Let’s face it, when you’re dealing with sensitive financial information, you want to make sure it stays, well, sensitive. Whether you’re a startup sharing your projections with potential investors, a business negotiating a merger, or simply hiring a contractor who will have access to your books, a non disclosure agreement (NDA) is your best friend. It’s a legal contract that protects your confidential information from being leaked or misused. Think of it as a promise sealed in ink that says, “What happens in the meeting, stays in the meeting (unless we both agree otherwise!).”

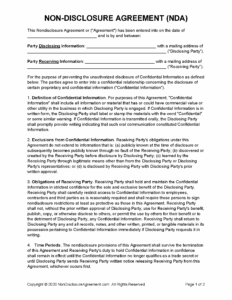

But who has time to draft a complicated legal document from scratch? That’s where a non disclosure agreement template for financial information comes in handy. It’s a pre-written document that you can customize to fit your specific needs. It provides a solid framework, saving you time and legal fees while ensuring you cover all the important bases. Think of it as a fill in the blanks approach to protecting your valuable data. With a solid template in hand, you are ensuring all bases are covered when you share such vital details.

This article will guide you through the world of NDAs, specifically focusing on those tailored for financial data. We’ll explore what they are, why you need one, and what key elements to look for in a template. We will also cover how to properly adapt your non disclosure agreement template for financial information for your precise situation. So, buckle up, and let’s dive into protecting your financial secrets!

Understanding the Power of a Non Disclosure Agreement for Financial Data

A non disclosure agreement, often shortened to NDA, is a legally binding contract where one or more parties agree not to disclose confidential information that they have shared with each other. In the context of financial information, this is particularly crucial. Financial data can include everything from revenue projections and profit margins to customer lists and investment strategies. Sharing this information without protection can be devastating if it falls into the wrong hands of competitors or even leaks publicly.

Imagine you are seeking funding for a new venture. You need to share your financial forecasts with potential investors. Without an NDA, those investors could easily share your projections with other companies, potentially giving your competitors an unfair advantage. Or perhaps you’re involved in a merger or acquisition. The due diligence process requires you to open your books and reveal sensitive financial information. An NDA ensures that the acquiring company won’t use your data for any purpose other than evaluating the deal.

Even within your own company, an NDA can be important. Consider employees or contractors who have access to your financial systems. They need to understand the importance of maintaining confidentiality. An NDA can formalize this understanding and provide a legal recourse if they breach their commitment.

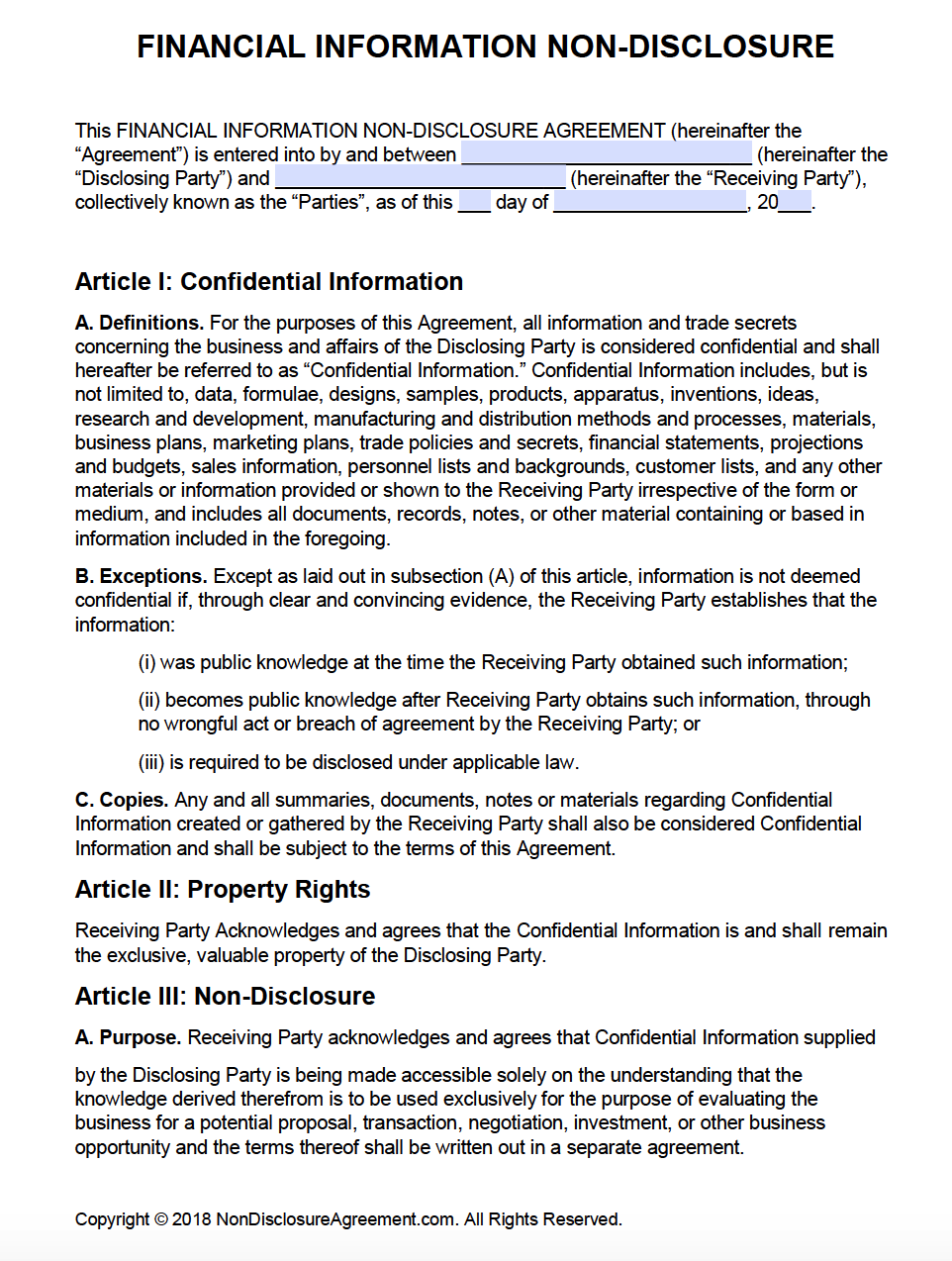

A well-drafted non disclosure agreement template for financial information should clearly define what constitutes confidential information, the scope of the agreement, the permitted uses of the information, and the duration of the agreement. It should also include provisions for remedies in case of a breach, such as injunctive relief (a court order preventing further disclosure) and monetary damages.

Ultimately, an NDA isn’t just a piece of paper; it’s a vital tool for protecting your competitive advantage, preserving your business secrets, and building trust in your business relationships. So, let’s delve deeper into the essential components that should be included in your NDA template.

Key Elements to Include in Your Non Disclosure Agreement Template

When crafting your non disclosure agreement template for financial information, several key elements must be clearly defined. These elements ensure that the agreement is comprehensive, enforceable, and effectively protects your sensitive data. Let’s explore them one by one.

First, definition of confidential information: Be specific! Don’t just say “financial information.” List the types of information you want to protect, such as revenue projections, profit margins, customer lists, pricing strategies, investment plans, and any other data that gives you a competitive advantage. The more detail you provide, the less room there is for interpretation and disputes.

Second, scope of the agreement: Clearly state the permitted uses of the confidential information. For example, if you’re sharing information with potential investors, specify that they can only use it for evaluating the investment opportunity. Prohibit them from using it for any other purpose, such as competing with you or sharing it with third parties. Your NDA should outline what the receiving party can do with the data, and more importantly, what they cannot.

Third, exclusions from confidentiality: There are certain types of information that can’t be protected by an NDA. Common exclusions include information that is already publicly available, information that the receiving party already knew before the disclosure, and information that the receiving party independently develops without using your confidential information. Be sure to include these exclusions in your template to avoid any ambiguity.

Fourth, term and termination: Specify how long the NDA will remain in effect. This could be a fixed period, such as two or five years, or it could be tied to a specific event, such as the completion of a project or the termination of a business relationship. Also, outline the circumstances under which the agreement can be terminated early, such as a material breach by either party.

Finally, remedies for breach: This section outlines the consequences of violating the NDA. It should include provisions for injunctive relief (a court order stopping the breaching party from further disclosing the information) and monetary damages to compensate the disclosing party for any losses suffered as a result of the breach. Including a strong remedies clause can deter parties from violating the agreement and provide you with legal recourse if they do.

Remember, your non disclosure agreement template for financial information is a crucial document that protects your business. Take the time to customize it carefully and ensure that it covers all the important bases.

Ultimately, having a well-structured NDA is not just about protecting your business; it’s about fostering trust and establishing clear boundaries in your business relationships. A clear NDA is a foundation for solid and secure partnership.