Ever dreamt of owning that charming little cottage by the lake, but aren’t quite ready to commit fully? Or maybe you’re a business owner eyeing a prime piece of real estate but need some time to secure financing? That’s where an option to purchase agreement can be a real game-changer. Think of it as a “right of first refusal” for a specific property, giving you the exclusive opportunity to buy it within a certain timeframe. It’s like putting a hold on your dream, giving you breathing room to make the best decision for your future.

This type of agreement isn’t just for personal use, either. Businesses often use option to purchase agreements to secure potential expansion locations or to evaluate the viability of a new venture before investing heavily in property. It provides a strategic advantage, allowing you to assess all angles before making a significant financial commitment. Understanding the ins and outs of such an agreement is crucial to ensuring a smooth and beneficial transaction.

So, where do you start? Crafting a solid option to purchase agreement can seem daunting. Luckily, there’s a readily available solution that simplifies the process: an option to purchase agreement template. Using a template not only saves you time and effort but also ensures that all essential legal aspects are covered, protecting your interests throughout the option period. Let’s dive into what these agreements entail and how you can leverage them to your advantage.

Understanding Option to Purchase Agreements

At its core, an option to purchase agreement is a legally binding contract where a property owner (the “grantor” or “seller”) grants a potential buyer (the “grantee” or “buyer”) the exclusive right, but not the obligation, to purchase a specific property at a predetermined price within a specified period. In exchange for this right, the buyer typically pays the seller a non-refundable option fee or option money. This fee compensates the seller for taking the property off the market during the option period and for the potential loss of other opportunities.

Think of it like this: you’re essentially paying for the privilege to “think about” buying the property. If, during the option period, you decide that the property isn’t right for you, you can simply walk away, forfeiting the option fee, but without any further obligation to purchase. Conversely, if you decide to exercise your option, the agreed-upon purchase price and terms, which are outlined in the agreement, will then govern the actual sale of the property.

The option period is a critical element of the agreement. It’s the timeframe during which the buyer has the exclusive right to purchase the property. The length of this period can vary depending on the circumstances, but it’s typically long enough for the buyer to conduct due diligence, secure financing, and assess the property’s suitability for their needs. During this time, the seller cannot sell the property to anyone else.

It’s also important to understand the distinction between an option to purchase and a purchase agreement. A purchase agreement obligates the buyer to buy the property, while an option to purchase only grants the right to buy. The buyer is not obligated to purchase the property if they choose not to exercise the option. This flexibility is one of the key advantages of an option to purchase agreement.

Before entering into an option to purchase agreement, it’s wise to consult with legal and financial professionals. They can help you understand the terms of the agreement, assess the risks and benefits, and ensure that the agreement protects your best interests. Remember, knowledge is power, especially when dealing with real estate transactions.

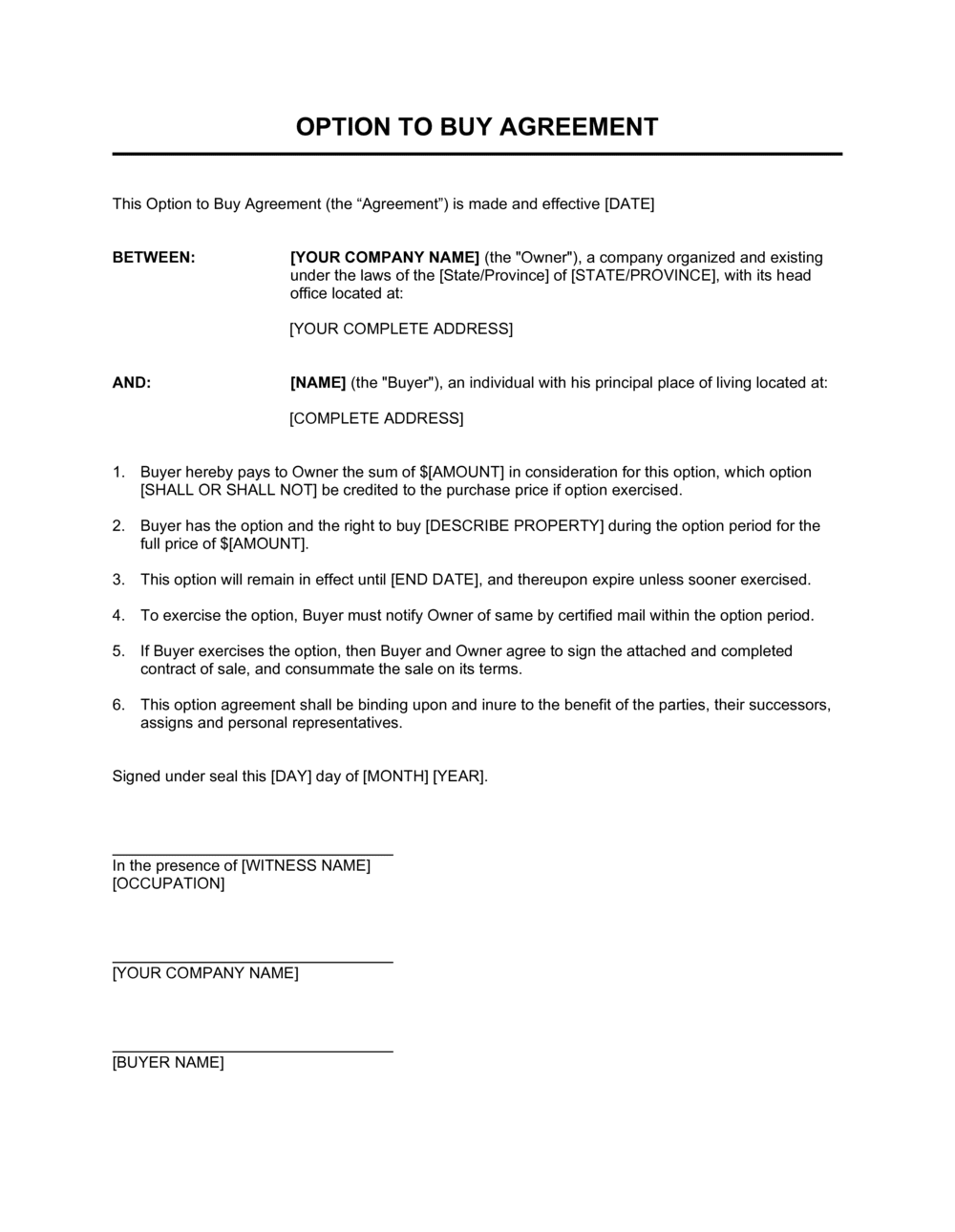

Key Components of an Option To Purchase Agreement Template

When you’re diving into an option to purchase agreement template, you’ll find several key components that are essential to clearly define the terms and protect all parties involved. First and foremost, the template will identify the parties. This includes the legal names and addresses of both the grantor (seller) and the grantee (buyer). Accuracy is crucial here to avoid any future disputes.

Next, the template will thoroughly describe the property in question. This description should be as detailed as possible, including the street address, legal description (often found on the property deed), and any included fixtures or personal property. A clear and unambiguous description prevents misunderstandings about what is actually being optioned.

The option fee, also known as option money, is a critical component. The template will specify the amount of the fee, how it is to be paid (e.g., certified check, wire transfer), and whether it is refundable or non-refundable. As mentioned earlier, this fee is typically non-refundable, compensating the seller for taking the property off the market.

The duration of the option period is another essential element. The template will clearly state the start and end dates of the option period, giving the buyer a specific timeframe to exercise their option. It’s crucial to adhere to these dates, as failure to exercise the option within the stipulated period will result in its expiration.

Finally, the option to purchase agreement template will outline the purchase price and terms of the potential sale. This includes the agreed-upon purchase price for the property, the method of payment (e.g., cash, financing), and any contingencies that must be met before the sale can be finalized. This section essentially lays out the framework for the future purchase agreement, should the buyer choose to exercise their option. Carefully reviewing and understanding all these components in an option to purchase agreement template will empower you to navigate this type of transaction with confidence.

An option to purchase agreement template can be a powerful tool, providing flexibility and control in real estate transactions. Whether you’re a prospective buyer or a property owner, understanding the key elements and using a well-drafted template can help you achieve your goals.

By carefully considering all aspects and seeking professional advice when needed, you can leverage this agreement to your advantage and pave the way for a successful outcome. An option to purchase agreement template can be your first step.