Ever heard of a loan where the lender can only come after specific collateral if you default? That’s the beauty of a non-recourse loan. It’s a financial tool offering a unique layer of protection for borrowers, especially in real estate and certain business ventures. Instead of chasing your personal assets, the lender’s recovery is limited to the asset securing the loan. This significantly reduces the risk for the borrower, but it also means lenders are very particular about the assets they’re willing to accept as collateral and the creditworthiness of the borrower.

Understanding the nuances of a non-recourse loan is crucial before diving in. Unlike a traditional loan where you’re personally liable, a non-recourse loan provides a safety net. Imagine investing in a property that takes a downturn. With a recourse loan, the lender can pursue your other assets if the property sale doesn’t cover the debt. With a non-recourse loan, their recourse is limited to the property itself, shielding your personal finances.

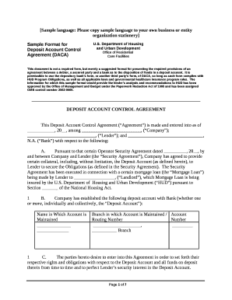

But how do you get started? That’s where a solid non recourse loan agreement template comes in. It’s the foundation of the entire arrangement, outlining the terms, conditions, and specific details of the loan. It ensures both the borrower and the lender are on the same page, minimizing potential misunderstandings and disputes down the line. It’s more than just paperwork; it’s the roadmap for a successful and secure lending relationship.

Diving Deep into Non-Recourse Loan Agreements

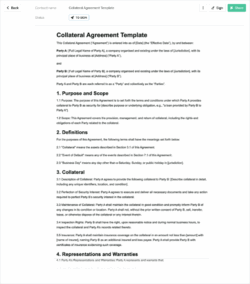

A non-recourse loan agreement is a legally binding document that specifies the terms and conditions of a loan where the lender’s recourse is limited to the collateral securing the loan. This means that if the borrower defaults, the lender can only seize and sell the collateral; they cannot pursue the borrower’s other assets or income. The agreement needs to be meticulously drafted to clearly define the rights and obligations of both parties. It’s a delicate balance of protecting the lender’s investment while providing a degree of financial security for the borrower.

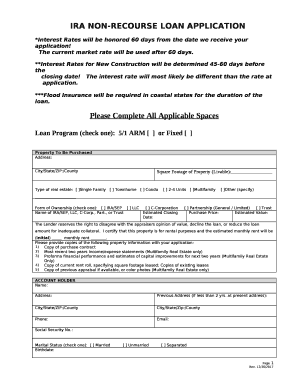

One of the most important sections of a non-recourse loan agreement is the definition of the collateral. The agreement must clearly identify the specific asset or assets that are securing the loan. This description should be detailed and unambiguous to avoid any confusion in case of default. For instance, if the collateral is a property, the agreement should include the legal address, property identification number, and any other relevant details.

The agreement will also outline the loan amount, interest rate, repayment schedule, and any fees associated with the loan. It’s crucial for the borrower to carefully review these terms and ensure they fully understand their financial obligations. The interest rate on a non-recourse loan is often higher than a traditional loan to compensate the lender for the increased risk. The repayment schedule should be structured in a way that is manageable for the borrower, taking into account their cash flow and financial projections.

Furthermore, the agreement must address the events of default. This section outlines the circumstances under which the lender can declare the loan to be in default and initiate foreclosure proceedings. Common events of default include failure to make timely payments, breach of covenants, and insolvency. It’s important for the borrower to understand these provisions and take steps to avoid any situations that could trigger a default.

Finally, a non-recourse loan agreement should include provisions for dispute resolution. This section outlines the process for resolving any disagreements between the borrower and the lender. Common methods of dispute resolution include mediation, arbitration, and litigation. Choosing a fair and efficient method of dispute resolution can save both parties time and money in the long run. Using a non recourse loan agreement template can save time and money to create the legal document.

Key Considerations When Using a Non Recourse Loan Agreement Template

While a non recourse loan agreement template can be a great starting point, it’s absolutely essential to remember that it’s just a template. Every loan situation is unique, and a one-size-fits-all approach simply won’t cut it. You need to tailor the template to your specific circumstances, ensuring that it accurately reflects the agreement between you and the lender. Ignoring this step could lead to serious legal and financial consequences down the road.

First, thoroughly review the template to understand each clause and provision. Don’t hesitate to seek legal advice if you’re unsure about anything. Pay close attention to the sections on collateral, events of default, and dispute resolution. These are often the most contentious areas, and it’s crucial to have a clear understanding of your rights and obligations.

Next, make sure that the template accurately reflects the specific terms of your loan. Are the loan amount, interest rate, and repayment schedule correct? Is the collateral adequately described? Are there any unique provisions that need to be added? Don’t assume that the template is perfect; double-check everything to ensure accuracy.

Consider adding clauses that address potential future scenarios. What happens if the collateral is damaged or destroyed? What happens if the borrower wants to sell the collateral? What happens if there’s a change in ownership of the borrowing entity? Addressing these issues upfront can help prevent disputes later on.

Finally, remember that a non recourse loan agreement template is not a substitute for legal advice. Before signing any loan agreement, it’s always a good idea to have it reviewed by an experienced attorney. An attorney can help you identify any potential risks or pitfalls and ensure that your interests are adequately protected. They can also help you negotiate more favorable terms with the lender.

This type of loan provides a level of security to the borrower that traditional loans simply cannot offer. Understanding the mechanics and benefits is key to making informed financial decisions.

Remember, every financial situation is unique. Seek professional guidance to ensure you’re making the best choice for your specific needs. Don’t be afraid to ask questions, do your research, and arm yourself with knowledge.