Ever finalized a transaction, a deal, or a service and want to make absolutely sure everyone’s on the same page? That’s where a paid in full agreement template comes in handy. Think of it as the ultimate handshake after all the money has changed hands. It’s a document that clearly states that one party has paid the other completely for a specific product or service, and that the debt is officially cleared. No lingering questions, no “I thought you still owed me…” moments. It’s peace of mind solidified on paper.

Why bother with a formal agreement? Well, in a perfect world, everyone would remember every detail and be honest. But life isn’t always perfect. Having a written record protects both the payer and the payee. For the payer, it’s proof that they fulfilled their obligation. For the payee, it confirms they received the agreed-upon amount and releases the payer from any further liability. It helps avoid misunderstandings and disputes down the road, especially when larger sums of money are involved.

In essence, a paid in full agreement template provides clarity and closure. Whether you’re a freelancer concluding a project, a small business owner selling goods, or an individual settling a personal loan, this document ensures that everyone involved is on the same page and can move forward with confidence. It’s a simple step that can save you a lot of headaches later on.

Why Use a Paid In Full Agreement Template?

There are numerous situations where a paid in full agreement template can be incredibly useful. Imagine you’ve been working on a freelance project for a client. You’ve completed the work to their satisfaction, and they’ve paid you the agreed-upon fee. A paid in full agreement serves as confirmation that the project is closed, and you won’t be chasing after additional payments later. Or perhaps you’re selling a used car to a private buyer. Once they hand over the cash, a signed agreement clearly states that they own the car free and clear, and no further payments are expected. It protects both parties from potential future claims.

Another common scenario is settling a debt for less than the original amount. Let’s say you owe a friend or family member money, and after some negotiation, you agree on a reduced payoff. The paid in full agreement will outline the revised amount and confirm that once that amount is paid, the entire debt is considered satisfied. Without this document, the lender could theoretically come back later and claim you still owe the remaining balance. It’s particularly crucial when dealing with significant debts or when there’s a pre-existing agreement in place.

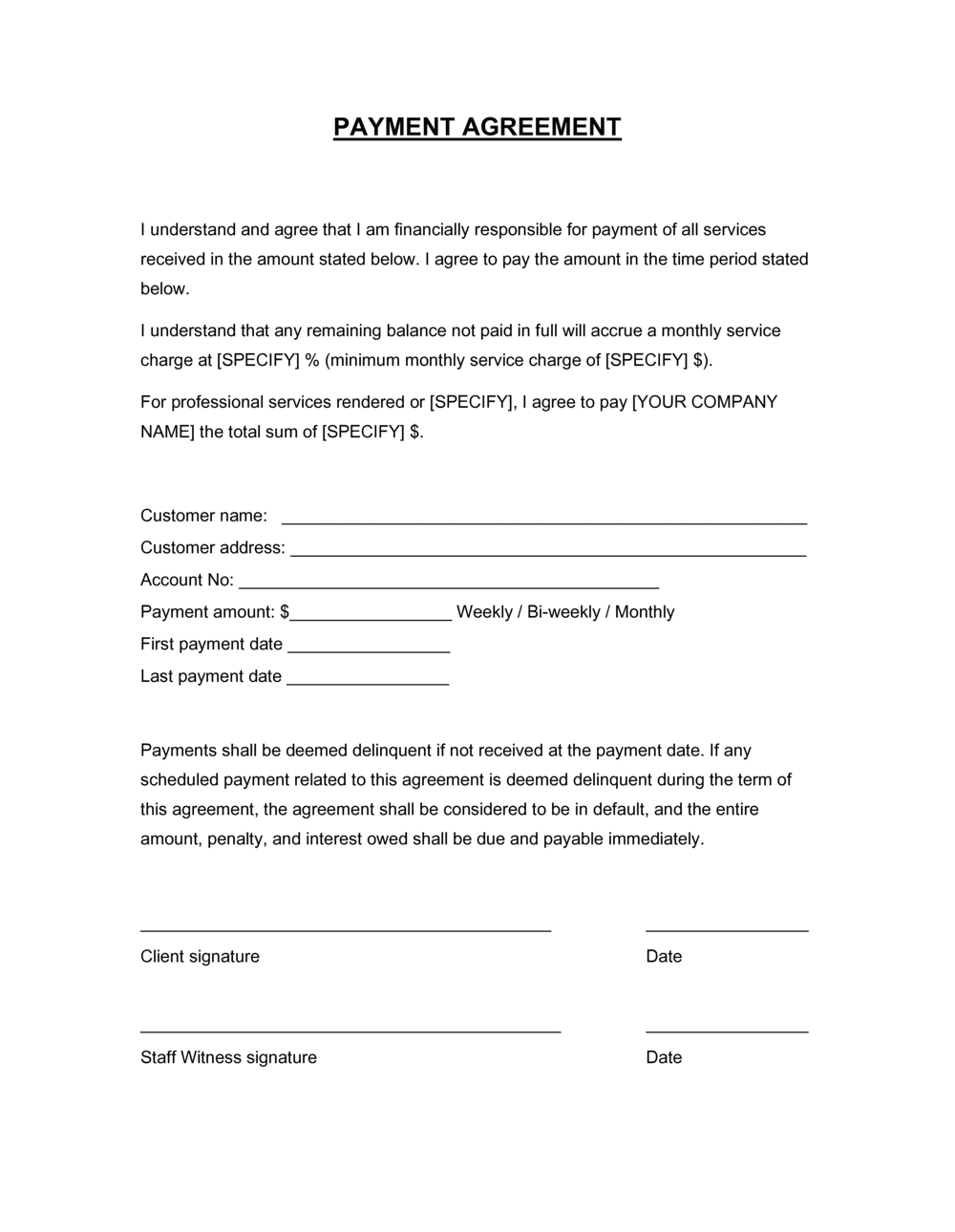

Using a template simplifies the process immensely. Instead of drafting a document from scratch, you can simply fill in the blanks with the relevant information. This saves time and ensures that you include all the essential details. A good template will typically include spaces for the names of both parties, the date of the agreement, a description of the goods or services provided, the total amount paid, and a clear statement that the payment constitutes full and final satisfaction of the debt. It also often includes signature lines for both parties to acknowledge their agreement.

Moreover, a template provides legal protection. While it’s not a substitute for legal advice, it does serve as a legally binding document that can be presented in court if necessary. It demonstrates that both parties understood and agreed to the terms of the payment. By using a well-written template, you reduce the risk of ambiguities or misunderstandings that could lead to legal disputes. It’s a cost-effective way to protect your interests and ensure a smooth and transparent transaction.

In short, a paid in full agreement template is an invaluable tool for anyone who wants to document a completed payment and avoid potential conflicts. It offers clarity, protection, and peace of mind, making it an essential part of responsible financial management. Whether you are buying, selling, or settling debts, this document provides a clear record of the transaction and helps ensure that everyone is on the same page.

Key Elements of a Comprehensive Paid In Full Agreement Template

When choosing a paid in full agreement template, it’s crucial to ensure it includes all the necessary elements for a legally sound and comprehensive document. At the very least, it should clearly state the names and addresses of both the payer (the one making the payment) and the payee (the one receiving the payment). This information identifies the parties involved and establishes their legal standing in the agreement. Accurate contact information is also helpful in case any further communication is required.

The agreement must also include a detailed description of the goods or services provided. Vague descriptions can lead to disputes later on. Be specific about what was delivered or performed. For example, if it’s for a freelance writing project, specify the number of articles, their titles, and any other relevant details. If it’s for the sale of a physical item, include the make, model, and any unique identifiers. The more specific you are, the less room there is for misinterpretation.

The amount paid is obviously a critical component. Clearly state the total amount paid, the currency used, and the method of payment (e.g., cash, check, credit card). Also, include the date the payment was made. This information serves as concrete evidence that the payment occurred as agreed. If there were any prior payment installments, it’s also a good idea to reference them and confirm that this final payment constitutes complete satisfaction of the debt.

Furthermore, the agreement should explicitly state that the payment represents full and final settlement of the debt. This is the core of the agreement and should be worded clearly and unambiguously. For instance, it might state: “The payment of [amount] represents full and final satisfaction of all debts and obligations owed by [payer] to [payee] related to [description of goods or services].” This statement leaves no room for doubt that the debt is completely cleared.

Finally, the agreement must include signature lines for both parties. Each party should sign and date the agreement to acknowledge their understanding and acceptance of the terms. Having a witness present during the signing can further strengthen the agreement, although it’s not always required. The signed document serves as a legally binding record of the agreement and can be used as evidence in case of any future disputes. Seeking legal counsel to review the paid in full agreement template before signing, especially for complex transactions, is always a prudent step.

By understanding the importance of using a paid in full agreement template and the key elements it should contain, you can protect yourself from potential misunderstandings and ensure a smooth and transparent transaction. It’s a simple yet powerful tool that can provide clarity and peace of mind for all parties involved.