So, you’re thinking about buying a business? Or maybe you’re selling? Either way, congratulations! It’s a big step, and one that requires careful planning and, most importantly, a solid offer to purchase business agreement template. Think of it like this: you wouldn’t build a house without a blueprint, right? Similarly, buying or selling a business needs a legally sound foundation, and that’s where this template comes in.

But let’s be honest, legal documents can be intimidating. All those clauses, sub-clauses, and legal jargon can make your head spin faster than a roulette wheel. The good news is, it doesn’t have to be that way. With the right offer to purchase business agreement template and a little bit of guidance, you can navigate the process with confidence, ensuring a smooth and successful transaction for everyone involved.

This article aims to demystify the offer to purchase business agreement template, walking you through its key components and providing insights into how to use it effectively. We’ll explore what it covers, why it’s essential, and how to tailor it to your specific needs. By the end, you’ll be well-equipped to draft, understand, and negotiate an offer that protects your interests and sets the stage for a thriving business venture.

Understanding the Offer to Purchase Business Agreement Template: A Deep Dive

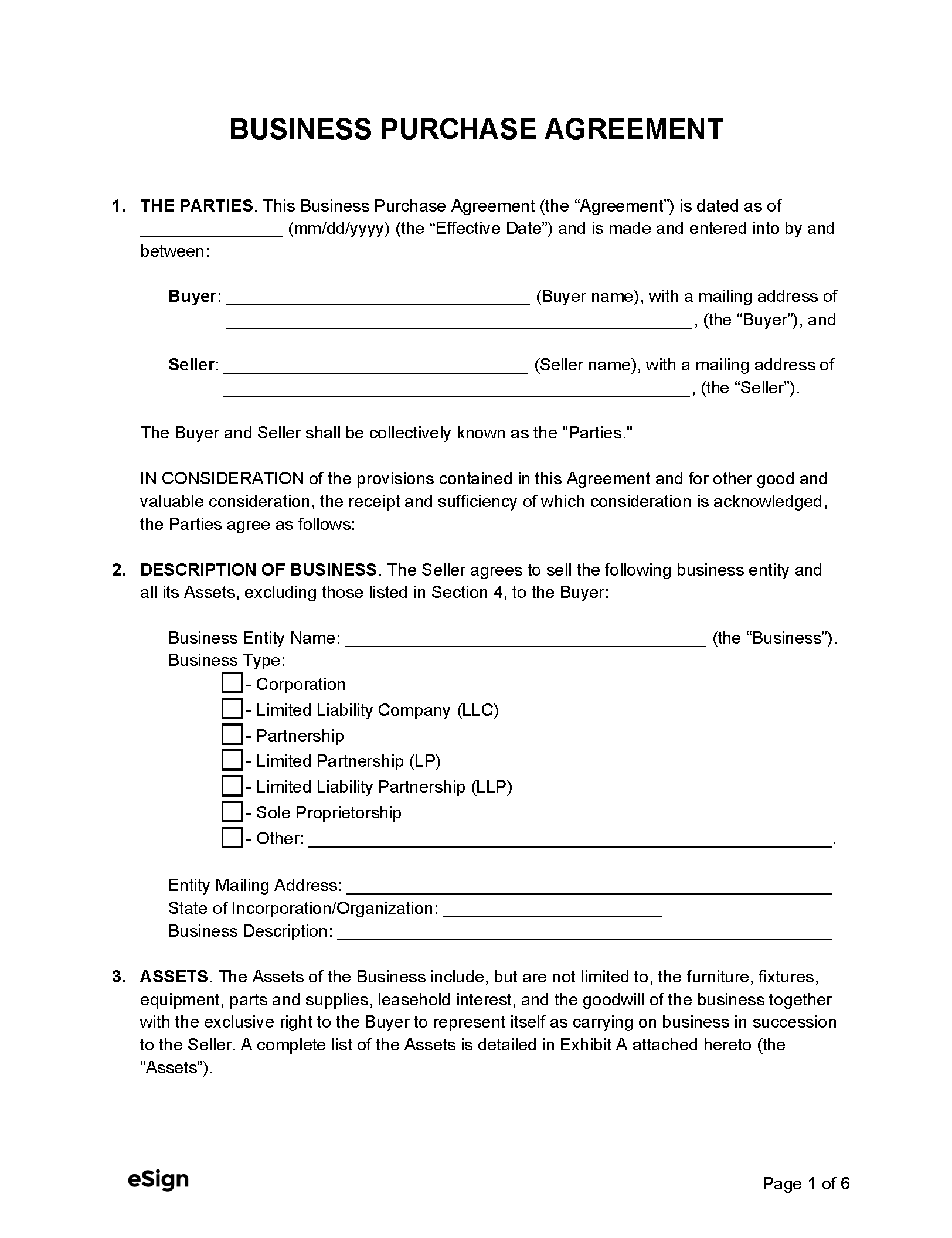

The offer to purchase business agreement template is essentially a formal proposal from a potential buyer to a seller, outlining the terms and conditions under which the buyer is willing to acquire the business. It’s a critical document because it lays the groundwork for the entire sale process. It is not a final sales agreement, but an offer to create one. Once signed by both parties, it becomes a binding letter of intent or contract depending on the specific wording and intent of the document.

Think of it as the first dance in a delicate negotiation. It sets the tone, defines the playing field, and establishes the key points of discussion. A well-crafted offer demonstrates seriousness, professionalism, and a clear understanding of the business being acquired. Conversely, a poorly written offer can be easily rejected, potentially jeopardizing the entire deal. It’s crucial that both the buyer and the seller understand each section of the agreement before signing.

So, what exactly goes into this crucial document? While specific templates may vary, most include standard sections, such as the identification of the parties involved (buyer and seller), a detailed description of the business being purchased (including assets, liabilities, and intellectual property), the proposed purchase price and payment terms (including any financing contingencies), the closing date (the date when ownership officially transfers), and any conditions precedent (things that must happen before the sale can proceed). Each of these points requires careful consideration and clear articulation to avoid future disputes.

Furthermore, a comprehensive offer to purchase business agreement template will also address due diligence. This section typically outlines the buyer’s right to review the business’s financial records, contracts, and other relevant documents to verify the accuracy of the information provided by the seller. It’s a critical step in mitigating risk and ensuring the buyer is making an informed decision. The time allowed for due diligence and the scope of the investigation should be clearly defined in the agreement.

Finally, the agreement should address issues such as confidentiality, non-compete agreements, and any representations and warranties made by the seller. These clauses provide additional protection for the buyer and help to ensure a fair and transparent transaction. For instance, a non-compete agreement prevents the seller from opening a competing business in the same geographic area for a specified period of time. All these details, when properly addressed in an offer to purchase business agreement template, safeguard all parties involved in the transaction.

Key Considerations When Using an Offer to Purchase Business Agreement Template

While an offer to purchase business agreement template provides a solid framework, it’s not a one-size-fits-all solution. Every business is unique, and the template should be tailored to reflect the specific circumstances of the transaction. Simply filling in the blanks without careful consideration can lead to misunderstandings, disputes, and even legal complications down the road.

One crucial consideration is the valuation of the business. The purchase price should be based on a thorough assessment of the business’s assets, liabilities, and future earning potential. Factors such as market conditions, industry trends, and the overall economic climate can also influence the valuation. Consider using a professional valuation service to ensure a fair and accurate price is determined. A realistic and well-supported valuation can greatly improve the chances of the offer being accepted.

Another important aspect is the structure of the deal. Will the buyer be purchasing the assets of the business, or the entity itself? This decision can have significant tax implications for both parties, so it’s essential to consult with a tax advisor to determine the most advantageous structure. Additionally, the form of payment should be clearly defined, whether it’s cash, stock, or a combination of both. Any financing contingencies should also be clearly outlined, specifying the amount of financing the buyer needs to secure and the timeframe for obtaining it.

Furthermore, pay close attention to the representations and warranties made by the seller. These are assurances about the accuracy of the information provided about the business. For example, the seller might warrant that the financial statements are accurate, that the business is in compliance with all applicable laws and regulations, and that there are no undisclosed liabilities. If these representations and warranties turn out to be false, the buyer may have recourse against the seller.

Finally, don’t underestimate the importance of seeking professional advice. Consulting with an attorney experienced in business acquisitions can help you navigate the complexities of the offer to purchase business agreement template and ensure that your interests are protected. They can review the template, identify potential risks, and negotiate favorable terms on your behalf. Investing in professional guidance can save you time, money, and headaches in the long run.

The entire process of buying or selling a business can seem daunting at first. However, with careful planning, thorough due diligence, and a well-crafted offer to purchase business agreement template, you can successfully navigate the complexities and achieve your desired outcome.

Ultimately, taking the time to understand the nuances of this agreement is an investment in your future success. By prioritizing clarity, accuracy, and professional guidance, you can create a solid foundation for a thriving business venture.