Ever find yourself in a situation where you need to formalize how money will change hands? Whether you’re lending a friend some cash, hiring a freelancer, or selling goods, a payment agreement template between two parties can be your best friend. It’s a straightforward way to get everyone on the same page and protect your interests. Think of it as a roadmap for financial transactions, making sure expectations are clear and minimizing potential misunderstandings down the line.

Without a clear agreement, things can quickly become messy. Imagine a scenario where you’ve agreed to pay a contractor in installments, but the payment schedule wasn’t clearly defined. Disagreements could arise about the amount due at each stage, leading to delays, frustration, and even legal disputes. A well-drafted payment agreement template between two parties eliminates this ambiguity by outlining every detail, leaving no room for misinterpretation.

In essence, a payment agreement template between two parties is a written commitment that outlines the terms of a financial transaction. It protects both the payer and the payee by establishing clear guidelines for payment amounts, due dates, and acceptable payment methods. It’s a simple document that can save you a whole lot of headaches.

Why You Absolutely Need a Payment Agreement

A payment agreement is more than just a formality; it’s a crucial tool for safeguarding your financial interests. It provides a clear record of the agreed-upon payment terms, helping to prevent disputes and misunderstandings. Think of it as an insurance policy for your transactions. Without one, you’re essentially relying on a handshake deal, which can be difficult to enforce if things go south. In many situations, a handshake isn’t enough, especially when significant amounts of money are involved.

So, what exactly makes a payment agreement so important? First and foremost, it establishes clarity. It specifies the exact amount owed, the due dates for payments, the acceptable methods of payment (e.g., check, credit card, electronic transfer), and any applicable late fees or penalties. This level of detail eliminates any potential ambiguity and ensures that both parties are fully aware of their obligations. Clear communication is key to a successful business relationship and this document is a great method to ensure clarity.

Secondly, a payment agreement provides legal protection. In the event of a payment dispute, a written agreement serves as evidence of the agreed-upon terms. This can be invaluable if you need to pursue legal action to recover unpaid funds. Without a written agreement, it can be difficult to prove the existence of a debt or the specific terms of the payment arrangement. This is where the payment agreement template between two parties can assist in legally documenting all the necessary information.

Furthermore, having a payment agreement in place fosters trust and professionalism. It demonstrates that you’re serious about the transaction and committed to fulfilling your obligations. This can strengthen your relationships with clients, vendors, and other parties. When people know that you value transparency and accountability, they’re more likely to trust you and do business with you.

Beyond the formal business world, a payment agreement can also be beneficial in personal situations, such as lending money to friends or family. While it might seem awkward to formalize such transactions, it can prevent misunderstandings and strained relationships down the line. By putting the terms in writing, you can avoid any confusion about repayment expectations and maintain a healthy relationship with your loved ones. Therefore, payment agreements are great for many scenarios.

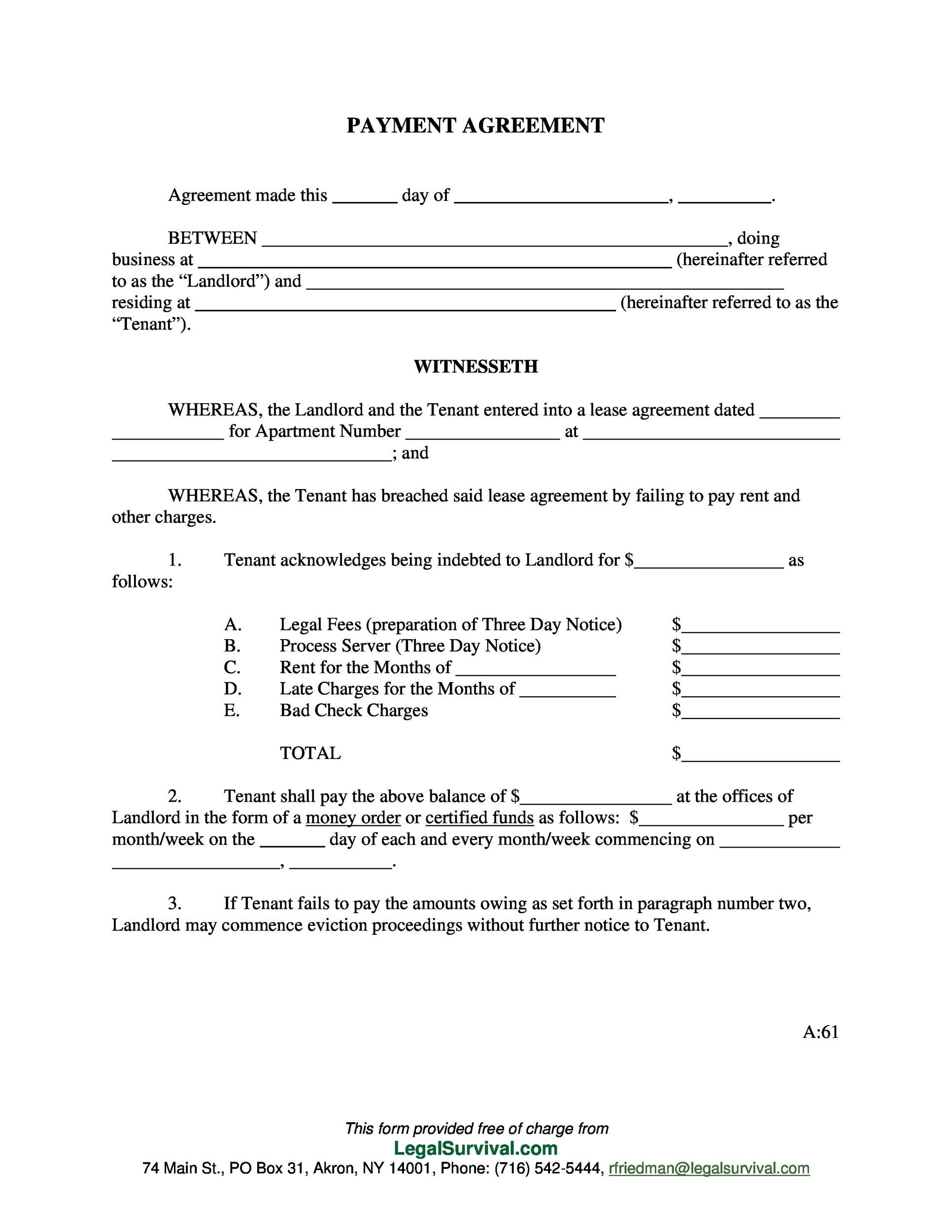

Key Elements of a Solid Payment Agreement Template

Creating a robust payment agreement template doesn’t have to be a daunting task. By understanding the key elements and incorporating them into your document, you can create a template that is both comprehensive and legally sound. Let’s break down the essential components:

First, you’ll need to clearly identify the parties involved. This includes the full legal names and addresses of both the payer and the payee. Accuracy is crucial here, as any errors could potentially invalidate the agreement. Take the time to verify the information and ensure that it’s correct.

Next, you need to specify the amount owed. This should be clearly stated in both numerical and written form (e.g., “$1,000.00” and “One Thousand Dollars”). This helps to avoid any confusion or misinterpretation of the amount due. If there are any applicable taxes or fees, they should also be clearly itemized.

The payment schedule is another critical element. This section should outline the due dates for all payments, as well as the amount due at each installment (if applicable). Be as specific as possible, and consider including a table or chart to visually represent the payment schedule. Clarity is key to preventing late payments and disputes.

Don’t forget to include information about acceptable payment methods. Will you accept checks, credit cards, electronic transfers, or other forms of payment? Specifying the acceptable methods upfront can streamline the payment process and avoid any surprises. Also, include any instructions for how to make payments, such as the payee’s bank account details or mailing address.

Finally, consider including clauses that address potential issues, such as late payments, early termination, or disputes. A late payment clause should specify any penalties or fees that will be assessed for payments received after the due date. An early termination clause should outline the conditions under which either party can terminate the agreement, as well as any associated costs or consequences. And a dispute resolution clause should specify the process for resolving any disagreements that may arise, such as mediation or arbitration. Thinking ahead and addressing potential problems can save you a lot of headaches down the road.

A payment agreement template between two parties is a great way to start.

The significance of a well-structured payment agreement is undeniable in fostering secure and transparent financial interactions. It serves as a cornerstone in building reliable business partnerships.