So, you’re thinking of lending or borrowing money from a family member? That’s a big step! Money and family can be a tricky mix, but it doesn’t have to be a recipe for disaster. The key is clear communication and, more importantly, a well-defined agreement. That’s where a personal loan agreement template between family comes in handy. It helps everyone involved to be on the same page and protects relationships from unnecessary strain.

Think of it like this: you wouldn’t just hand over your car keys without knowing who’s driving, where they’re going, and when they’ll be back, right? The same principle applies to lending money. A formal agreement, even within a family, sets expectations, defines responsibilities, and avoids misunderstandings down the line. It might feel a little awkward at first, but trust me, it’s worth the effort in the long run.

This article will guide you through everything you need to know about creating a personal loan agreement template between family. We’ll cover the essential components, explain why it’s so important, and even provide some tips to ensure the process goes smoothly. By the end, you’ll be well-equipped to navigate this potentially sensitive situation with confidence and maintain strong family bonds.

Why Use a Personal Loan Agreement Template Between Family?

Okay, let’s be honest. The idea of sitting down with your sibling or parent and hammering out the details of a loan agreement might sound a little formal, even cold. But hear me out. A written agreement isn’t about distrust; it’s about clarity and respect. It shows that you value the relationship and are committed to handling the loan responsibly. Imagine relying solely on verbal promises. Memories fade, interpretations differ, and suddenly you’re in a he-said-she-said situation that could damage your bond.

Using a personal loan agreement template between family helps avoid future disagreements. It clearly outlines the amount borrowed, the interest rate (if any), the repayment schedule, and any penalties for late payments. By documenting these details, you’re creating a shared understanding that minimizes the potential for misunderstandings and hurt feelings. Think of it as a preventative measure – a way to protect your relationship from the potentially corrosive effects of unresolved financial issues.

Beyond relationship preservation, a formal agreement can also be helpful for tax purposes. If you’re charging interest on the loan (which is perfectly acceptable, even within a family), documenting the interest earned or paid is crucial for both parties’ tax returns. Without proper documentation, you could face scrutiny from tax authorities. Having a written agreement ensures that everything is above board and compliant with legal requirements. It’s always better to be safe than sorry when it comes to financial matters, regardless of who you’re dealing with.

Furthermore, a personal loan agreement template between family provides a framework for handling unexpected situations. What happens if the borrower loses their job? What if the lender suddenly needs the money back sooner than anticipated? A well-drafted agreement should address these contingencies and outline the process for renegotiating the terms of the loan. This proactive approach can prevent crises and ensure that both parties are protected in the event of unforeseen circumstances.

In short, using a personal loan agreement template between family is not about doubting your loved ones; it’s about fostering open communication, preventing misunderstandings, ensuring tax compliance, and establishing a framework for handling potential challenges. It’s an act of responsibility and a testament to the value you place on your family relationships. Taking the time to create a clear and comprehensive agreement will ultimately strengthen your bond and provide peace of mind for everyone involved.

Key Components of a Personal Loan Agreement Template

Now that you understand the importance of using a personal loan agreement template between family, let’s delve into the essential components that should be included. Think of this as a checklist to ensure your agreement is comprehensive and legally sound. Missing even one key element could lead to disputes and undermine the effectiveness of the document.

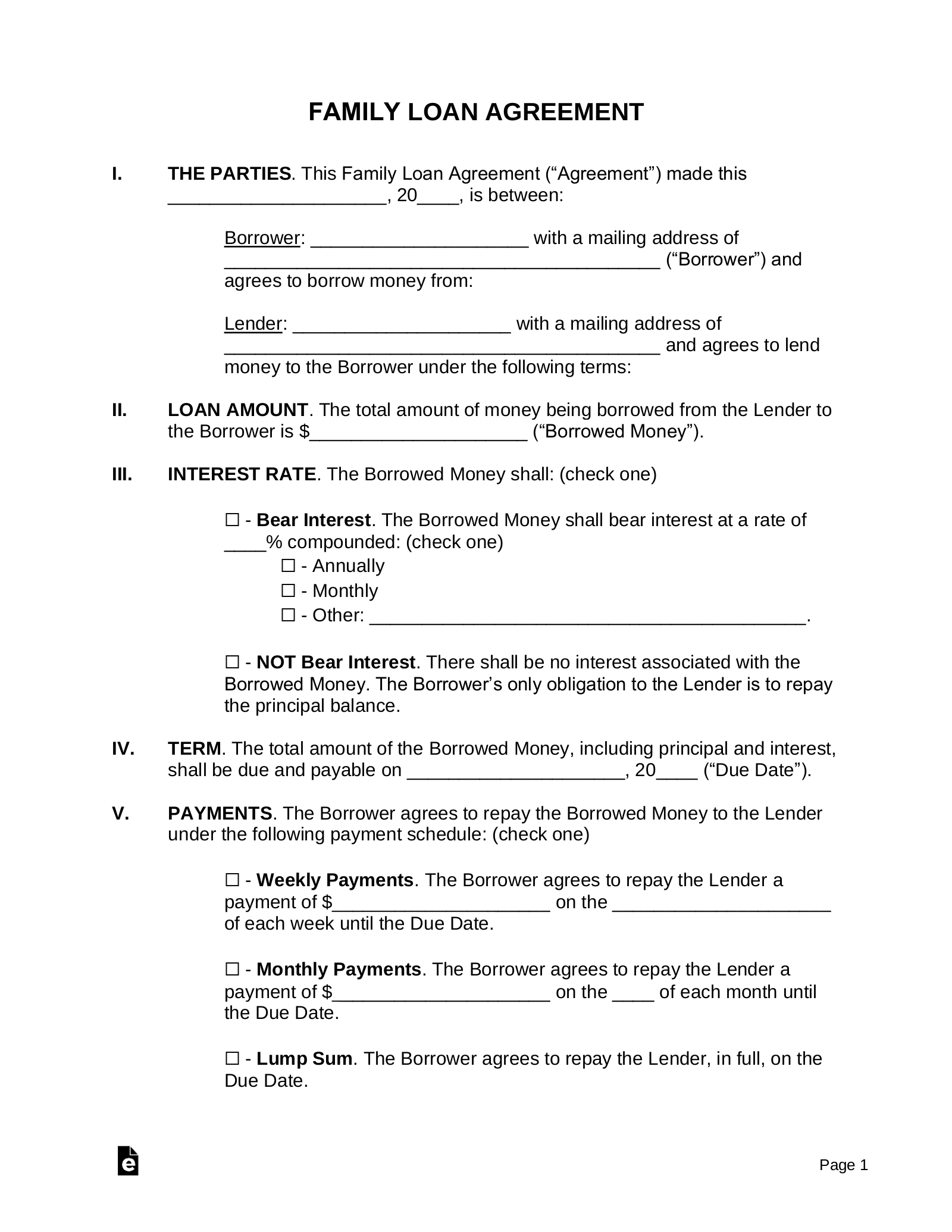

First and foremost, the agreement should clearly identify the parties involved – the lender and the borrower. Include their full legal names and addresses. This might seem obvious, but it’s crucial for legal clarity. Next, specify the principal amount of the loan. This is the actual amount of money being lent. Be precise and avoid vague descriptions. For example, instead of saying “about five thousand dollars,” state “$5,000.00.”

The agreement should also address the interest rate, if any. While you might choose not to charge interest to a family member, it’s important to explicitly state this in the agreement. If you are charging interest, specify the percentage rate and how it will be calculated. Be sure to comply with any applicable usury laws in your jurisdiction, which limit the maximum interest rate that can be charged. This prevents any legal complications down the road.

Perhaps the most crucial element is the repayment schedule. This section should clearly outline how the loan will be repaid, including the frequency of payments (e.g., weekly, monthly), the amount of each payment, and the due date. Specify whether the payments will be made via check, electronic transfer, or another method. Also, include details about how the payments will be applied – first to interest and then to principal, for example. A well-defined repayment schedule minimizes ambiguity and helps both parties stay on track.

Finally, the agreement should address default and remedies. What happens if the borrower fails to make a payment on time? Specify the consequences of default, such as late payment fees or the acceleration of the entire loan balance. Also, outline the lender’s remedies in the event of default, such as the right to take legal action to recover the debt. While you might not want to think about these worst-case scenarios, it’s important to have a clear plan in place to protect both parties’ interests. Including all these components in your personal loan agreement template between family will ensure clarity and protect your relationship.

Creating a personal loan agreement template between family can seem like a daunting task, but it doesn’t have to be. By being thorough and considering all the potential scenarios, you can create a document that protects both parties and strengthens your family bond. Open communication and a willingness to compromise are essential throughout the process.

Ultimately, the most important thing is to treat each other with respect and understanding. Remember, the goal is to help each other out, not to create conflict or resentment. A well-crafted personal loan agreement template between family can serve as a valuable tool for navigating these situations and ensuring a positive outcome for everyone involved.