schedule and methodology.

Dissolution: This section outlines the procedures for dissolving the LLC, including how assets will be distributed and debts will be paid.

You may also encounter sections addressing topics such as meetings, voting rights, indemnification, and dispute resolution. Remember, a New York LLC operating agreement template is a starting point. Feel free to customize it to address the unique circumstances of your business.

There’s a definite sense of security that comes from having a well-defined operating agreement. It’s like having a solid contract between you and your fellow members, spelling out exactly how things will work.

Think of it as an investment in your business’s future. The time and effort you put into creating a strong operating agreement now will pay off handsomely in the long run. It’s a small price to pay for peace of mind and a solid foundation for your business.