So, you’re starting a Limited Liability Company (LLC) in Pennsylvania? Congratulations! That’s a fantastic step toward building your business dream. But before you dive headfirst into the exciting world of entrepreneurship, there’s a crucial document you’ll need to get in order: the PA LLC operating agreement. Think of it as the instruction manual for your business, outlining how things will run, who’s responsible for what, and what happens if things change down the road.

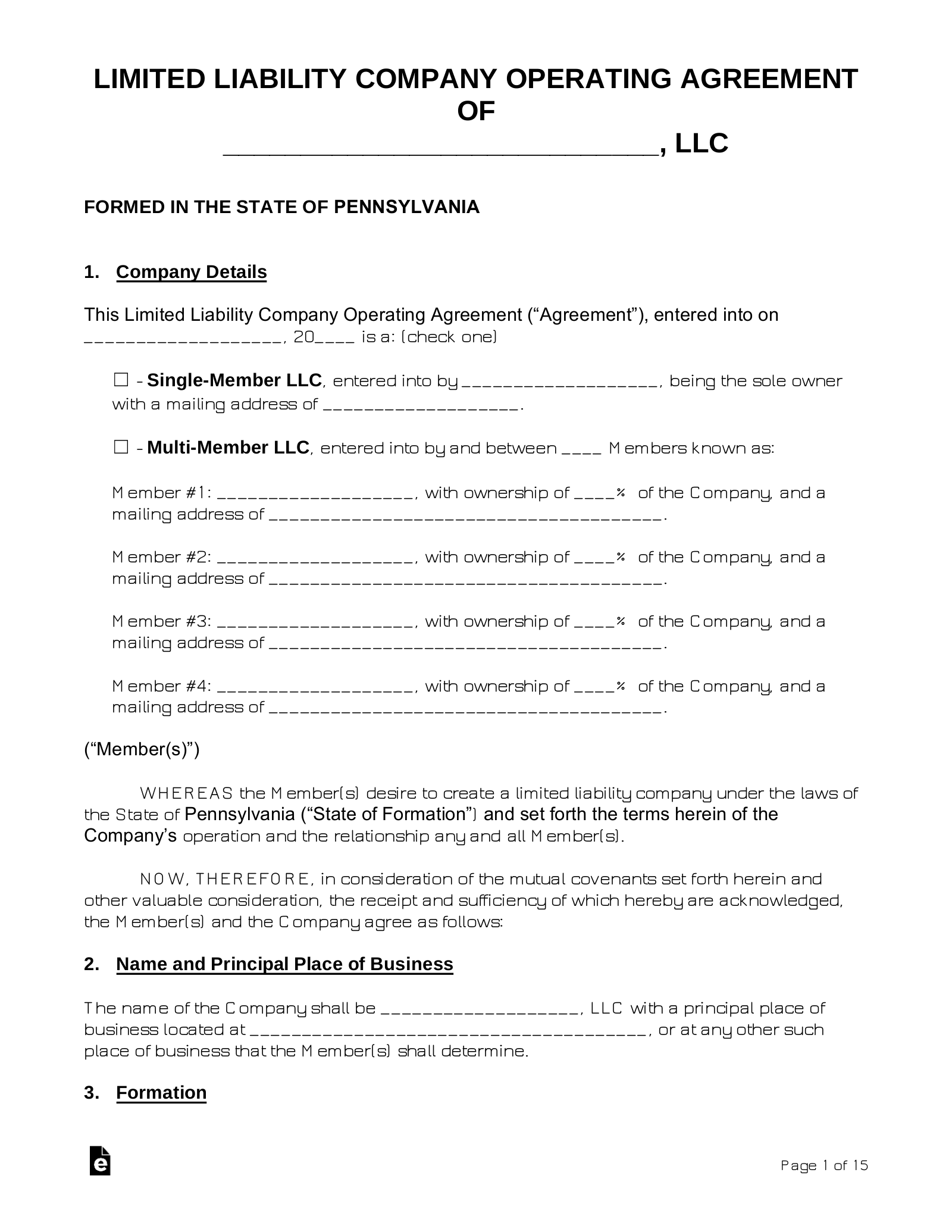

Creating an operating agreement might sound daunting, but it doesn’t have to be. Luckily, there are resources available to help, including a PA LLC operating agreement template. These templates provide a framework for you to build upon, ensuring you cover all the essential bases for your business structure in Pennsylvania.

This article will walk you through what an operating agreement is, why it’s so important (even if you’re a single-member LLC!), and how to find and customize a PA LLC operating agreement template to suit your specific business needs. Let’s get started on building a solid foundation for your Pennsylvania LLC!

Why You Need a PA LLC Operating Agreement

Okay, let’s get real. You might be thinking, “Do I *really* need an operating agreement? I’m just one person running this show!” The answer is a resounding YES! Even if you’re a single-member LLC, an operating agreement is invaluable. It’s not just a formality; it’s a foundational document that protects you and your business in the long run.

Firstly, a well-drafted operating agreement helps solidify the separation between you and your business. This is crucial for maintaining your limited liability protection. Without it, a court might view your LLC as an extension of yourself, potentially putting your personal assets at risk if your business faces legal trouble or debts. The operating agreement clearly states that your LLC is a separate legal entity, shielding your personal finances from business liabilities.

Secondly, it clarifies the roles, responsibilities, and ownership percentages of each member (if you have multiple members). This is especially important for multi-member LLCs. Imagine disputes arising later about profit sharing, decision-making power, or what happens if a member wants to leave. An operating agreement proactively addresses these potential conflicts, outlining the procedures for resolving disagreements and ensuring a smoother operating experience.

Thirdly, a PA LLC operating agreement template can offer important provisions specific to Pennsylvania law. While many aspects of LLC operation are generally applicable, some legal nuances might exist within the state. The operating agreement allows you to document specific provisions related to your business’s governance and operational procedures within the state of Pennsylvania.

Finally, having an operating agreement simply makes your business appear more credible and professional. When dealing with banks, investors, or even potential clients, presenting a well-organized and legally sound operating agreement demonstrates that you’ve taken the time to establish a legitimate and well-managed business.

What to Include in Your PA LLC Operating Agreement

So, you’re convinced you need an operating agreement (good!). Now, what should it include? A solid PA LLC operating agreement template will typically cover these essential areas:

**Basic Information:** This section includes the name of your LLC, its registered agent and office address, and the purpose of your business. It essentially sets the stage for who your business is and where it operates.

**Membership Details:** Here, you’ll list the names and addresses of all the members (owners) of the LLC, along with their initial contributions (cash, property, services) and their percentage of ownership in the company.

**Management Structure:** This section outlines how the LLC will be managed. Will it be member-managed (where the members directly run the business) or manager-managed (where designated managers are responsible for day-to-day operations)? It also defines the roles and responsibilities of managers, if applicable.

**Voting Rights and Procedures:** This outlines how decisions will be made within the LLC. Will each member have one vote, or will voting power be proportional to their ownership percentage? It should also detail the procedures for holding meetings and making important decisions.

**Profit and Loss Allocation:** This crucial section specifies how profits and losses will be divided among the members. Usually, this is based on their ownership percentage, but you can customize it to fit your specific circumstances. It’s vital to clearly define this to avoid disagreements later.

**Distributions:** How and when will profits be distributed to the members? Will distributions be made regularly (e.g., quarterly or annually) or only when the company has sufficient funds? This section should clearly outline the distribution process.

**Transfer of Membership Interests:** What happens if a member wants to sell their share of the LLC? This section outlines the process for transferring membership interests, including any restrictions or requirements for obtaining consent from the other members.

**Dissolution:** This section specifies the circumstances under which the LLC will be dissolved (e.g., the death or withdrawal of a member) and the procedures for winding up the business and distributing its assets.

Using a PA LLC operating agreement template will ensure you haven’t forgotten critical details and will help you think through different scenarios and their implications for your business.

While starting an LLC might seem complex, understanding the importance of a PA LLC operating agreement and customizing one with a template can alleviate much of the burden. It is a tool that should be given proper focus to ensure long-term success.