So, you’re diving into the world of partnerships, huh? That’s fantastic! Starting a business with a partner can be an incredibly rewarding experience. You get to share the workload, bounce ideas off someone, and celebrate successes together. But before you pop the champagne, it’s crucial to get your ducks in a row, especially when it comes to the financial aspect. That’s where a partnership profit sharing agreement template comes in handy. Think of it as the roadmap for how you and your partner will divide the spoils of your hard work. It’s all about clarity, fairness, and setting the stage for a healthy and profitable partnership.

Now, you might be thinking, “Do I really need a formal agreement? Can’t we just wing it?” Trust me, you don’t want to wing it when it comes to money. Even if you’re partnering with your best friend or a family member, having a written agreement is essential. It removes any ambiguity and protects both parties in case disagreements arise down the road. It’s far better to have these potentially awkward conversations upfront than to let financial issues strain your relationship and potentially sink your business.

This isn’t just some legal mumbo jumbo designed to scare you. A solid partnership profit sharing agreement template is a tool that empowers you and your partner to build a strong foundation for your business. It helps you think through all the important aspects of your financial relationship, from how profits are defined to what happens if one partner wants to leave the business. So, let’s break down what goes into creating one and how it can benefit you both.

Key Elements of a Partnership Profit Sharing Agreement

Crafting a robust partnership profit sharing agreement is vital for a smooth and equitable business relationship. It’s more than just stating how the money will be divided; it’s about defining the very essence of your partnership and safeguarding its future. Here’s a rundown of the core elements you’ll want to include in your agreement.

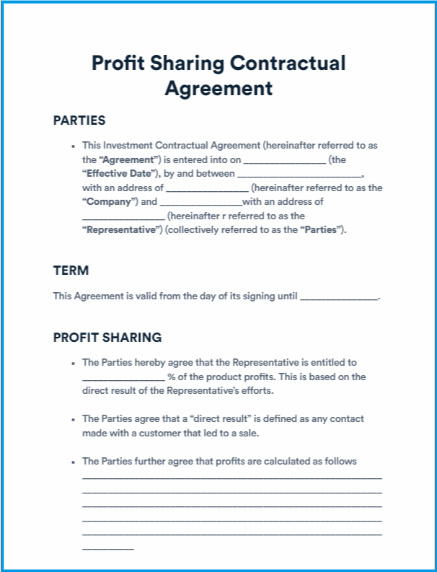

First and foremost, clearly define what constitutes “profit.” This might seem obvious, but it’s important to be specific. Does it include revenue after all expenses, including salaries, operational costs, and taxes? Does it include revenue generated from specific projects or clients? Leaving this vague can lead to misunderstandings and disputes down the line. List all the costs that will be deducted from the income to arrive at the figure of profit to be shared.

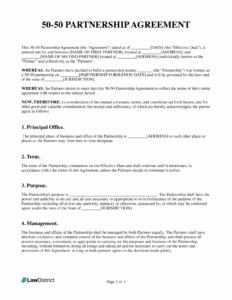

Next, outline the exact profit sharing ratio. This is the percentage of profits each partner will receive. It could be a simple 50/50 split, or it could be based on factors like initial investment, contributions to the business, or time commitment. For example, if one partner contributes significantly more capital upfront, they might be entitled to a larger share of the profits. Or, if one partner works full-time while the other works part-time, that should also be factored into the equation. Ensure that your profit sharing model aligns with the reality of your respective contributions and future expectations.

Beyond the basic percentage split, consider incorporating provisions for guaranteed payments. These are regular payments made to partners, regardless of the company’s profitability. They can act as a salary or a way to compensate partners for their day-to-day contributions. If you choose to implement guaranteed payments, clearly define the amount, frequency, and how they will be treated in relation to the overall profit sharing. Will they be deducted from a partner’s share of the profits, or will they be paid in addition to their profit share?

Finally, your agreement should address how losses will be handled. Will partners share losses in the same proportion as profits? This is a crucial point to clarify, as it can have significant financial implications. Also, think about what happens if one partner cannot cover their share of the losses. Will the other partners be responsible for absorbing the shortfall? Detailing the potential outcome of losses in the agreement ensures that all parties are aware of their obligations and responsibilities.

Why a Partnership Profit Sharing Agreement Template is Essential

A partnership profit sharing agreement template is more than just a legal document; it’s a tool that fosters trust, prevents conflict, and sets the stage for long-term success in your business venture. It might seem like overkill to some, especially when you’re just starting out and everything is sunshine and rainbows. But trust me, having a clear and comprehensive agreement in place is an investment in the health and longevity of your partnership. Let’s explore the key reasons why you absolutely need one.

First and foremost, it provides clarity and eliminates ambiguity. When it comes to money, assumptions can be dangerous. A well-drafted agreement spells out exactly how profits will be calculated, how they will be distributed, and what happens in various scenarios. This eliminates any room for misunderstanding or misinterpretation, which can be a major source of conflict in any partnership. By putting everything in writing, you create a shared understanding and a clear roadmap for your financial relationship.

Secondly, it helps prevent disputes and disagreements. Even in the best of partnerships, disagreements are bound to arise. But having a written agreement in place provides a framework for resolving those disputes. If there’s a question about how profits should be distributed or how losses should be handled, you can simply refer back to the agreement. This can save you a lot of time, money, and emotional energy in the long run. It also ensures that any disputes are resolved fairly and objectively, rather than based on personal feelings or assumptions.

Thirdly, a partnership profit sharing agreement template protects both partners. It ensures that each partner’s rights and responsibilities are clearly defined. This can be particularly important if one partner contributes more capital, time, or expertise to the business. The agreement can outline how those contributions will be recognized and rewarded. It also protects partners from potential liabilities, such as lawsuits or debts incurred by the business. By clearly defining the roles and responsibilities of each partner, the agreement can help to minimize the risk of personal liability.

Finally, having a well-documented partnership profit sharing agreement template is essential for attracting investors or securing loans. Potential investors or lenders will want to see that you have a solid business plan in place, including a clear and equitable agreement on how profits will be shared. This demonstrates that you’ve thought through all the important aspects of your partnership and that you’re committed to running a professional and well-organized business. It also gives investors or lenders confidence that their investment will be protected and that they’ll receive a fair return.

The partnership profit sharing agreement template is a crucial thing. It is about setting a direction for your business and the profits it is going to generate.

When it comes to ensuring the success of your collaborative business endeavor, a well crafted partnership profit sharing agreement template is of utmost importance. It safeguards your interests while fostering a climate of trust and fair practice.