Let’s face it, healthcare costs can be daunting. You’ve gone in for a necessary procedure, received excellent care, and now you’re looking at a bill that feels a bit overwhelming. It’s a common situation, and luckily, many healthcare providers understand this and are willing to work with you. That’s where a patient payment plan agreement comes in handy. It’s a structured way to manage your medical expenses over time, making them more manageable and less stressful.

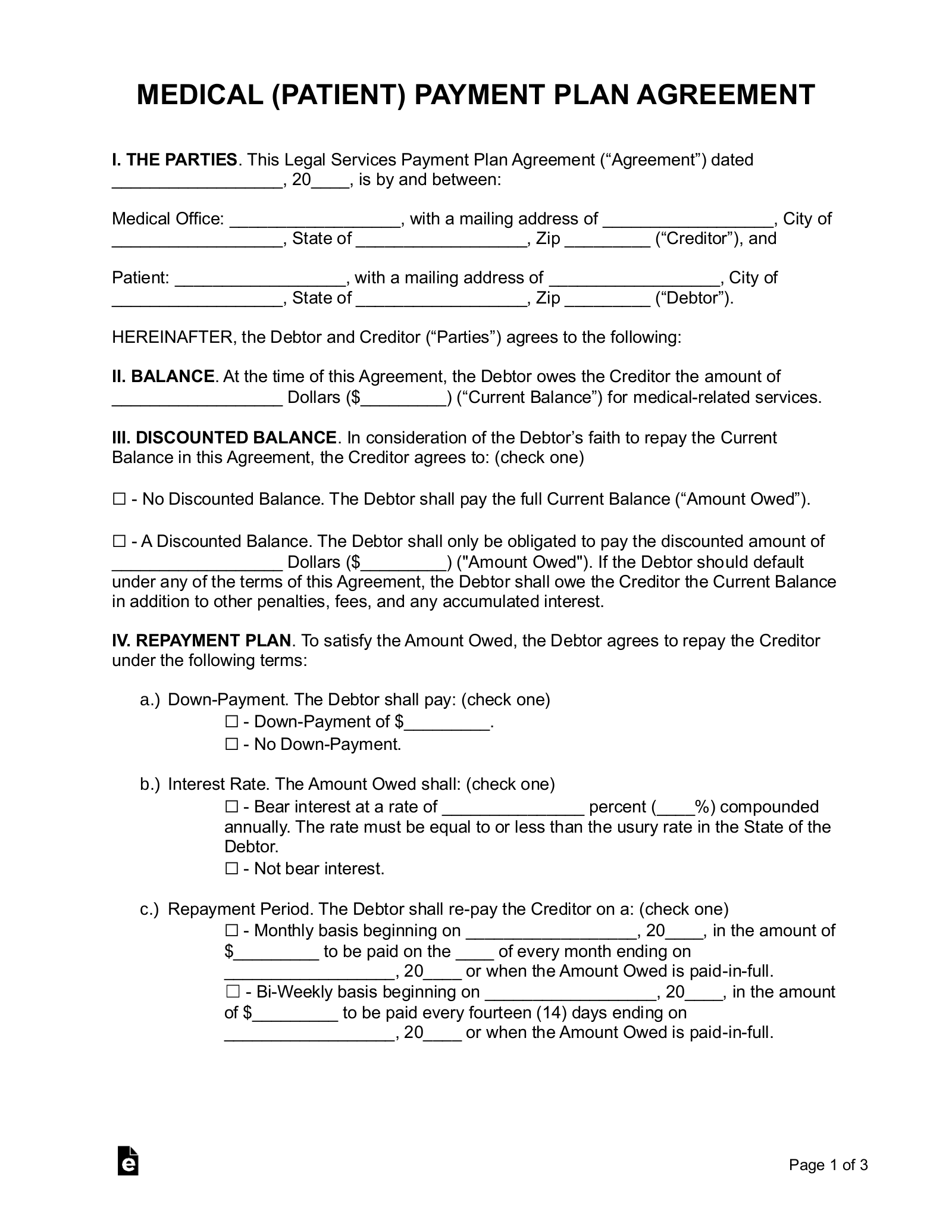

Think of a patient payment plan agreement template as a roadmap to financial peace of mind concerning your healthcare bills. It outlines the terms of your payment arrangement with your healthcare provider, including the total amount owed, the amount of each installment, the frequency of payments (weekly, monthly, etc.), and any associated fees or interest. Having this agreement in writing protects both you and the provider, ensuring everyone is on the same page and avoiding potential misunderstandings down the line.

So, if you’re facing a significant medical bill and want to explore options beyond a single lump-sum payment, a patient payment plan might be the perfect solution. It allows you to prioritize your health without straining your finances completely. The key is to approach the discussion with your healthcare provider proactively and explore the possibility of creating a mutually agreeable payment plan. Often, they are more than willing to help you navigate the financial aspect of your care.

Understanding the Essentials of a Patient Payment Plan Agreement

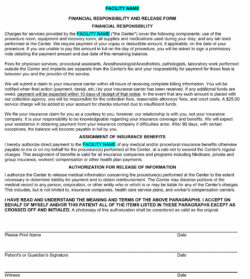

A patient payment plan agreement isn’t just a casual handshake deal; it’s a formal document outlining specific terms and conditions. Understanding these essential components is crucial before signing on the dotted line. First and foremost, the agreement will clearly state the total amount of the outstanding medical bill. This should match your records and any explanations of benefits you’ve received from your insurance company. If there are any discrepancies, address them with your provider before proceeding.

Next, the agreement will detail the installment amounts and the frequency of payments. This is perhaps the most important section for you, as it determines the affordability of the plan. Be realistic about your budget and ensure the payment schedule aligns with your income and other financial obligations. If the proposed payments are too high, don’t hesitate to negotiate with your provider to find a more manageable arrangement.

The agreement should also specify the due date for each payment and the accepted methods of payment. Are you able to pay online, by mail, or in person? Are there any penalties for late payments? These are critical details to understand to avoid unnecessary fees or complications. It’s also wise to inquire about options for adjusting the payment plan in case of unforeseen financial hardship.

Furthermore, a well-drafted patient payment plan agreement will address the consequences of default. What happens if you miss a payment or are unable to fulfill the terms of the agreement? Will the entire balance become due immediately? Will the account be sent to collections? Knowing these consequences upfront will help you avoid potentially damaging your credit score.

Finally, the agreement should include contact information for both you and the healthcare provider. This ensures clear lines of communication in case you have any questions or concerns during the payment period. Remember, a patient payment plan agreement is a legally binding document, so it’s in your best interest to read it carefully and understand all the terms before signing.

Creating a Fair and Effective Payment Plan

The goal of a patient payment plan is to make your medical bills more manageable, but it’s crucial to ensure the plan is fair and effective for both you and your healthcare provider. It’s not just about agreeing to a set amount; it’s about creating a sustainable arrangement that promotes financial well-being and fosters a positive relationship with your provider. Open communication is key to achieving this.

When discussing a payment plan with your provider, be honest about your financial situation. Don’t be afraid to explain your income, expenses, and any other debts you may have. This will help them understand your ability to pay and tailor the plan accordingly. Some providers may even be willing to offer a discount or waive certain fees if you demonstrate genuine financial hardship.

Consider offering a slightly larger initial payment, if possible. This can demonstrate your commitment to fulfilling the agreement and may lead to more favorable terms for the remaining installments. It also reduces the total amount you’ll be paying interest on, if any interest is applied.

Be proactive in monitoring your payments and keeping track of your balance. Most providers offer online portals or billing statements that allow you to easily track your progress. If you notice any discrepancies or have any questions, contact your provider immediately to resolve them.

Ultimately, a successful patient payment plan is one that you can realistically adhere to. It requires careful planning, open communication, and a commitment to fulfilling your obligations. By working collaboratively with your healthcare provider, you can create a plan that alleviates financial stress and allows you to focus on your health and well-being. Using a well-structured patient payment plan agreement template can make the whole process smoother and more transparent.

Navigating healthcare costs can feel overwhelming, but remember that many providers are willing to work with their patients. Don’t hesitate to initiate the conversation and explore the possibility of a patient payment plan. With a little planning and open communication, you can find a solution that fits your budget and allows you to manage your medical expenses effectively.

The process may seem daunting, but with a clear understanding of your financial situation and a willingness to collaborate with your healthcare provider, you can create a manageable and mutually beneficial payment plan. Remember, your health is paramount, and there are resources available to help you navigate the financial aspects of your care.