Need to lend or borrow money without all the legal fuss? Let’s be honest, wading through mountains of paperwork is nobody’s idea of a good time. That’s where a one page loan agreement template comes in handy. It’s a simplified, streamlined way to document a loan, making sure everyone’s on the same page (literally!) without getting bogged down in unnecessary jargon. Think of it as a handshake agreement, but with a little more… well, agreement.

We’ve all been there, right? Lending money to a friend or family member, or maybe borrowing a little ourselves. While trust is important, having a written record protects both parties. A clear and concise agreement minimizes the risk of misunderstandings down the line and helps maintain good relationships. No one wants a loan turning into a source of awkwardness at Thanksgiving dinner.

So, if you’re looking for a quick and easy way to formalize a loan, you’re in the right place. We’re going to explore the benefits of using a one page loan agreement template, what to include, and why it’s a smarter move than relying on just a verbal promise. Let’s dive in and make this whole loan process a whole lot simpler.

Why Choose a One Page Loan Agreement? Simplicity and Clarity

The beauty of a one page loan agreement lies in its simplicity. Traditional loan agreements can be lengthy and filled with legal terminology that can be difficult to understand. This can be intimidating for both the lender and the borrower. A one page template cuts through the complexity, presenting the essential information in a clear and concise manner. This makes it easier for everyone to understand their rights and responsibilities.

Imagine trying to explain a complex, multi page document to a friend who just needs a small loan to cover a car repair. Their eyes might glaze over, and you might both end up feeling more stressed than necessary. A one page loan agreement avoids this scenario by focusing on the core elements of the loan, such as the principal amount, interest rate (if any), repayment schedule, and any collateral involved. It is also quick to draft and be on your way instead of thinking for hours.

Furthermore, a streamlined agreement saves time and resources. Legal fees can be expensive, and drafting a custom loan agreement from scratch can be a time-consuming process. A one page template provides a cost-effective and efficient solution, allowing you to document the loan quickly and easily. The time you save can be spent on more important things, like actually helping your friend fix their car!

The clear structure minimizes the potential for disputes. By clearly outlining the terms of the loan in a simple and easy to understand format, you reduce the risk of misunderstandings or disagreements later on. This can help maintain good relationships and prevent legal complications. When things are written in understandable terms everyone can have the same idea of the written statement.

While a one page loan agreement may not be suitable for every situation (complex commercial loans, for example, may require more detailed agreements), it’s an excellent option for personal loans, small business loans, or any situation where simplicity and clarity are paramount. Choosing a one page template does not mean you are choosing less quality or that the document is not legally enforcable.

Essential Elements of a One Page Loan Agreement

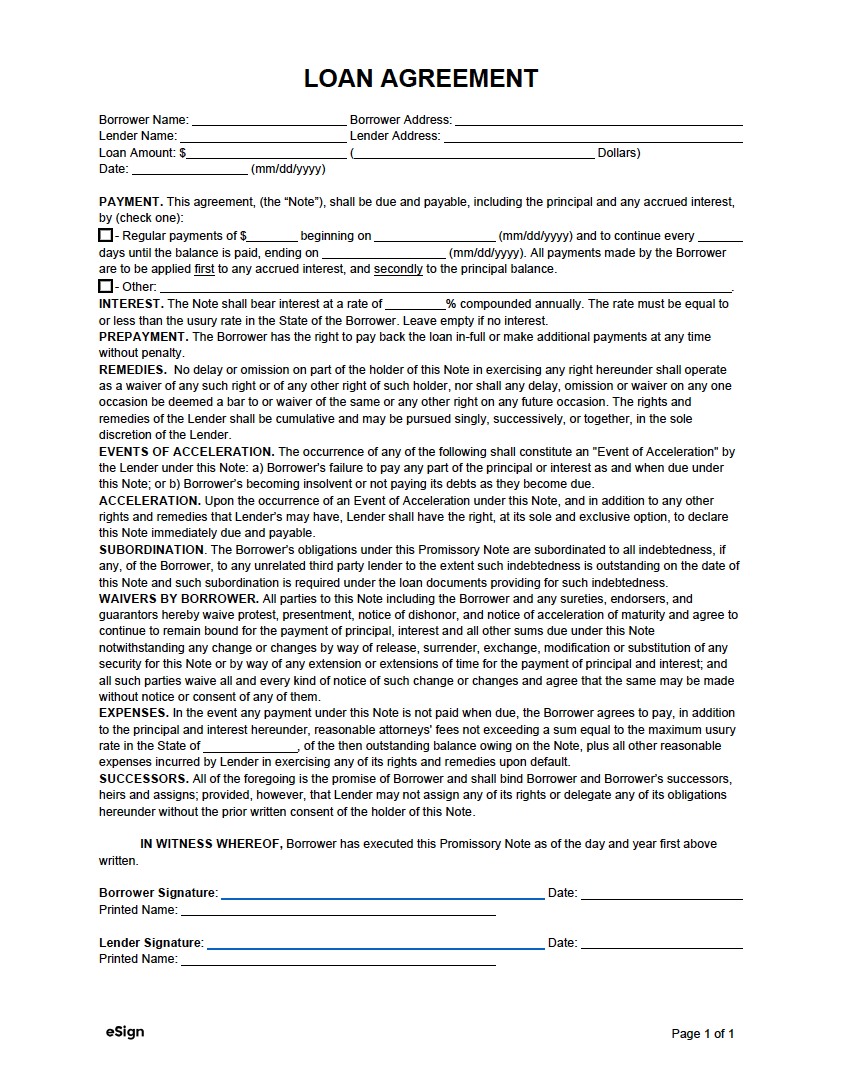

A good one page loan agreement template should include several key elements to ensure clarity and enforceability. First and foremost, it needs to clearly identify the parties involved: the lender (the person or entity providing the loan) and the borrower (the person or entity receiving the loan). Include their full legal names and addresses to avoid any confusion.

Next, specify the principal amount of the loan – the exact amount of money being lent. State the currency as well (e.g., US dollars, Euros). It’s also crucial to clearly define the interest rate, if any, and how it will be calculated. Will it be a fixed rate or a variable rate? Include details on how often the interest will be compounded (e.g., monthly, annually).

The repayment schedule is another critical element. Outline the amount of each payment, the frequency of payments (e.g., weekly, monthly), and the due date for each payment. Specify the method of payment (e.g., check, electronic transfer) and where the payments should be sent. The agreement should also address what happens if a payment is late or missed.

If the loan is secured by collateral (an asset that the lender can seize if the borrower defaults), clearly describe the collateral in detail. Include its make, model, serial number, or any other identifying information. State the conditions under which the lender can seize the collateral in the event of default. What would happen if the payment is late? How many payments can be missed before it defaults?

Finally, the agreement should include clauses addressing default, governing law, and dispute resolution. A default clause outlines what constitutes a default on the loan and what remedies the lender has in the event of a default. The governing law clause specifies which jurisdiction’s laws will govern the agreement. The dispute resolution clause outlines how any disputes will be resolved (e.g., through mediation or arbitration). Ensure that both the lender and the borrower sign and date the agreement to signify their consent.

A one page loan agreement template offers a convenient way to document a loan. It’s a great starting point for creating a document that protects both the lender and the borrower while keeping things simple.

It’s important to remember that while a one page loan agreement template is a helpful tool, it may not be suitable for all situations. Consult with a legal professional if you have any doubts or if the loan involves complex terms or significant amounts of money.