Navigating the world of business often means juggling invoices, payments, and the delicate dance of extending credit to your clients. Sometimes, a straightforward invoice with immediate payment isn’t feasible, and that’s where a “net 30” payment arrangement comes into play. But how do you formalize that agreement to protect both your interests and your client’s? This is where a payment arrangement net 30 terms agreement template becomes your best friend. It’s a structured way to lay out the terms of your agreement, ensuring everyone is on the same page and minimizing the risk of misunderstandings or disputes down the line.

Think of a payment arrangement net 30 terms agreement template as a roadmap for your financial relationship with a client. It spells out the specifics: what goods or services are being provided, the total cost, and most importantly, the timeframe for payment. “Net 30” simply means that the full payment is due 30 days from the date of the invoice. Using a template ensures you don’t forget any crucial details and helps create a professional and legally sound document.

This article is designed to guide you through the process of understanding and utilizing a payment arrangement net 30 terms agreement template. We’ll explore the key components of such a template, why it’s essential for your business, and how to customize it to fit your specific needs. Let’s dive in and demystify the world of net 30 payment arrangements.

Why You Need a Payment Arrangement Net 30 Terms Agreement Template

In the fast-paced world of commerce, relying on verbal agreements or vague understandings just doesn’t cut it, especially when it comes to money. A payment arrangement net 30 terms agreement template provides clarity and protection for both parties involved. It’s a written record of the agreed-upon terms, minimizing the potential for disputes and misunderstandings that can damage business relationships and lead to costly legal battles.

Imagine extending credit to a client without a formal agreement. What happens if they claim they didn’t understand the payment terms? Or if they dispute the amount owed? Without a written agreement, you’re left relying on he-said-she-said, which is rarely a winning situation. A well-crafted payment arrangement net 30 terms agreement template eliminates these ambiguities, ensuring everyone is on the same page from the outset.

Furthermore, having a standardized template streamlines your business processes. Instead of drafting a new agreement from scratch each time you offer net 30 terms, you can simply adapt the template to the specific details of each transaction. This saves you time and effort, allowing you to focus on other aspects of your business.

Beyond clarity and efficiency, a payment arrangement net 30 terms agreement template also demonstrates professionalism. It shows your clients that you’re serious about your business and committed to fair and transparent practices. This can enhance your reputation and build trust, leading to stronger and more long-lasting business relationships.

In essence, a payment arrangement net 30 terms agreement template is an investment in your business’s security and success. It protects your financial interests, streamlines your operations, and fosters positive client relationships. It’s a small price to pay for the peace of mind it provides.

Key Components of a Payment Arrangement Net 30 Terms Agreement Template

Now that we’ve established the importance of a payment arrangement net 30 terms agreement template, let’s break down the essential components that should be included to ensure it’s comprehensive and effective. While specific templates may vary slightly, certain elements are crucial for clarity and legal soundness.

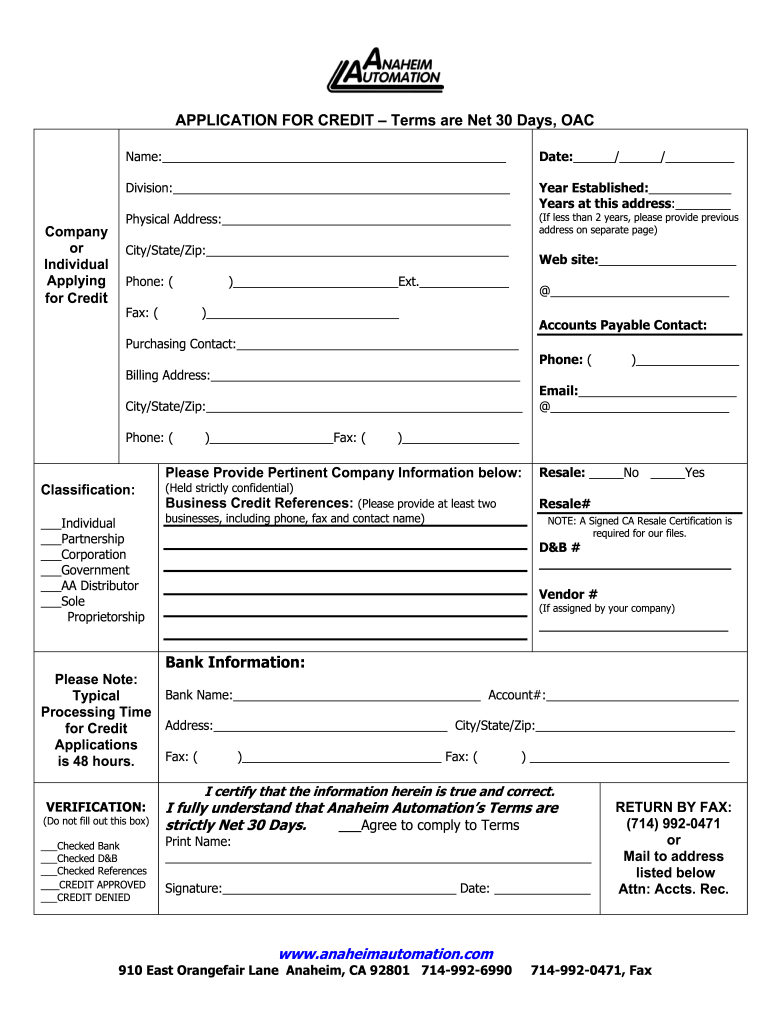

First and foremost, the agreement should clearly identify the parties involved: your business and the client. Include full legal names and addresses for both entities. This establishes who is bound by the agreement and makes it easier to pursue legal action if necessary.

Next, provide a detailed description of the goods or services being provided. Be as specific as possible, including quantities, specifications, and any other relevant details. This helps avoid disputes about the scope of the agreement. Clearly state the total amount due for the goods or services.

The core of the agreement, of course, is the payment terms. Explicitly state that the payment is due “net 30,” meaning 30 days from the invoice date. Include the invoice date itself for absolute clarity. Specify the acceptable methods of payment (e.g., check, credit card, electronic transfer) and any relevant instructions. You may also want to include information on late payment fees or interest charges, and under what circumstances they apply.

Finally, include a section on governing law and dispute resolution. Specify which state’s laws will govern the agreement and outline the process for resolving any disputes, such as mediation or arbitration. This section helps ensure that any legal proceedings will be conducted fairly and efficiently. Ensure that both parties sign and date the agreement to indicate their consent to the terms outlined within.

Ultimately, having access to a payment arrangement net 30 terms agreement template helps protect your business in the long run.

Putting a payment arrangement net 30 terms agreement template into practice can lead to more transparent business transactions. It sets clear expectations between you and your client, reducing the chances of misunderstandings and disagreements. This clarity fosters a healthier working relationship built on trust and mutual understanding. By formalizing the payment terms, you create a foundation for open communication and collaboration, leading to more successful partnerships and a smoother business process overall.

Clarity in payment terms also allows for better financial planning for both parties. Your client can anticipate the payment deadline and allocate resources accordingly, while you can project your cash flow with greater accuracy. This predictability helps maintain financial stability and facilitates informed decision-making for both your business and your client’s. Implementing a payment arrangement net 30 terms agreement template promotes responsible financial practices and contributes to the long-term sustainability of your business relationships.