Ever been in a situation where you need to solidify a payment arrangement for a service rendered or a product sold? Maybe you’re a freelancer, a small business owner, or even just selling something online to an individual. That’s where a one time payment agreement template comes in handy. It’s a simple yet effective way to document the terms of a single payment, ensuring both parties are on the same page and reducing the risk of future misunderstandings or disputes. Think of it as a friendly handshake, but in writing. This agreement clarifies what is being paid for, the amount, the payment date, and any other relevant details that provide clarity and protection for everyone involved.

The beauty of using a one time payment agreement template lies in its straightforward nature. You don’t need to be a legal expert to draft one. These templates provide a basic framework that you can customize to fit your specific needs. They help you avoid ambiguity and potential disagreements by clearly outlining the payment terms. In essence, it’s a contract that protects both the payer and the payee, ensuring a smooth and transparent transaction. By formalizing the payment, you establish a record that can be useful for accounting, tax purposes, or in the unlikely event of a dispute.

In the following sections, we’ll delve deeper into the key components of a one time payment agreement template and explore how to effectively use it. We’ll also discuss situations where it’s particularly beneficial and offer tips for ensuring it accurately reflects your specific agreement. So, whether you’re selling your old guitar, providing a one-off consulting service, or anything in between, understanding how to use a one time payment agreement template can be a valuable asset.

Understanding the Core Elements of a One Time Payment Agreement Template

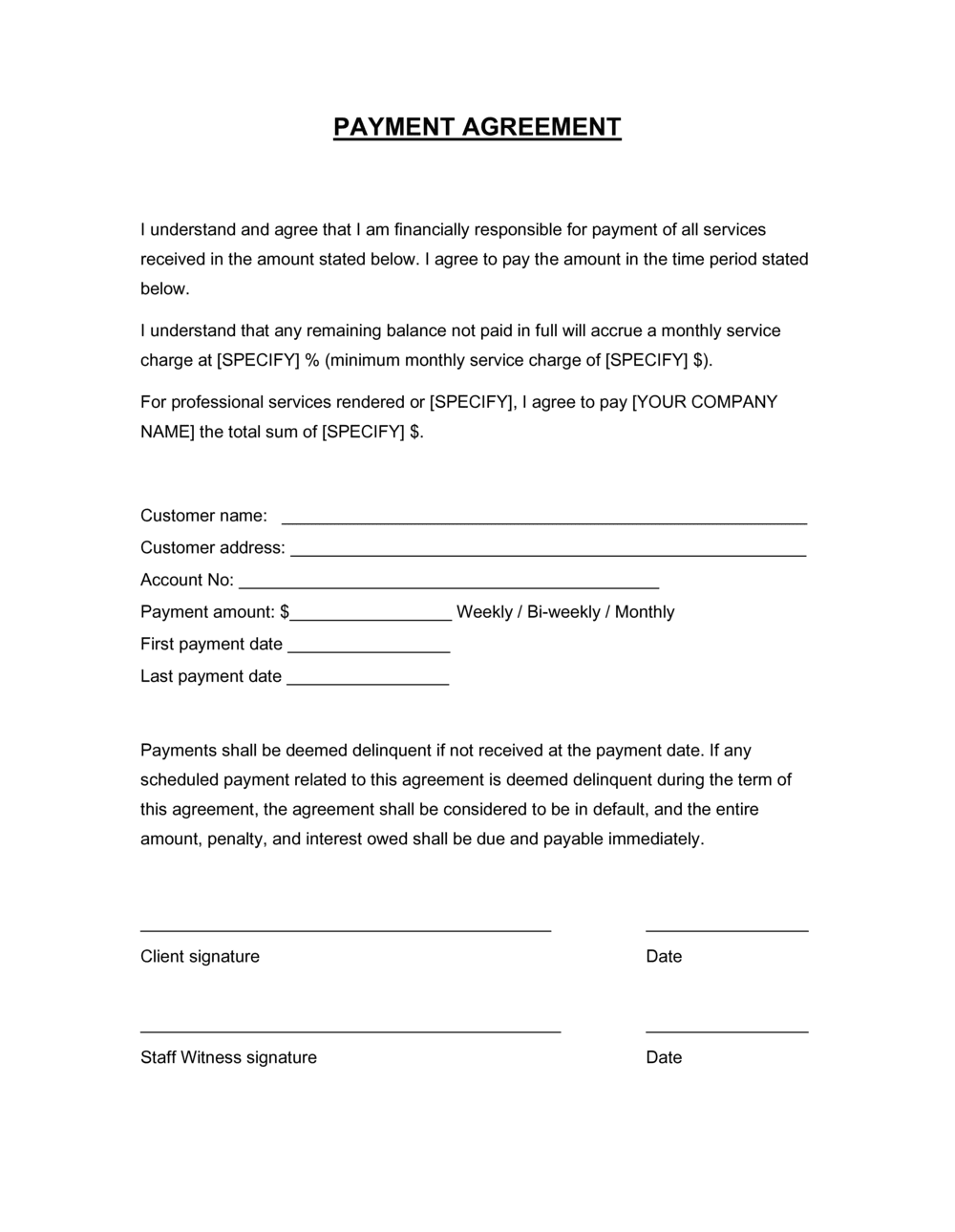

A solid one time payment agreement template consists of several essential components that clearly define the terms of the transaction. These components work together to create a legally sound and easily understandable document. Let’s break down each element to give you a comprehensive overview.

Firstly, the agreement must clearly identify the parties involved. This includes the full legal names and addresses of both the payer (the person making the payment) and the payee (the person receiving the payment). Accurate identification is crucial for ensuring the agreement is enforceable and that there is no confusion about who is bound by its terms. A well-drafted agreement will leave no doubt as to the identity of each party.

Secondly, the agreement should clearly describe the goods or services being provided in exchange for the payment. Be as specific as possible to avoid any ambiguity. If you’re selling a product, include its make, model, and any relevant specifications. If you’re providing a service, describe the scope of the service in detail. For example, instead of writing “consulting services,” specify “one-time consulting services regarding marketing strategy development.” The more specific you are, the less room there is for misunderstanding.

Thirdly, the agreement needs to explicitly state the agreed-upon payment amount and the due date. This is perhaps the most crucial element of the entire agreement. Ensure that the payment amount is clearly stated in both numerical and written form (e.g., “$1,000.00” and “One Thousand United States Dollars”). The due date should also be clearly stated, using a specific date (e.g., “November 15, 2024”). Consider adding a clause addressing late payment fees or penalties, if applicable.

Finally, the agreement should include sections for both parties to sign and date. Signatures serve as evidence that both parties have read, understood, and agreed to the terms of the agreement. The date of signing is also important, as it establishes the effective date of the agreement. Consider including a clause stating the governing law (i.e., which state’s laws will govern the agreement in the event of a dispute) and a clause addressing dispute resolution (e.g., mediation or arbitration).

Optional Clauses to Consider

While the core elements are essential, you might also consider adding optional clauses to address specific situations. For example, you could include a confidentiality clause if the agreement involves sensitive information. You could also include a clause addressing cancellation or termination of the agreement, specifying the conditions under which either party can terminate the agreement before the payment is made. Remember, customization is key to ensuring the one time payment agreement template meets your specific needs.

When is a One Time Payment Agreement Template Most Useful?

A one time payment agreement template isn’t just a formality; it’s a valuable tool for various scenarios. It’s most beneficial when you need to document a specific payment arrangement for a service or product without establishing an ongoing relationship. Think of situations like freelance work, a single sale of goods, or a one-off consulting engagement. In these instances, a comprehensive contract might be overkill, but a simple agreement is essential to ensure clarity and protect your interests.

Consider a freelance graphic designer who is hired to create a logo for a client. A one time payment agreement template would clearly outline the scope of work (logo design), the payment amount, and the deadline for completion. This agreement helps prevent misunderstandings about the number of revisions included or the delivery format of the final logo. Without it, the designer might end up spending extra time and effort addressing unexpected requests, while the client might be dissatisfied with the final product.

Another scenario where this type of agreement is extremely useful is in the sale of goods between individuals. Imagine you’re selling your used car online. A one time payment agreement template can document the agreed-upon price, the payment method, and the date of transfer of ownership. This protects both you and the buyer by establishing a clear record of the transaction and preventing potential disputes about the terms of the sale.

Furthermore, one time payment agreements are also beneficial in consulting services where a fixed fee is charged for a specific project. A consultant hired to provide a single training session, for example, can use this type of agreement to specify the content of the training, the payment amount, and the date of the session. This avoids confusion about the scope of the consultant’s responsibilities and ensures they are compensated fairly for their time and expertise.

In essence, a one time payment agreement template provides a simple, legally sound way to document a specific payment arrangement, regardless of the type of goods or services involved. By clearly outlining the terms of the transaction, it helps prevent misunderstandings, protects your interests, and ensures a smooth and transparent payment process. Whether you’re a freelancer, a small business owner, or simply selling something online, this type of agreement can be a valuable asset.

Crafting a clear understanding from the beginning can save potential headaches down the road. A straightforward agreement sets the stage for a positive interaction.

By taking the time to document payment terms, you ensure fair compensation for your work or goods. This also fosters trust and transparency between parties.