Navigating a job loss is tough, especially when you’re over 40. It’s a time filled with uncertainty, and the severance agreement presented to you can feel overwhelming. Don’t worry, you’re not alone! Understanding what a severance agreement is, and especially one tailored for individuals over 40, is crucial to protecting your rights and ensuring a smoother transition to your next chapter.

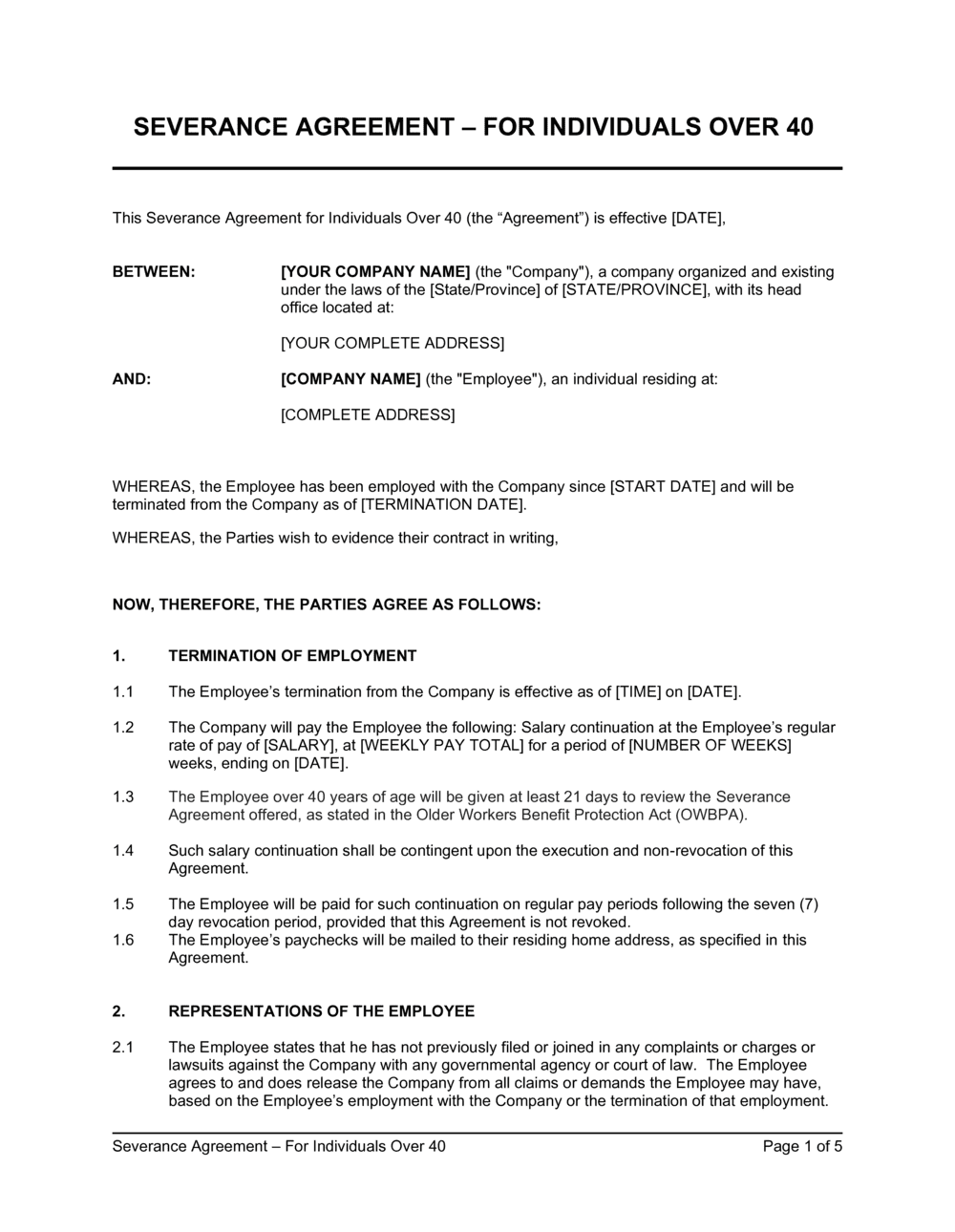

A severance agreement is essentially a contract between you and your former employer. In exchange for signing the agreement, which usually includes releasing the company from any potential legal claims, you receive certain benefits. These benefits can include things like severance pay, continued health insurance coverage, and outplacement services. However, it’s important to note that when you are over 40, federal law provides you with additional protections related to these agreements.

This article aims to break down the key elements of an over 40 severance agreement template, helping you understand your rights and empowering you to make informed decisions. We’ll explore the specific provisions to watch out for, the role of the Age Discrimination in Employment Act (ADEA), and provide practical advice to ensure you’re getting a fair deal. Knowledge is power, and when it comes to severance agreements, that power can translate into financial security and peace of mind.

Understanding Severance Agreements and the ADEA

When you’re over 40 and facing a job separation, the Age Discrimination in Employment Act (ADEA) plays a significant role in how severance agreements are handled. The ADEA protects individuals 40 years of age or older from employment discrimination based on age. This means that any severance agreement offered to someone in this age group must meet specific requirements to be considered valid and enforceable, particularly concerning the waiver of rights related to age discrimination.

One crucial aspect of ADEA compliance is the “knowing and voluntary” waiver requirement. This means you must fully understand the agreement and agree to its terms without any undue pressure or coercion. To ensure this, the ADEA mandates that the agreement is written in plain language, easily understandable by the average person. It must clearly state the rights you are waiving, including any potential claims under the ADEA. The agreement must also explicitly mention that you are waiving your right to sue for age discrimination.

Furthermore, the ADEA provides specific timeframes for consideration and revocation. Individuals over 40 are typically given at least 21 days to consider the severance agreement. If the severance is offered in connection with an exit incentive or other employment termination program offered to a group or class of employees, the consideration period extends to 45 days. After signing the agreement, you have a seven-day revocation period during which you can change your mind and cancel the agreement. This revocation period allows for a final review and consultation with an attorney if needed.

It’s also essential that the severance agreement provides something of value that you wouldn’t otherwise be entitled to. This is known as “consideration.” Simply receiving your final paycheck or accrued vacation time doesn’t constitute valid consideration. Instead, the severance agreement should offer benefits like severance pay beyond what’s legally required, continuation of health insurance coverage, outplacement services, or other benefits. This consideration is what makes the waiver of your rights legally binding.

Finally, the agreement should clearly outline the scope of the release, specifying exactly which claims you are waiving and which claims you are not. For example, you might be waiving your right to sue for age discrimination or wrongful termination, but not waiving your right to file a workers’ compensation claim or a claim for unpaid wages. A well-drafted over 40 severance agreement template will clearly define these limitations to avoid any future misunderstandings or disputes.

Key Provisions to Look for in a Severance Agreement

When reviewing an over 40 severance agreement template, several key provisions deserve close attention. These provisions determine the extent of your benefits, the scope of your obligations, and the legal protections you are relinquishing. Carefully scrutinizing each section is crucial to ensuring you receive a fair deal and avoid potential pitfalls.

First and foremost, examine the section detailing severance pay. Determine the amount offered, the method of payment (lump sum versus installments), and the timing of payments. Understand if the severance pay is subject to taxes and how it might affect your eligibility for unemployment benefits. Compare the proposed amount to industry standards and your length of service to gauge its fairness. You might also want to research if you can negotiate for a higher severance amount.

Next, pay close attention to the provisions related to benefits continuation, particularly health insurance coverage. Under the Consolidated Omnibus Budget Reconciliation Act (COBRA), you generally have the right to continue your health insurance coverage for a certain period after leaving your job. However, the severance agreement might offer subsidized COBRA coverage or an alternative health insurance option. Understand the costs associated with each option and how long the coverage will last. Also, inquire about the continuation of other benefits, such as life insurance, disability insurance, and retirement plan contributions.

Another important section concerns the release of claims. As previously mentioned, this is where you agree to waive your right to sue the company for certain types of claims. Make sure you fully understand which claims are being released and whether you have any potential legal claims that you are unwilling to waive. Consider consulting with an attorney to assess the value of any potential claims and whether the severance benefits adequately compensate you for releasing them.

Non-disparagement and confidentiality clauses are also common in severance agreements. A non-disparagement clause prevents you from making negative or critical statements about the company, its products, or its employees. A confidentiality clause prohibits you from disclosing confidential information about the company. Understand the scope of these clauses and whether they unduly restrict your ability to speak freely about your experiences. Also, consider how these clauses might impact your ability to seek future employment.

Finally, review the provisions regarding outplacement services and assistance with finding a new job. Some severance agreements offer career counseling, resume writing assistance, and networking opportunities. These services can be invaluable in helping you transition to your next role. Understand the scope of the outplacement services offered, the qualifications of the providers, and the duration of the services.

Taking the time to carefully review and understand all the provisions of an over 40 severance agreement template can protect you and your future. Remember, you have the right to seek legal advice and negotiate the terms of the agreement. Don’t hesitate to exercise these rights to ensure you receive a fair and beneficial outcome.

Carefully consider all aspects of the agreement. Your future well-being may depend on it.

Remember that this document is a legally binding agreement, and signing it will impact your rights and responsibilities, so consider all of the clauses of the over 40 severance agreement template.