So, you’re thinking about lending or borrowing money from someone you know? That’s fantastic! Keeping it within the family or friends circle can be a really flexible and convenient option. But before you hand over that cash (or receive it!), it’s super important to get everything in writing. A personal loan agreement template uk can be your best friend in these situations. It might sound a bit formal, but trust me, it’s all about protecting everyone involved and preventing awkward misunderstandings down the line. No one wants to ruin a friendship over a loan gone sour.

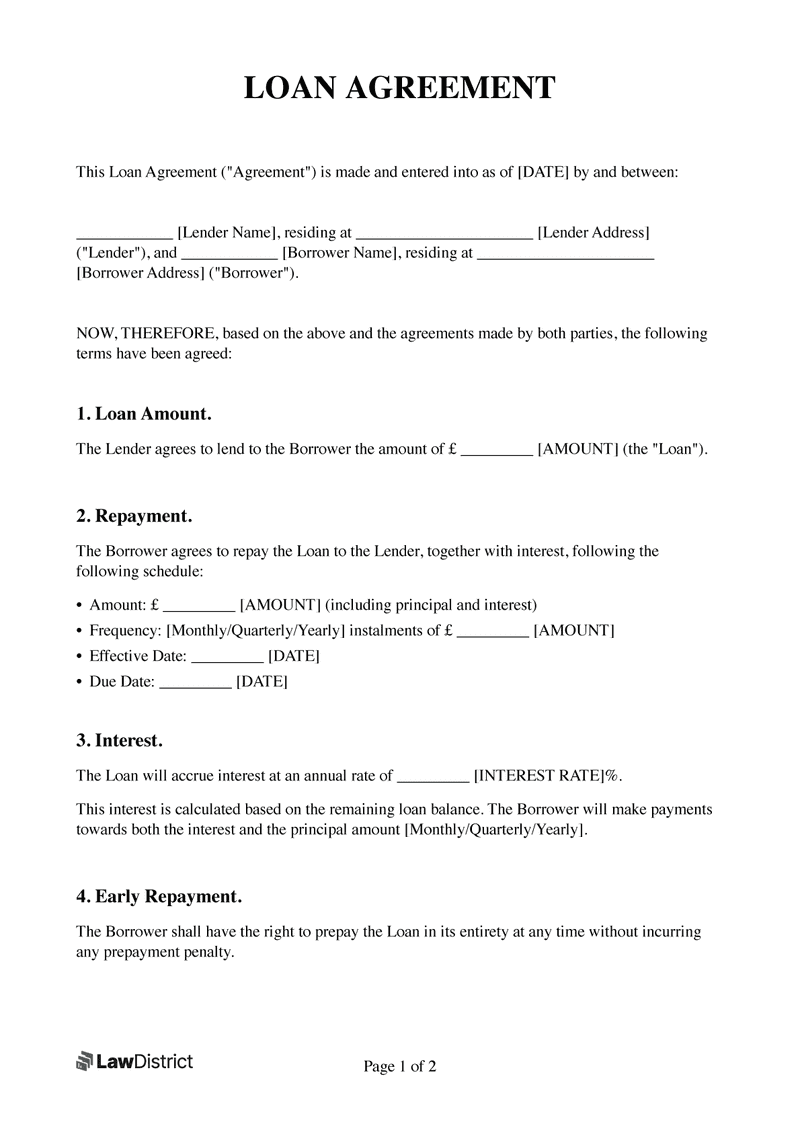

Think of a personal loan agreement template uk as a friendly guide that lays out all the terms of your loan. It’s like a roadmap, showing exactly where you’re headed. We’re talking about details like the amount of money being lent, the interest rate (if any), how often repayments will be made, and the deadline for paying everything back. By putting all of this in black and white, both the lender and the borrower are on the same page, minimizing the potential for confusion or disputes.

In the UK, having a clear and legally sound personal loan agreement is crucial. While you might trust your loved ones implicitly, life can throw curveballs. Circumstances change, memories fade, and what seemed perfectly clear at the beginning can become murky over time. A well-drafted agreement ensures that everyone understands their responsibilities and rights, providing peace of mind and a solid foundation for a successful loan arrangement.

Why You Absolutely Need a Personal Loan Agreement

Okay, so you might be thinking, “Do I really need a formal agreement for a loan to my brother or best mate?” The answer is a resounding YES. While trust is important, a written agreement provides clarity and protection for both parties. It’s not about distrust; it’s about being responsible and planning for the unexpected. Life happens, and having a clear agreement in place can prevent misunderstandings and preserve relationships.

Imagine this: you lend your friend a substantial amount of money to start a business. You both vaguely agree on a repayment plan, but nothing is written down. A few months later, your friend’s business hits a rough patch, and they start missing payments. You feel awkward bringing it up, and your friend feels guilty and avoids you. Suddenly, your friendship is strained, all because of a lack of clarity regarding the loan terms. A simple personal loan agreement template uk could have prevented this entire scenario.

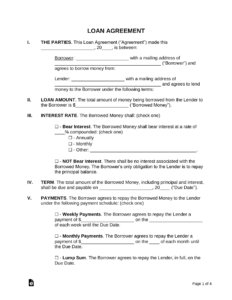

A personal loan agreement template uk clearly outlines the key aspects of the loan. This includes the principal amount (the amount borrowed), the interest rate (if any), the repayment schedule (how often and how much the borrower will repay), and the final repayment date. It also covers what happens if the borrower defaults on the loan, such as late payment fees or other consequences. By specifying these details upfront, both the lender and the borrower know exactly where they stand.

Moreover, a written agreement can serve as valuable evidence in case of a dispute. If the borrower fails to repay the loan as agreed, the lender can use the agreement to pursue legal action. While no one wants to think about going to court against a friend or family member, having a legally binding document can protect your financial interests. In the UK, courts take written contracts seriously, so a well-drafted personal loan agreement significantly strengthens your position.

Don’t forget, a personal loan agreement doesn’t have to be complicated or filled with legal jargon. There are plenty of user-friendly personal loan agreement template uk available online that you can easily adapt to your specific needs. The key is to ensure that all the essential information is included and that both parties understand and agree to the terms before signing the agreement.

What To Include In Your Personal Loan Agreement Template Uk

Crafting the perfect personal loan agreement template uk doesn’t need to be a daunting task. Let’s break down the key components you’ll want to include to ensure a comprehensive and legally sound document. Remember, the goal is clarity and mutual understanding, so be as specific as possible.

First and foremost, clearly identify the parties involved. This means including the full legal names and addresses of both the lender and the borrower. This might seem obvious, but it’s a crucial step for establishing who is bound by the agreement. Next, state the principal amount of the loan – the exact amount of money being lent. This should be expressed in pounds sterling (GBP) to avoid any ambiguity.

Now, let’s talk about interest. Will interest be charged on the loan? If so, specify the interest rate as an annual percentage rate (APR). Clearly outline how the interest will be calculated and when it will be applied. If no interest is being charged, explicitly state that the loan is interest-free. This avoids any potential misunderstandings down the line. The repayment schedule is another vital component. Detail the frequency of payments (e.g., weekly, monthly, quarterly), the amount of each payment, and the method of payment (e.g., bank transfer, cash). Include the date of the first payment and the final repayment date.

Your personal loan agreement template uk should also address what happens in case of default. Define what constitutes a default (e.g., missing a certain number of payments) and outline the consequences of default, such as late payment fees, increased interest rates, or legal action. Consider including a clause that allows the lender to demand immediate repayment of the entire outstanding balance in the event of a default. It’s also wise to include a section on governing law. State that the agreement is governed by the laws of England and Wales. This specifies which legal jurisdiction will apply in case of a dispute.

Finally, ensure that both the lender and the borrower sign and date the agreement. It’s also a good idea to have the agreement witnessed by an independent third party. While not always legally required, having a witness adds an extra layer of credibility to the document. By including all of these elements in your personal loan agreement template uk, you’ll create a robust and reliable agreement that protects the interests of both parties.

Remember, while a template can be a great starting point, it’s always a good idea to get legal advice to ensure that your specific situation is covered. A solicitor can review your agreement and make sure it complies with all relevant laws and regulations in the UK.

So, there you have it. Creating a personal loan agreement isn’t about being distrustful. It’s about being responsible and proactive, ensuring that everyone involved understands their rights and obligations. It’s an investment in your relationships and your financial well-being.

By taking the time to document your loan agreement, you are establishing transparency and reducing the risk of future disagreements. It’s a simple step that can save you a lot of potential headaches and heartache.