Ever committed to something, paid upfront, and then life threw a curveball? Suddenly, that pottery class you were so excited about just doesn’t fit into your schedule anymore, or that website design project you commissioned needs to be put on hold indefinitely. That’s where a non refundable payment agreement comes in handy for both the service provider and the client. It’s all about setting clear expectations from the start, ensuring everyone is on the same page regarding payment terms and what happens if things don’t go exactly as planned.

These agreements aren’t designed to be unfair; instead, they aim to protect businesses and individuals who invest time, resources, or incur expenses upfront based on a commitment from a client. Think of it as a way to cover initial costs or secure a spot in a limited-capacity program. They provide a framework for managing financial risk and offer peace of mind to those providing goods or services. It’s about establishing a fair exchange and mitigating potential losses if the agreement is terminated early.

So, what exactly is included in a non refundable payment agreement, and why would you need one? We’ll break down the key components, explore different scenarios where it’s beneficial, and offer some helpful tips for creating a solid agreement that protects everyone involved. Think of this as your guide to navigating the world of non refundable payments with confidence and clarity, ensuring you understand your rights and obligations before committing to a transaction.

Understanding Non Refundable Payment Agreements: A Detailed Look

At its core, a non refundable payment agreement is a legally binding document that outlines the terms and conditions under which a payment is considered non refundable. This means that once the payment is made, it will not be returned to the payer, even if the goods or services are not ultimately received or used as originally anticipated. It’s a crucial tool for businesses and individuals who need to protect their investments and ensure they are compensated for their time, effort, and resources.

These agreements aren’t just a formality; they play a significant role in setting clear expectations and managing risk. For example, imagine a photographer who books a wedding shoot six months in advance. They block off that date, turn down other potential clients, and invest time in pre-wedding consultations and planning. If the wedding is canceled at the last minute, a non refundable retainer fee helps compensate the photographer for the lost income and time invested. Similarly, a software developer might require a non refundable deposit to cover the initial costs of development and secure their commitment to the project.

The key to a valid and enforceable non refundable payment agreement is transparency and mutual consent. Both parties must understand the terms and conditions of the agreement and agree to them willingly. This means the agreement should be written in clear, concise language, avoiding legal jargon that could be confusing or misinterpreted. It should also explicitly state that the payment is non refundable and explain the circumstances under which this policy applies. Ambiguity can lead to disputes and invalidate the agreement.

Furthermore, it’s essential to ensure that the agreement is fair and reasonable. While non refundable payments are generally enforceable, courts may scrutinize agreements that are deemed overly harsh or unconscionable. For instance, a non refundable payment for a service that is never provided at all might be considered unfair. The agreement should also outline any exceptions to the non refundable policy, such as in cases of unforeseen circumstances or breaches of contract by the service provider.

In essence, a well-drafted non refundable payment agreement is a powerful tool for protecting your interests and setting clear expectations. It fosters trust and transparency between parties, minimizing the risk of disputes and ensuring that everyone is on the same page. By understanding the key components and principles of these agreements, you can confidently enter into transactions knowing your rights and obligations are clearly defined.

Situations Where a Non Refundable Payment Agreement Template is Essential

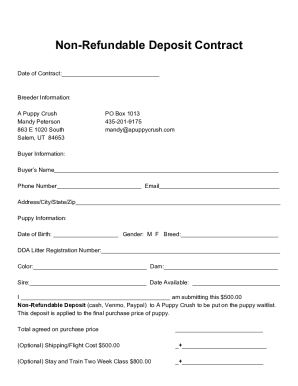

There are many different contexts where using a non refundable payment agreement template is highly recommended, if not essential. These situations generally involve scenarios where the provider incurs significant upfront costs, commits to a specific timeline, or foregoes other opportunities based on the client’s commitment.

Consider the realm of event planning. Event planners often require non refundable deposits to secure venues, book entertainment, and manage other logistical arrangements. These deposits help cover the planner’s initial expenses and compensate them for the time and effort involved in planning the event. Similarly, caterers may require non refundable payments to purchase ingredients and prepare for the event, ensuring they are not left with unsold food if the event is canceled.

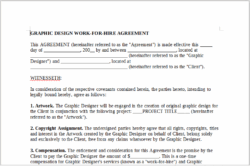

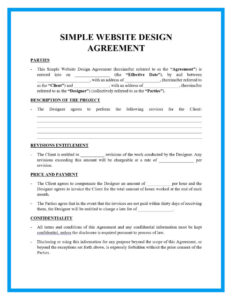

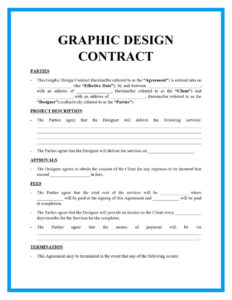

Another common scenario is in the realm of creative services. Graphic designers, web developers, and photographers often require non refundable payments to cover their initial consultation, design work, and setup costs. This protects them from losing time and resources on projects that are ultimately canceled or abandoned. It also ensures that they are compensated for their creative efforts, even if the final product is not ultimately used.

Educational institutions and training programs also frequently use non refundable payment agreements. Enrollment fees for courses, workshops, and retreats are often non refundable to cover the costs of instructors, materials, and facilities. This policy helps ensure that the program can operate effectively and that resources are not wasted on students who drop out early. It allows the program to plan effectively based on confirmed enrollment numbers.

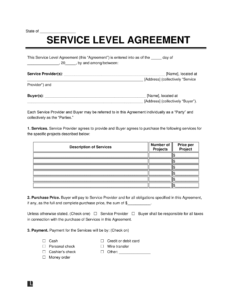

Beyond these specific examples, any situation where a provider invests significant time, resources, or incurs expenses upfront based on a client’s commitment could benefit from a non refundable payment agreement. This could include consulting services, coaching programs, custom-made products, or any other scenario where the provider needs to protect their investment and ensure they are compensated for their efforts. Using a non refundable payment agreement template can help ensure that all the necessary terms and conditions are clearly outlined and legally enforceable.

In short, employing a non refundable payment agreement template is a smart move for businesses and individuals who need to safeguard their investments, secure commitments, and manage risk. It’s about setting clear expectations and ensuring that everyone is on the same page from the outset. A non refundable payment agreement template makes sure that you are protected in the event that something does not go according to plan.

Ultimately, clear communication and a well-defined agreement protect both parties involved in a transaction. It helps avoid misunderstandings and ensures everyone is aware of their rights and responsibilities.

By using a non refundable payment agreement template, you are taking a proactive step towards managing expectations and fostering a positive working relationship. This can help build trust and ensure a smooth and successful outcome for everyone involved.