Navigating the world of healthcare can be tricky, especially when it comes to understanding your financial obligations. It’s not always as simple as just showing your insurance card and assuming everything is covered. That’s where a patient financial responsibility agreement comes into play. It’s a document designed to clarify exactly what you, as the patient, are responsible for paying, ensuring both you and your healthcare provider are on the same page. Think of it as a roadmap for your healthcare finances, helping you avoid unexpected bills and confusion down the line.

This agreement isn’t meant to scare you; instead, it’s a tool for transparency. Healthcare providers use it to outline their billing practices, accepted insurance plans, and payment policies. By signing a patient financial responsibility agreement, you acknowledge that you understand these aspects and agree to fulfill your financial obligations. It’s a crucial step in building a trusting relationship with your healthcare provider, fostering open communication about costs and payment options.

In this article, we’ll delve into the intricacies of a patient financial responsibility agreement, explaining its importance, what it typically includes, and why it’s essential for both patients and healthcare providers. We’ll also explore how a patient financial responsibility agreement template can simplify the process, making it easier to understand and implement. Ultimately, our goal is to empower you with the knowledge you need to confidently navigate the financial side of healthcare.

Understanding the Importance and Key Elements of a Patient Financial Responsibility Agreement

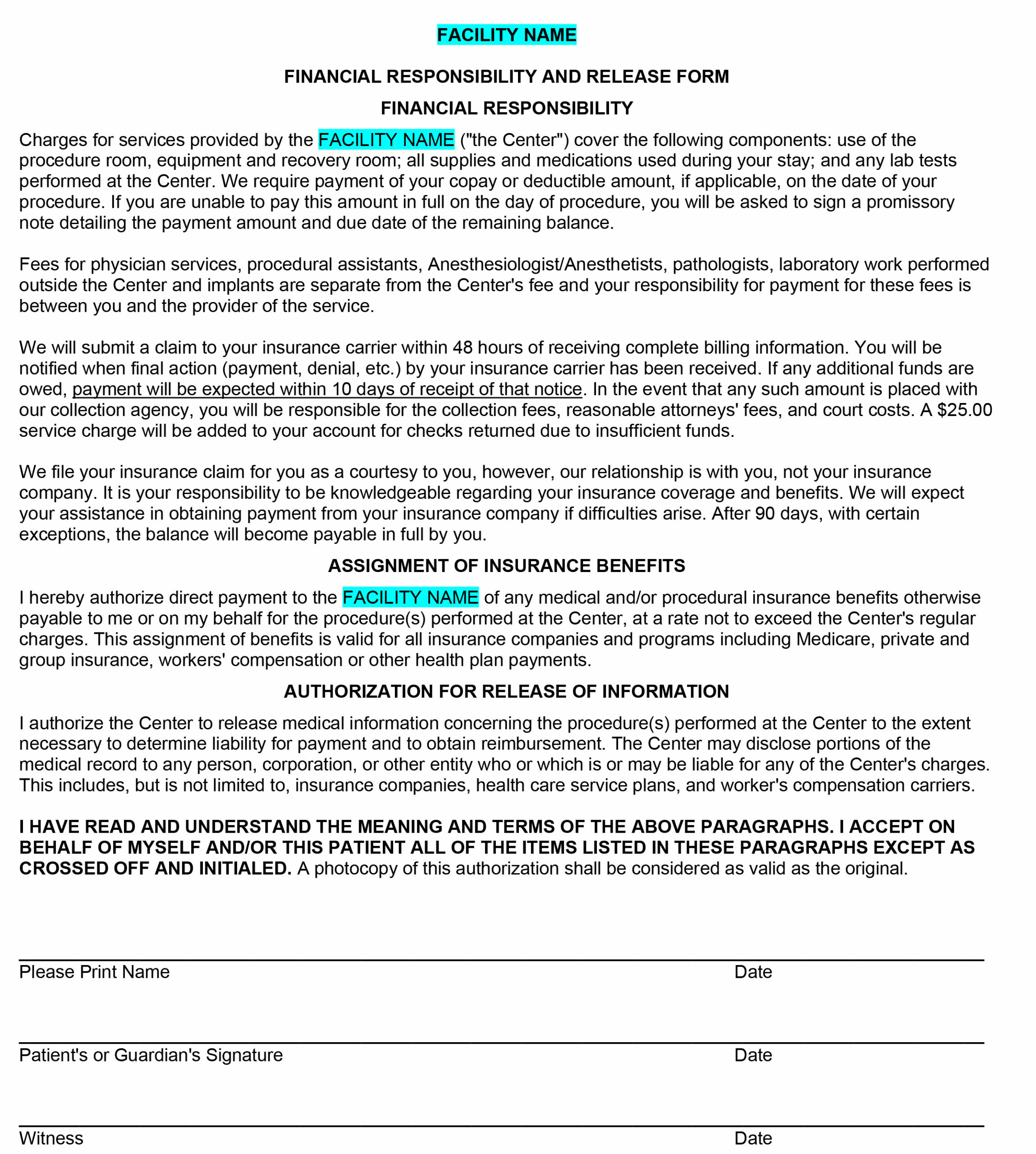

A patient financial responsibility agreement is more than just a piece of paper; it’s a cornerstone of transparent and ethical healthcare billing. It ensures that patients are fully aware of their financial obligations before receiving treatment, minimizing the potential for misunderstandings and disputes. This agreement outlines the patient’s responsibility for deductibles, co-pays, co-insurance, and any services not covered by their insurance plan. It also clarifies the provider’s billing practices and the patient’s payment options. Without such an agreement, patients might be surprised by unexpected medical bills, leading to frustration and potentially damaging the patient-provider relationship.

These agreements generally cover several key areas. First, they clearly state that the patient is responsible for any amounts not covered by their insurance, including deductibles, co-pays, and co-insurance. Second, they outline the provider’s billing practices, such as when bills will be sent and the methods of payment accepted. Third, they may include information about payment plans or financial assistance programs offered by the provider. Fourth, the agreement should clearly describe the process for appealing a bill or resolving a billing dispute. Fifth, it may address situations where a patient does not have insurance or chooses not to use their insurance.

For healthcare providers, using a standardized patient financial responsibility agreement template offers numerous benefits. It ensures consistency in billing practices, reduces the risk of errors, and provides a clear record of the patient’s understanding of their financial obligations. By using a template, providers can save time and resources that would otherwise be spent creating individualized agreements for each patient. Furthermore, a well-written agreement can help protect the provider from legal challenges related to billing disputes.

From the patient’s perspective, a clear and concise patient financial responsibility agreement provides peace of mind. It allows patients to make informed decisions about their healthcare, knowing exactly what costs they will be responsible for. This can be particularly important for patients with chronic conditions or those undergoing expensive treatments. By understanding their financial obligations upfront, patients can plan accordingly and avoid financial stress.

The agreement should also clearly define what happens in case of non-payment. This section might outline the provider’s collection policies, including when accounts will be sent to collections and the potential consequences of non-payment. It’s important for patients to understand these policies so they can proactively address any financial challenges they may face. Open communication with the provider about payment options and potential financial difficulties can often lead to mutually agreeable solutions.

Essential Components to Include in Your Patient Financial Responsibility Agreement Template

Creating an effective patient financial responsibility agreement template requires careful consideration of the essential components that will protect both the patient and the healthcare provider. Clarity and comprehensiveness are key, ensuring that all relevant information is presented in a way that is easy for the patient to understand. Ambiguity can lead to misunderstandings and disputes, so it’s crucial to be precise in the language used and to avoid jargon or technical terms that the average patient may not be familiar with.

The template should include sections that clearly identify the patient and the healthcare provider, including their names, addresses, and contact information. It should also specify the date the agreement is signed and the period of time it covers. A detailed description of the services covered by the agreement is essential, including any limitations or exclusions. This section should be specific enough to avoid confusion, but also flexible enough to accommodate a range of potential services.

Another crucial element is a clear explanation of the patient’s financial responsibilities, including deductibles, co-pays, co-insurance, and any other fees that the patient may be responsible for. The agreement should also outline the provider’s billing practices, including when bills will be sent and the acceptable methods of payment. Information about payment plans or financial assistance programs should also be included, if available.

The template should also address the process for appealing a bill or resolving a billing dispute. This section should clearly outline the steps the patient needs to take to file a complaint and the timeline for the provider to respond. Including a dispute resolution process can help prevent minor disagreements from escalating into more serious issues.

Finally, the patient financial responsibility agreement template should include a statement acknowledging that the patient has read and understood the agreement. This statement should be signed and dated by both the patient and a representative of the healthcare provider. Keeping a copy of the signed agreement in the patient’s medical record provides documentation that the patient was informed of their financial responsibilities.

Healthcare finance is important and should be considered for every patient. A patient financial responsibility agreement template helps both parties keep aligned with what the patient is responsible for, and what the healthcare facility can expect.

The proper use of this agreement ensures transparency and trust, and reduces misunderstandings. It protects both patient and provider and allows them to have a successful financial relationship.