Dealing with medical bills can be overwhelming, especially when unexpected expenses arise. It’s not always easy to pay large sums upfront, and that’s where a payment plan agreement template medical comes in handy. Think of it as a roadmap to managing your healthcare costs in a way that’s manageable and predictable. It outlines the terms and conditions for paying off your medical debt in installments, making it easier to budget and avoid further financial strain.

These agreements are beneficial for both patients and healthcare providers. For patients, it offers a structured approach to debt repayment, reducing stress and preventing potential collection actions. For healthcare providers, it ensures a steady stream of income and reduces the likelihood of unpaid bills. It’s a win-win situation that promotes financial stability for everyone involved.

In this article, we will explore the ins and outs of payment plan agreement templates medical, covering everything from what they are and why they’re important to how to create and use them effectively. We’ll also touch on common issues and provide helpful tips to ensure a smooth and successful payment plan experience. So, let’s dive in and learn how to navigate medical bills with confidence and ease.

Understanding the Importance of a Medical Payment Plan Agreement

A medical payment plan agreement is more than just a piece of paper; it’s a formal agreement that outlines how a patient will repay their medical debt over a specified period. It’s designed to be mutually beneficial, providing clarity and structure for both the patient and the healthcare provider. Without a clear agreement, misunderstandings can arise, leading to frustration, legal issues, and damaged relationships. A well-drafted agreement helps to avoid these pitfalls by setting clear expectations and responsibilities.

One of the key benefits of a medical payment plan agreement is its ability to prevent debt collection actions. When a patient agrees to a payment plan and adheres to its terms, the healthcare provider is less likely to pursue aggressive collection methods, such as sending the debt to a collection agency or pursuing legal action. This can save the patient from significant stress and potential damage to their credit score. It also allows the patient to maintain a positive relationship with their healthcare provider.

Furthermore, a payment plan can offer a sense of control and empowerment to patients facing substantial medical bills. Rather than feeling overwhelmed by a large lump-sum payment, the patient can break down the debt into manageable installments that fit within their budget. This can significantly reduce anxiety and improve their overall financial well-being. It’s about creating a sustainable plan that works for their individual circumstances.

From the healthcare provider’s perspective, a payment plan agreement provides a reliable source of income. Instead of writing off unpaid debt, the provider can receive regular payments over time, improving their cash flow and financial stability. It also demonstrates a commitment to working with patients and providing compassionate care, which can enhance the provider’s reputation and patient satisfaction.

In essence, a medical payment plan agreement is a vital tool for managing healthcare costs effectively. It fosters transparency, reduces risk, and promotes financial stability for both patients and healthcare providers. By understanding its importance and utilizing it properly, individuals can navigate the complexities of medical billing with greater confidence and peace of mind.

Creating and Using a Medical Payment Plan Agreement Template

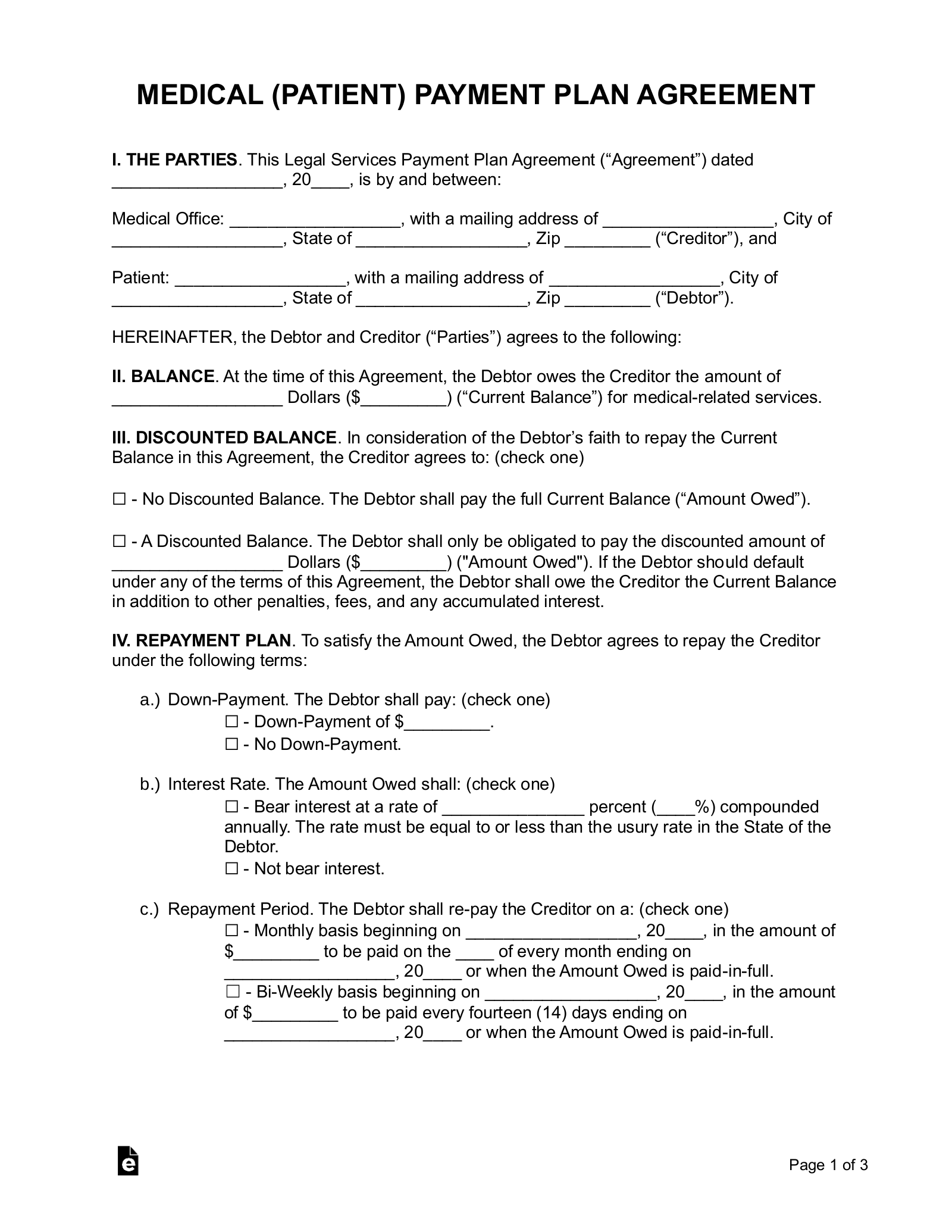

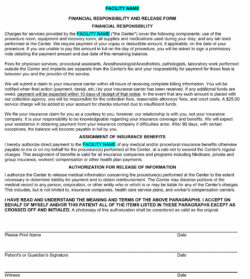

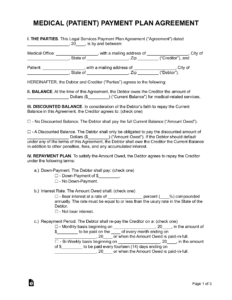

Crafting a comprehensive and legally sound payment plan agreement template medical doesn’t have to be a daunting task. There are several key elements to include to ensure clarity and protect the interests of both parties. Start by clearly identifying the parties involved: the patient (or guarantor) and the healthcare provider. Include their full names, addresses, and contact information. This establishes a clear record of who is agreeing to the terms.

Next, provide a detailed description of the medical services rendered and the total amount owed. Break down the charges if necessary, so the patient understands what they are paying for. Specify the initial payment amount, the frequency of subsequent payments (e.g., monthly, bi-weekly), and the due date for each payment. Be precise and leave no room for ambiguity. Also include information on where the payments should be remitted – address, online portal, etc.

The agreement should also address any potential late payment fees or penalties. Clearly outline the consequences of missed payments, such as a late fee or a potential default on the agreement. However, be mindful of state and federal regulations regarding late fees, as some jurisdictions have limits on what can be charged. It’s always advisable to consult with legal counsel to ensure compliance.

Another crucial element is the inclusion of a default clause. This clause specifies the conditions under which the agreement can be considered null and void. For example, if the patient consistently fails to make payments or violates other terms of the agreement, the healthcare provider may have the right to terminate the plan and pursue other collection options. Conversely, the agreement should also outline the patient’s rights, such as the right to request a modification of the payment plan if their financial circumstances change.

Finally, ensure that the agreement includes a clear and concise termination clause, outlining how the agreement can be terminated by either party. It’s also important to include a section on dispute resolution, specifying how any disagreements or disputes will be handled, such as through mediation or arbitration. Both parties should carefully review the agreement before signing it, and each should retain a copy for their records. Remember, a well-crafted payment plan agreement template medical is a valuable tool for managing medical debt and fostering positive relationships between patients and healthcare providers.

Navigating medical bills doesn’t have to feel like climbing a mountain. With a well-defined payment plan, those costs become manageable steps. Remember to communicate openly with your healthcare provider about your financial situation.

Healthcare providers also benefit from these agreements. Consistent payments and a reduction in collection efforts improve their financial outlook. It’s a collaborative approach to healthcare finance, ensuring everyone can access and afford necessary medical services.