So, you’re thinking about starting a business in the Empire State with a partner? That’s fantastic! New York offers a wealth of opportunity for entrepreneurs. But before you start popping champagne bottles and brainstorming your company’s logo, there’s a crucial piece of paperwork you absolutely need to take care of: a partnership agreement. Think of it as the roadmap for your business journey, ensuring everyone is on the same page and preventing potential headaches down the road.

A solid partnership agreement is especially important in a vibrant and litigious business environment like New York. It clarifies roles, responsibilities, and what happens if, say, one partner wants to leave or if disagreements arise. Without one, you’re essentially relying on default state laws, which might not align with what you and your partner actually intended for your business. This can lead to complicated legal battles and strain even the strongest relationships.

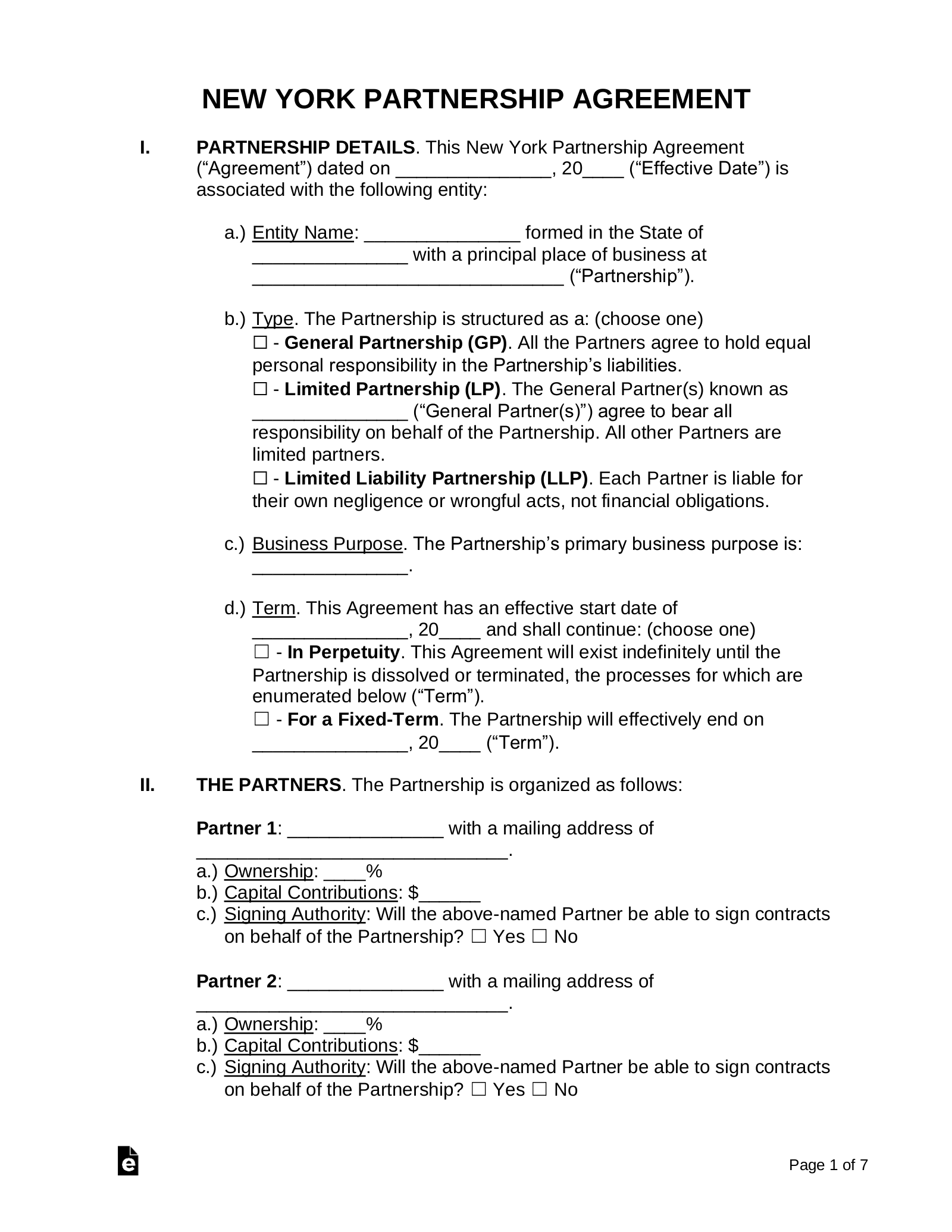

Finding a good partnership agreement template new york can seem daunting, but it’s a worthwhile investment in the future success of your business. It lays the groundwork for a stable and profitable venture. Let’s dive into why a partnership agreement is essential and what key elements you should include to protect your interests and foster a healthy business relationship with your partner.

Why You Absolutely Need a Partnership Agreement in New York

Imagine starting a business with your best friend. You’re both excited, full of ideas, and ready to conquer the world. You shake hands, maybe even share a celebratory pizza, and get to work. Everything is smooth sailing…until it isn’t. Disagreements arise. One partner feels overworked, the other feels undervalued. Profits aren’t as high as you hoped. Without a clear agreement in place, these issues can quickly escalate and threaten the entire business.

A partnership agreement serves as a legally binding document that outlines the terms and conditions of your business partnership. It clearly defines each partner’s rights, responsibilities, and obligations. This includes things like capital contributions, profit and loss sharing, management roles, decision-making processes, and procedures for resolving disputes. Think of it as a prenuptial agreement for your business – it’s much better to hash out these details beforehand than to try and figure them out in the heat of a conflict.

Specifically in New York, having a comprehensive partnership agreement can protect you from unintended consequences dictated by state law. New York’s partnership laws can be complex, and without a written agreement, the default rules may not reflect your intended arrangement. For instance, what happens if a partner wants to withdraw from the partnership? What if a partner becomes incapacitated? What if the partnership incurs debt? A well-drafted agreement addresses these potential scenarios, providing clarity and minimizing the risk of costly legal disputes.

Moreover, a partnership agreement establishes a clear framework for resolving disagreements. It can outline a specific mediation or arbitration process, saving you time and money compared to going to court. It can also detail the procedures for expelling a partner or dissolving the partnership, ensuring a fair and orderly process for all involved.

Ultimately, a partnership agreement promotes transparency, trust, and mutual understanding among partners. It sets the stage for a successful and long-lasting business relationship by providing a clear roadmap for navigating the challenges and opportunities that come with running a business in New York.

Key Elements of a Solid Partnership Agreement

Now that you understand the importance of having a partnership agreement, let’s talk about what should be included. While every agreement is unique and should be tailored to your specific business needs, there are several key elements that are essential for a comprehensive and effective document.

First and foremost, you need to clearly identify the partners involved and the name of the partnership. This seems obvious, but it’s crucial to be precise. Include the legal names and addresses of each partner. State the official name of your business and its principal place of business. Define the purpose of the partnership – what exactly will your business do? Be as specific as possible to avoid any ambiguity later on.

Next, outline each partner’s capital contribution. How much money or other assets is each partner contributing to the business? Is it a cash investment, equipment, intellectual property, or something else? Clearly define the value of each contribution and how it will be accounted for. This is essential for determining each partner’s ownership percentage and share of profits and losses.

The agreement should also specify how profits and losses will be allocated among the partners. Will profits be divided equally, or based on each partner’s capital contribution or the amount of time they devote to the business? What about losses? Will they be shared in the same proportion as profits? Be explicit about the allocation method to prevent disputes down the road. Remember to consider New York state and federal tax implications when determining profit and loss allocation.

Management and decision-making are another critical aspect to address. Who will be responsible for the day-to-day operations of the business? How will major decisions be made? Will decisions require unanimous consent, or will a majority vote suffice? Clearly define the roles and responsibilities of each partner and the procedures for making important decisions to ensure smooth and efficient management.

Finally, don’t forget to address what happens if a partner wants to leave, becomes incapacitated, or dies. These are difficult but necessary conversations to have. Your partnership agreement should outline the procedures for withdrawing from the partnership, including any notice requirements and the method for valuing the departing partner’s interest. It should also address the potential for disability or death of a partner and how the partnership will be dissolved or restructured in such cases. The use of a partnership agreement template new york can greatly assist in addressing these concerns.

Drafting a partnership agreement can be tricky, so seeking guidance from an attorney or business advisor is always a wise move to ensure you cover all the necessary bases and tailor the agreement to your unique situation. A carefully crafted agreement is an investment that can save you significant time, money, and stress in the long run.

Ultimately, forging a successful partnership in New York, or anywhere, requires careful planning and open communication. While the initial excitement of launching a business is understandable, taking the time to establish a solid foundation with a partnership agreement is the key to building a lasting and prosperous venture. A well-defined agreement, tailored to your specific needs, can serve as the compass guiding your business through both calm waters and turbulent storms.