So, you’re starting a single member LLC? Congratulations! That’s a fantastic step towards protecting your personal assets and giving your business a more professional structure. But before you jump headfirst into the world of entrepreneurship, there’s a crucial document you need to consider: the operating agreement. Think of it as the constitution for your one-person company. It might seem daunting, but it’s really there to help you lay out the groundwork for how your LLC will operate. Don’t worry; it’s not as complicated as it sounds, and using an operating agreement template for single member llc can make the process significantly easier.

Many people starting a single-member LLC wonder if an operating agreement is really necessary. After all, it’s just you, right? You’re the boss, the employee, and everything in between! While it might seem like an extra step, creating an operating agreement template for single member llc provides several key benefits. It formalizes the separation between you and your business, which can be vital in protecting your personal assets from business debts and liabilities. It also helps clarify how profits and losses are handled and sets the stage for potential future changes, like adding members or selling the business.

This document isn’t just about fulfilling legal requirements; it’s about providing clarity and a roadmap for your business. It’s also useful when opening a business bank account, securing loans, or even just showing potential clients that you’re serious about your business. In essence, an operating agreement for a single-member LLC demonstrates that you’ve taken the time to carefully consider how your business operates, which can build trust and credibility. Let’s dive into why this document is so important and how you can create one that works for you.

Why You Need an Operating Agreement for Your Single Member LLC

Even though you are the sole owner and operator of your LLC, having an operating agreement serves several crucial purposes. The most significant of these is establishing the separation between your personal assets and your business assets. This separation is the core principle behind forming an LLC in the first place. Without a formal agreement outlining this separation, you risk losing the liability protection that the LLC provides. If your business is sued or incurs debt, a well-written operating agreement can help shield your personal savings, home, and other possessions from being seized to cover those obligations.

Think of your operating agreement as a shield. It proves to creditors, lenders, and even the courts that your LLC is a separate entity from you, the individual. This is especially important in cases where your business dealings might be challenged. A solid operating agreement can be the difference between losing your personal assets and protecting them. It also shows that you’re running your business professionally and that you’ve taken the time to establish a solid foundation.

Beyond liability protection, an operating agreement also clarifies how profits and losses are allocated. While it might seem obvious that all profits and losses go to you in a single-member LLC, documenting this in the agreement prevents any potential future confusion. It sets the stage for tax purposes and provides a clear record of how your business operates financially.

Furthermore, an operating agreement can address what happens to your LLC if you become incapacitated or pass away. This is especially important for ensuring the continuity of your business and providing clear instructions for your heirs. The agreement can specify who will manage the LLC in your absence and how the business will be transferred or dissolved.

Finally, creating an operating agreement helps you think through the details of your business operations. It forces you to consider issues like your business purpose, the location of your business, and how decisions will be made. This proactive planning can help you avoid potential problems down the road and ensure that your business runs smoothly from the start. Using an operating agreement template for single member llc makes this process straightforward.

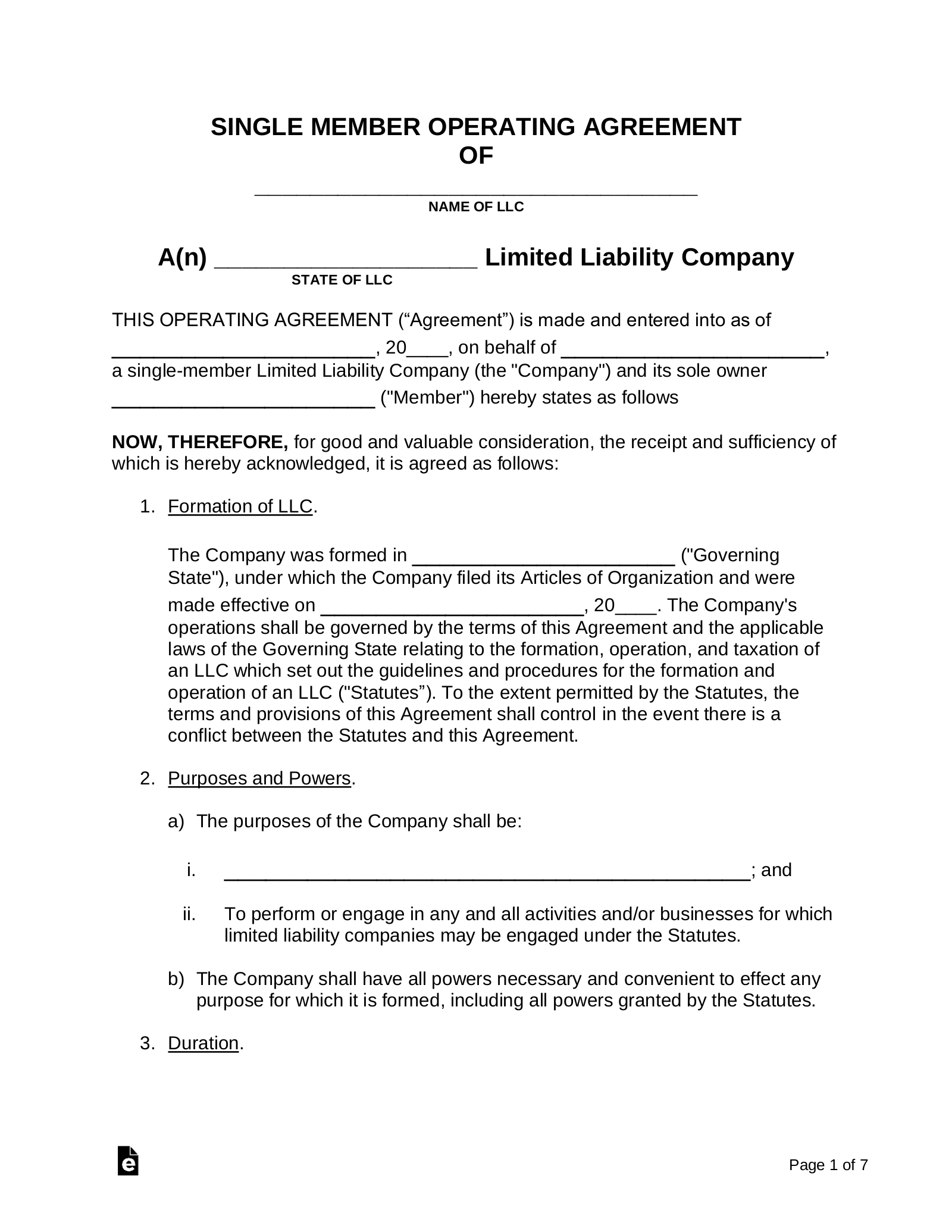

Key Components of a Single Member LLC Operating Agreement

While the specific content of your operating agreement may vary depending on your business and your individual circumstances, there are several key components that should be included in every operating agreement template for single member llc. These components provide a comprehensive overview of your business and its operations.

First and foremost, your operating agreement should clearly state the name of your LLC and its principal place of business. This establishes the legal identity and location of your business. It should also include a statement of purpose, outlining the specific business activities your LLC will engage in. This statement should be broad enough to allow for future growth and diversification, but specific enough to clearly define your business.

The agreement should also detail the ownership structure of the LLC, stating that you are the sole member and owner. It should outline your rights and responsibilities as the owner, including your authority to make decisions and manage the business. This section also typically covers the contribution of capital to the LLC. While you might not be investing a significant amount of money upfront, this section clarifies that you, as the member, have contributed capital to the business. It may specify the form of contribution (cash, property, services) and the initial value.

Another crucial component is the section on management and operations. This section details how the LLC will be managed and who has the authority to make decisions. In a single-member LLC, this is straightforward: you, as the owner, have complete control over the business. However, this section can also address specific operational procedures and guidelines, such as how contracts will be signed, how bank accounts will be managed, and how records will be maintained.

Finally, your operating agreement should include provisions for amendments, dissolution, and governing law. The amendment section outlines the process for making changes to the agreement in the future. The dissolution section specifies the circumstances under which the LLC will be dissolved and how its assets will be distributed. The governing law section states which state’s laws will govern the interpretation and enforcement of the agreement. It’s generally the state where the LLC was formed.

Creating this document is about planning ahead, addressing potential issues, and formalizing the structure of your business. It provides clarity, protection, and a solid foundation for your single-member LLC.

This formal document ensures that your business is treated as a separate entity, which can have significant legal and financial benefits down the line. It’s a small investment of time that can pay off big in the long run.