Let’s face it, healthcare can be expensive. Even with insurance, copays, deductibles, and out-of-pocket expenses can quickly add up, leaving patients with bills they struggle to manage. As a medical office, you want to provide excellent care while also ensuring your financial health. Offering payment plan options can be a win-win solution, allowing patients to access the care they need while providing you with a predictable revenue stream. But how do you formalize these arrangements? That’s where a solid payment plan agreement template for medical office comes in.

Think of a payment plan agreement template for medical office as a roadmap for both you and your patient. It clearly outlines the terms of the repayment, protecting both parties and preventing misunderstandings down the road. It details the total amount owed, the installment amount, the frequency of payments (weekly, bi-weekly, monthly), and the due date for each payment. It also includes important clauses regarding late fees, default, and potential legal recourse, ensuring everyone is on the same page about the consequences of not adhering to the agreement. A well-drafted template simplifies this process, saving you time and legal hassles.

This article will explore the importance of having a payment plan agreement template for medical office, the key components you should include, and how to implement it effectively. We’ll break down the essentials, provide tips for clear communication, and offer insights into how a structured payment plan can improve patient satisfaction and boost your office’s financial stability. Let’s get started.

Why Use a Payment Plan Agreement Template?

In the complex world of medical billing, clarity and structure are your best friends. Simply agreeing to a payment plan verbally isn’t enough. It leaves room for misinterpretations, disputes, and potential legal issues down the line. A written payment plan agreement template for medical office offers a level of security and professionalism that verbal agreements simply can’t match. It’s a formal record of the agreement, outlining the specific terms that both you and the patient have agreed to.

Furthermore, a well-designed template ensures consistency across all payment plans offered by your office. This consistency helps to maintain fairness and avoid any perception of favoritism or discrimination. It also streamlines the administrative process, making it easier for your staff to manage and track payment plans efficiently. Instead of reinventing the wheel each time a patient needs a payment plan, you can simply customize the template with the patient’s specific information.

Another crucial benefit is the protection it offers your medical office. By clearly outlining the consequences of late payments or default, the agreement serves as a deterrent against non-payment. It also provides a legal framework for pursuing collections if necessary. While you hope it never comes to that, having a legally sound agreement in place protects your financial interests and allows you to recoup the funds owed for the services you provided.

Beyond the legal and financial benefits, a payment plan agreement can also improve the patient experience. When patients understand the terms of their repayment plan clearly, they’re more likely to feel confident and less stressed about their medical bills. This transparency fosters trust and strengthens the patient-provider relationship. It shows that you’re willing to work with them to make healthcare affordable and accessible.

Ultimately, a payment plan agreement template is an investment in the long-term health of your medical office. It protects your financial stability, streamlines your administrative processes, and improves the patient experience. It’s a cornerstone of responsible and compassionate patient care.

Key Components of a Payment Plan Agreement

Creating a comprehensive payment plan agreement involves carefully crafting each section to protect both your practice and your patients. Here are essential components to include:

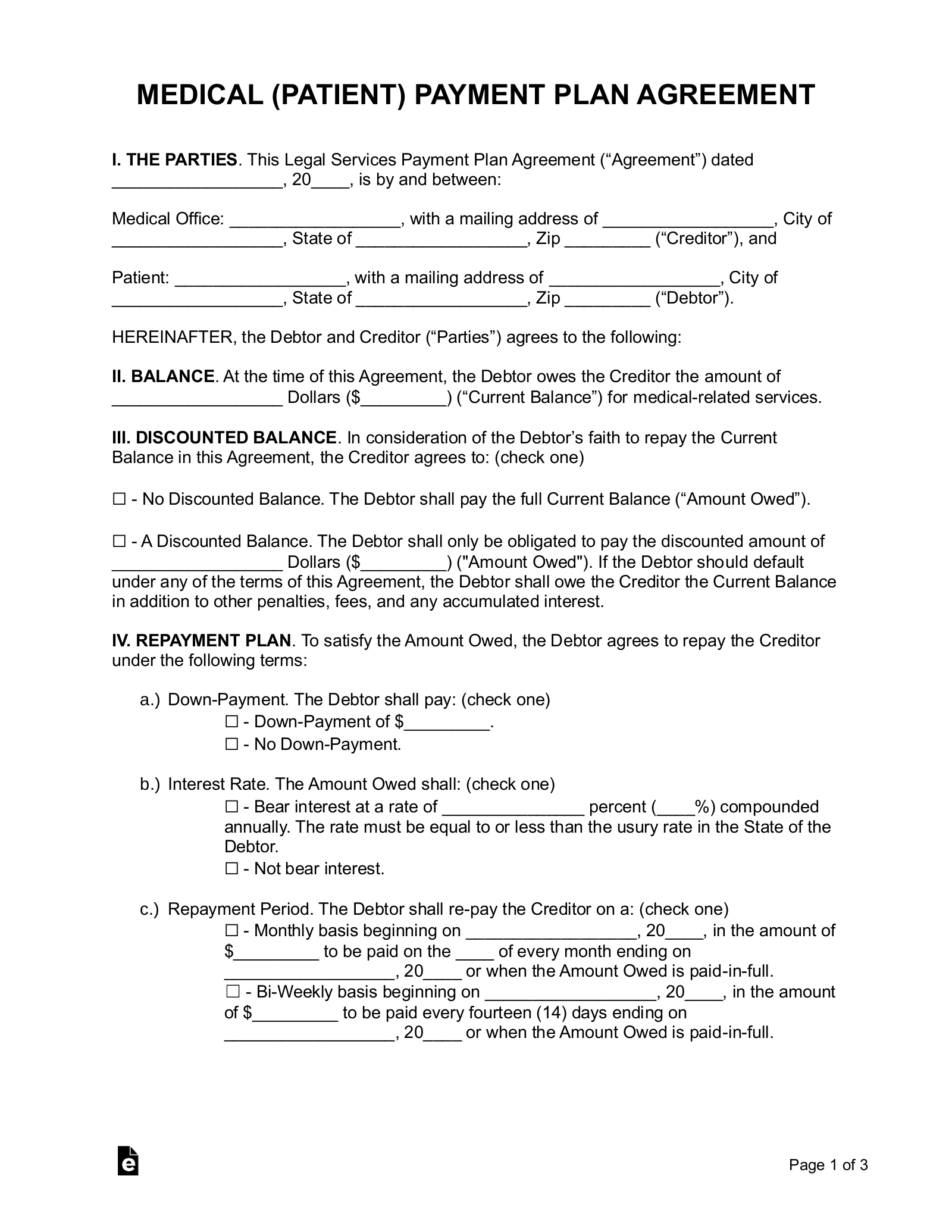

Identification of Parties: Clearly state the full legal names and addresses of both the medical office and the patient. This seemingly simple step is crucial for legal enforceability.

Total Amount Owed: Specify the exact total amount due for the medical services rendered. This should match the amount on the patient’s billing statement. Include a breakdown if possible, referencing the dates of service and the types of procedures performed.

Payment Schedule: Detail the payment schedule, including the installment amount, the frequency of payments (e.g., weekly, bi-weekly, monthly), and the specific due date for each payment. Be precise and unambiguous to avoid confusion.

Late Payment Policy: Outline the consequences of late payments. Will there be a late fee? If so, how much? How many days late does a payment have to be before a late fee is applied? Clearly define these terms.

Default Clause: Define what constitutes a default on the agreement. This might include missing multiple payments or failing to adhere to other terms outlined in the agreement. Specify the consequences of default, such as acceleration of the remaining balance or referral to a collections agency.

Interest (if applicable): Some agreements may include interest charges. Be sure to comply with all applicable state and federal laws regarding interest rates and disclosure requirements. It’s often advisable to consult with a legal professional regarding this aspect.

Confidentiality Clause: This clause ensures that both parties agree to keep the terms of the agreement confidential. This protects the patient’s privacy and prevents the agreement from being disclosed to unauthorized third parties.

Governing Law: Specify the state law that will govern the interpretation and enforcement of the agreement. This is typically the state where the medical office is located.

Entire Agreement Clause: This clause states that the written agreement represents the entire understanding between the parties and supersedes any prior oral or written agreements.

Signatures: Require both the patient and a representative of the medical office to sign and date the agreement. This signifies their agreement to the terms outlined in the document.

By including these key components, you can create a comprehensive and legally sound payment plan agreement that protects your interests and ensures clear communication with your patients.

In conclusion, using a payment plan agreement template for medical office is a smart business practice. It provides protection, structure, and improved patient relations.

Remember to tailor the template to your specific needs and seek legal advice when necessary to ensure compliance with all applicable laws and regulations.